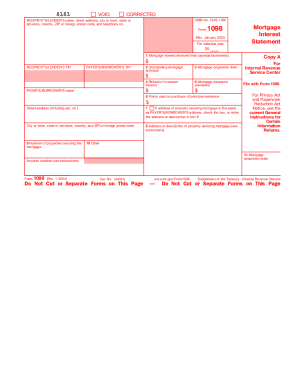

IRS 1098 2018 free printable template

Show details

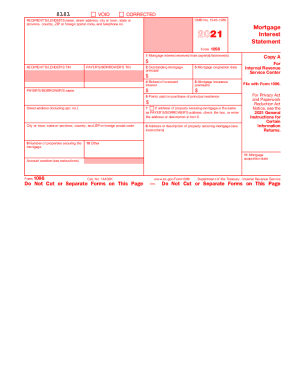

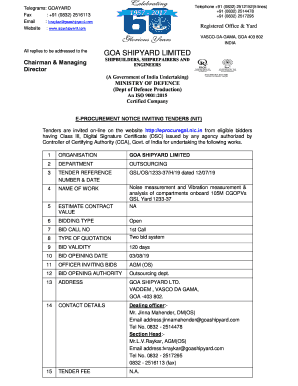

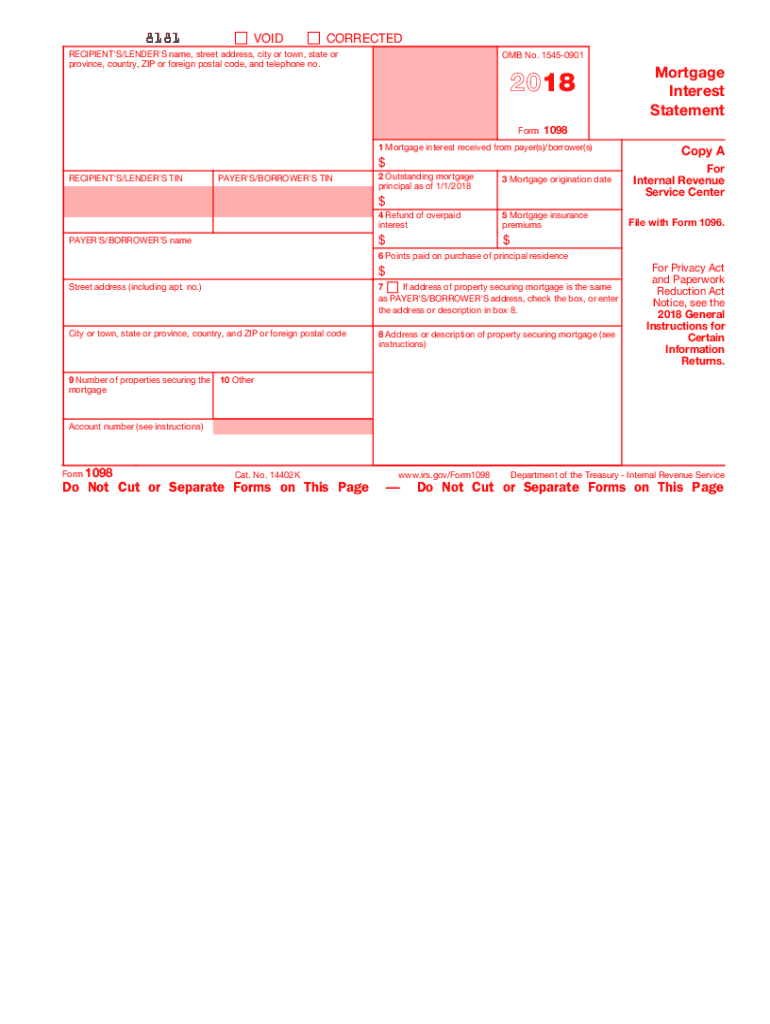

Copy C For Recipient/ Lender To complete Form 1098 use Returns and The 2018 Instructions for Form 1098. City or town state or province country and ZIP or foreign postal code 8 Address or description of property securing mortgage see For Privacy Act and Paperwork Reduction Act Notice see the 2018 General Certain Information Returns. 9 Number of properties securing the 10 Other Account number see instructions Form 1098 Cat. No. 14402K Do Not Cut or Separate Forms on This Page www.irs.gov/Form1098...Department of the Treasury - Internal Revenue Service CORRECTED if checked Caution The amount shown may OMB No. 1545-0901 not be fully deductible by you. Attention Copy A of this form is provided for informational purposes only. Copy A appears in red similar to the official IRS form* The official printed version of Copy A of this IRS form is scannable but the online version of it printed from this website is not. Do not print and file copy A downloaded from this website a penalty may be imposed...for filing with the IRS information return forms that can t be scanned* See part O in the current General Instructions for Certain Information Returns available at www*irs*gov/form1099 for more information about penalties. Please note that Copy B and other copies of this form which appear in black may be downloaded and printed and used to satisfy the requirement to provide the information to the recipient. To order official IRS information returns which include a scannable Copy A for filing with...the IRS and all other applicable copies of the form visit www. IRS*gov/orderforms. Click on Employer and Information Returns and we ll mail you the forms you request and their instructions as well as any publications you may order. Electronically FIRE system visit www. IRS*gov/FIRE or the IRS Affordable Care Act See IRS Publications 1141 1167 and 1179 for more information about printing these tax forms. VOID CORRECTED RECIPIENT S/LENDER S name street address city or town state or province...country ZIP or foreign postal code and telephone no. OMB No* 1545-0901 Form 1 Mortgage interest received from payer s /borrower s PAYER S/BORROWER S TIN 2 Outstanding mortgage principal as of 1/1/2018 3 Mortgage origination date 4 Refund of overpaid interest 5 Mortgage insurance premiums Mortgage Statement Copy A Internal Revenue Service Center File with Form 1096. 6 Points paid on purchase of principal residence Street address including apt* no* If address of property securing mortgage is the...same the address or description in box 8. City or town state or province country and ZIP or foreign postal code 8 Address or description of property securing mortgage see For Privacy Act and Paperwork Reduction Act Notice see the 2018 General Certain Information Returns. 9 Number of properties securing the 10 Other Account number see instructions Form 1098 Cat* No* 14402K Do Not Cut or Separate Forms on This Page www*irs*gov/Form1098 Department of the Treasury - Internal Revenue Service...CORRECTED if checked Caution The amount shown may OMB No* 1545-0901 not be fully deductible by you.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1098

How to edit IRS 1098

How to fill out IRS 1098

Instructions and Help about IRS 1098

How to edit IRS 1098

To edit IRS 1098, access the document using a compatible PDF editor, such as pdfFiller. Make sure you have all necessary information at hand, including amounts paid and the recipient's information. Locate the text fields in the form and enter the required data. Review the entries for accuracy before saving the changes.

How to fill out IRS 1098

Filling out IRS 1098 requires accurate information about mortgage interest payments or qualified tuition payments. Follow these steps to complete the form:

