IRS 4506-A 2017 free printable template

Show details

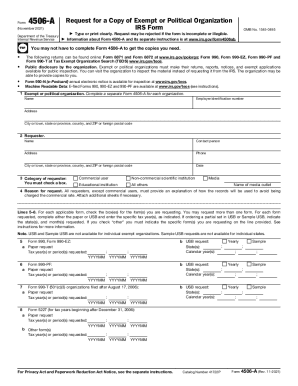

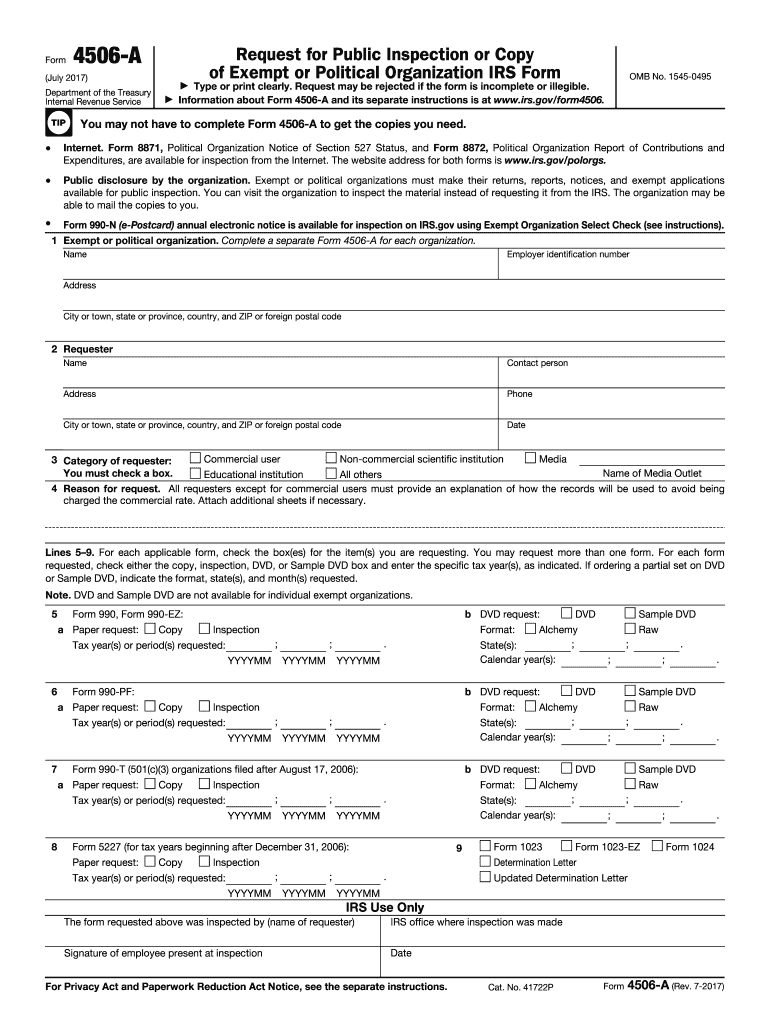

Form 4506-A July 2017 Department of the Treasury Internal Revenue Service OMB No. 1545-0495 Type or print clearly. Request may be rejected if the form is incomplete or illegible. Information about Form 4506-A and its separate instructions is at www.irs.gov/form4506. Request for Public Inspection or Copy of Exempt or Political Organization IRS Form You may not have to complete Form 4506-A to get the copies you need. Internet. 1 Exempt or political organization. Complete a separate Form 4506-A for...each organization. Name Employer identification number Address City or town state or province country and ZIP or foreign postal code 2 Requester Contact person Phone Date Commercial user Non-commercial scientific institution Media 3 Category of requester Name of Media Outlet You must check a box. Form 8871 Political Organization Notice of Section 527 Status and Form 8872 Political Organization Report of Contributions and Expenditures are available for inspection from the Internet. The website...address for both forms is www*irs*gov/polorgs. Public disclosure by the organization* Exempt or political organizations must make their returns reports notices and exempt applications available for public inspection* You can visit the organization to inspect the material instead of requesting it from the IRS* The organization may be able to mail the copies to you. Form 990-N e-Postcard annual electronic notice is available for inspection on IRS*gov using Exempt Organization Select Check see...instructions. Educational institution All others 4 Reason for request. All requesters except for commercial users must provide an explanation of how the records will be used to avoid being charged the commercial rate. Attach additional sheets if necessary. Lines 5 9. For each applicable form check the box es for the item s you are requesting. You may request more than one form* For each form requested check either the copy inspection DVD or Sample DVD box and enter the specific tax year s as...indicated* If ordering a partial set on DVD or Sample DVD indicate the format state s and month s requested* Note. DVD and Sample DVD are not available for individual exempt organizations. Form 990 Form 990-EZ Copy Inspection a Paper request Tax year s or period s requested YYYYMM Form 990-PF b DVD request DVD Format Alchemy State s Calendar year s. Form 990-T 501 c 3 organizations filed after August 17 2006 Sample DVD Raw Form 5227 for tax years beginning after December 31 2006 Form 1023...Determination Letter Updated Determination Letter IRS Use Only The form requested above was inspected by name of requester IRS office where inspection was made Signature of employee present at inspection For Privacy Act and Paperwork Reduction Act Notice see the separate instructions. Form 8871 Political Organization Notice of Section 527 Status and Form 8872 Political Organization Report of Contributions and Expenditures are available for inspection from the Internet. The website address for...both forms is www*irs*gov/polorgs. Public disclosure by the organization* Exempt or political organizations must make their returns reports notices and exempt applications available for public inspection* You can visit the organization to inspect the material instead of requesting it from the IRS* The organization may be able to mail the copies to you.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 4506-A

