IRS Instruction 2441 2017 free printable template

Instructions and Help about IRS Instruction 2441

How to edit IRS Instruction 2441

How to fill out IRS Instruction 2441

About IRS Instruction 2 previous version

What is IRS Instruction 2441?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

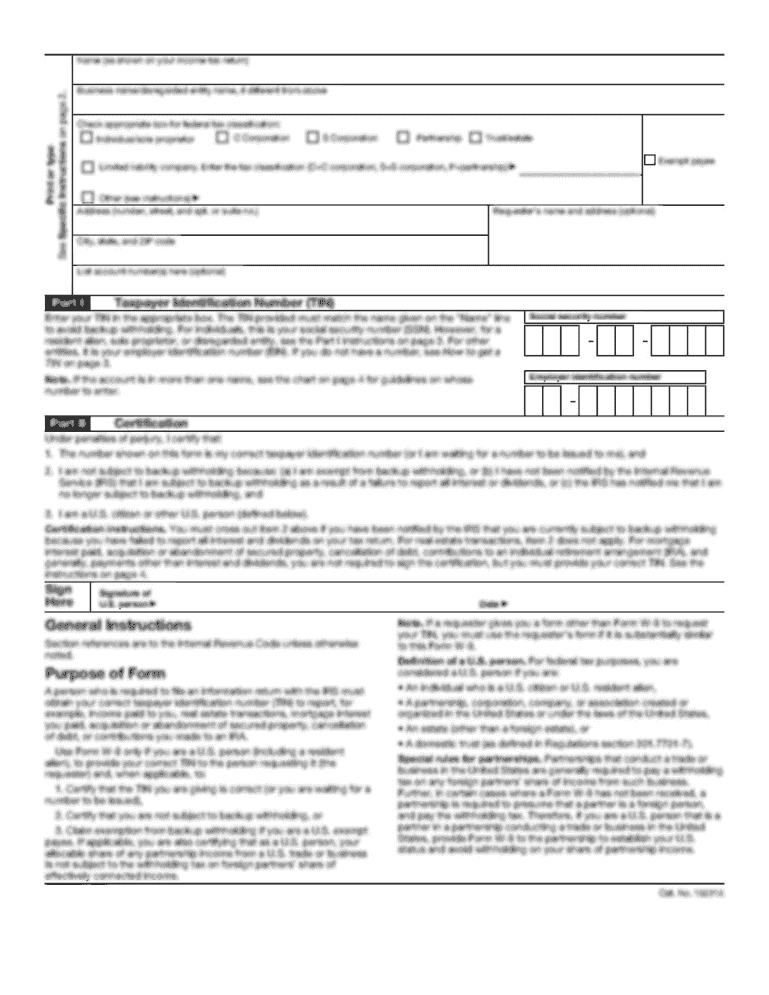

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS Instruction 2441

What should I do if I realize I've made a mistake after submitting the instructions form 2441 2017?

If you need to correct an error after filing instructions form 2441 2017, you should prepare and file an amended return. It's essential to indicate that it is an amended form and include the correct information. Keep in mind the documentation needed to support the changes to avoid complications.

How can I verify the status of my submitted instructions form 2441 2017?

To track the status of your instructions form 2441 2017, utilize the IRS online tracking tool or call the IRS directly. Ensure you have your submission date and other relevant information handy, as this helps streamline the inquiry process.

What should I do if my e-filed instructions form 2441 2017 is rejected?

If your e-filed instructions form 2441 2017 is rejected, review the error codes provided by the IRS. Common issues include missing information or formatting errors. Correct the noted issues and resubmit the form as soon as possible to avoid delays in processing.

Are electronic signatures acceptable for the instructions form 2441 2017?

Yes, electronic signatures are generally accepted for instructions form 2441 2017 when filed electronically. Ensure that your e-signature complies with the IRS requirements for authenticity and security to avoid potential issues.

What privacy and data security measures should I be aware of when submitting instructions form 2441 2017 electronically?

When submitting instructions form 2441 2017 electronically, it is crucial to use secure portals and ensure that your personal information is encrypted. Familiarize yourself with IRS privacy policies and protocols that protect your data during submission to safeguard against unauthorized access.