01

Gather necessary information, such as mortgage borrower details or student's information.

02

Enter the lender's or educational institution's details.

03

Fill in the amounts paid during the tax year.

Double-check all entries for any possible errors before finalizing your submission.

About IRS previous version

What is IRS 1098?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What payments and purchases are reported?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS previous version

What is IRS 1098?

IRS 1098, officially known as the Mortgage Interest Statement, is a tax form used by lenders to report mortgage interest payments made by borrowers. This information assists borrowers during tax filing by providing necessary documentation to claim eligible tax deductions.

What is the purpose of this form?

The purpose of IRS 1098 is to inform the Internal Revenue Service (IRS) and the taxpayer of the total mortgage interest paid during the year. By reporting this information, taxpayers can accurately report their deductions on Schedule A of Form 1040, which can potentially reduce their taxable income.

Who needs the form?

Taxpayers who paid $600 or more in mortgage interest during the year and secured financing from a financial institution are typically issued IRS 1098. This form is necessary for those looking to take advantage of mortgage interest deductions when filing their federal income tax returns.

When am I exempt from filling out this form?

Taxpayers may be exempt from filling out this form if they did not pay $600 or more in mortgage interest or if the interest is reported by someone other than a lender. Additionally, individuals who do not plan to deduct interest payments on their tax return may not need to utilize this form.

Components of the form

IRS 1098 consists of various components, including sections for the borrower's name, address, and the interest paid. The form also includes the lender's information and a unique identifying number. It may contain additional details such as points paid and mortgage insurance premiums, which enhance the information provided for tax reporting purposes.

What payments and purchases are reported?

IRS 1098 primarily reports mortgage interest payments that taxpayers made during the tax year. It may also report other related payments, such as points paid to reduce the mortgage interest rate and supplementary payments for mortgage insurance. These reported amounts are essential for accurately determining tax deductions.

What are the penalties for not issuing the form?

Failure to issue IRS 1098 when required can result in penalties for the lender. The penalties may include fines for each form not filed or corrections that are late. It is essential for lenders to comply and ensure that applicable borrowers receive the form to prevent such penalties.

What information do you need when you file the form?

When filing IRS 1098, you will need several pieces of information, including the borrower's name, Social Security Number, address, and the total mortgage interest paid during the tax year. Ensure correct reporting of all financial amounts to avoid submission discrepancies.

Is the form accompanied by other forms?

IRS 1098 may not necessarily be accompanied by other forms when submitted; however, it can be used in conjunction with Schedule A of Form 1040, where taxpayers report their deductions. It is common for taxpayers to reference IRS 1098 while completing their annual tax returns.

Where do I send the form?

The IRS 1098 is typically sent to the Internal Revenue Service as part of the recipient's tax return. If you are a lender, you must ensure that a copy is provided to the borrower by the end of January of the following year to comply with IRS regulations.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

very simple and useful but I would include some more functions

Great, easy and User friendly to the max.....thanks

See what our users say