How to edit IRS 4506-A

How to fill out IRS 4506-A

Instructions and Help about IRS 4506-A

How to edit IRS 4506-A

To edit IRS 4506-A, use a compatible PDF editing tool like pdfFiller. This tool allows you to fill in your information, mark the checkbox options, and sign the form electronically. After editing, ensure to save the changes for submission or personal records. Be aware of any required fields to complete to maintain the form's validity.

How to fill out IRS 4506-A

Filling out IRS 4506-A requires accurate information to request information on your tax account from the IRS. Follow these steps:

01

Begin by providing your name and address at the top of the form.

02

Indicate the type of return for which you are requesting information.

03

Provide specific details such as Social Security number (SSN) or Employer Identification Number (EIN), tax year(s), and other identification numbers as requested.

04

Review the completed sections before signing and dating the form.

After filling out the form, double-check for accuracy to avoid processing delays.

About IRS 4506-A 2017 previous version

What is IRS 4506-A?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 4506-A 2017 previous version

What is IRS 4506-A?

IRS 4506-A is a form used to request a transcript of tax information from the IRS. This form aids individuals and entities in obtaining copies of their tax returns, tax account information, and related documents. It is essential for verifying income, filing corrections, or applying for loans and financial aid.

What is the purpose of this form?

The purpose of IRS 4506-A is to allow taxpayers to request tax-related information directly from the IRS. This form can be crucial for personal finance management, tax audits, or instances where original tax documents are lost. It helps ensure that all tax filings are accurate and supported by necessary documentation.

Who needs the form?

Individuals or businesses who require tax returns or account information from the IRS need to complete IRS 4506-A. Common users include mortgage applicants, financial aid seekers, and individuals needing to clarify tax records for various legal or financial purposes. Additionally, tax professionals may utilize this form on behalf of their clients.

When am I exempt from filling out this form?

You may be exempt from filling out this form if you have access to your tax documents through other means, such as online account access on the IRS website. Additionally, certain tax practitioners may be authorized to retrieve information without this form if a power of attorney is in effect. However, for most official requests, completion of IRS 4506-A is required.

Components of the form

The IRS 4506-A form consists of several components that must be accurately completed, including:

01

Taxpayer information section.

02

Details regarding the request, including form types and tax years.

03

A signature section to authorize the IRS to release the requested information.

Filling out each component is critical for ensuring your request is successfully processed.

What are the penalties for not issuing the form?

If you fail to submit IRS 4506-A when required, penalties may vary depending on the context of your request. Common repercussions include delays in loan applications or financial transactions that depend on verified tax information. Furthermore, not providing requested tax information can lead to compliance issues with the IRS or other entities, potentially resulting in further financial scrutiny.

What information do you need when you file the form?

When filing IRS 4506-A, gather all necessary information in advance. This includes your name, address, SSN or EIN, the type of tax return relevant to your request, and the specific tax years. Having comprehensive data prepared will facilitate the completion of the form and expedite processing times.

Is the form accompanied by other forms?

IRS 4506-A may sometimes need to be accompanied by supplementary forms, especially if you are requesting specific types of documents or transcripts. For instance, if you are acting on behalf of someone else, you might need a power of attorney form (IRS Form 2848) to accompany IRS 4506-A. Always check IRS guidelines for any additional documents required.

Where do I send the form?

When your IRS 4506-A form is complete, send it to the appropriate IRS address as specified in the form's instructions. The mailing address may vary based on your location and the type of transcript requested. Ensure you send it via a secure method to confirm it reaches the IRS safely.

See what our users say