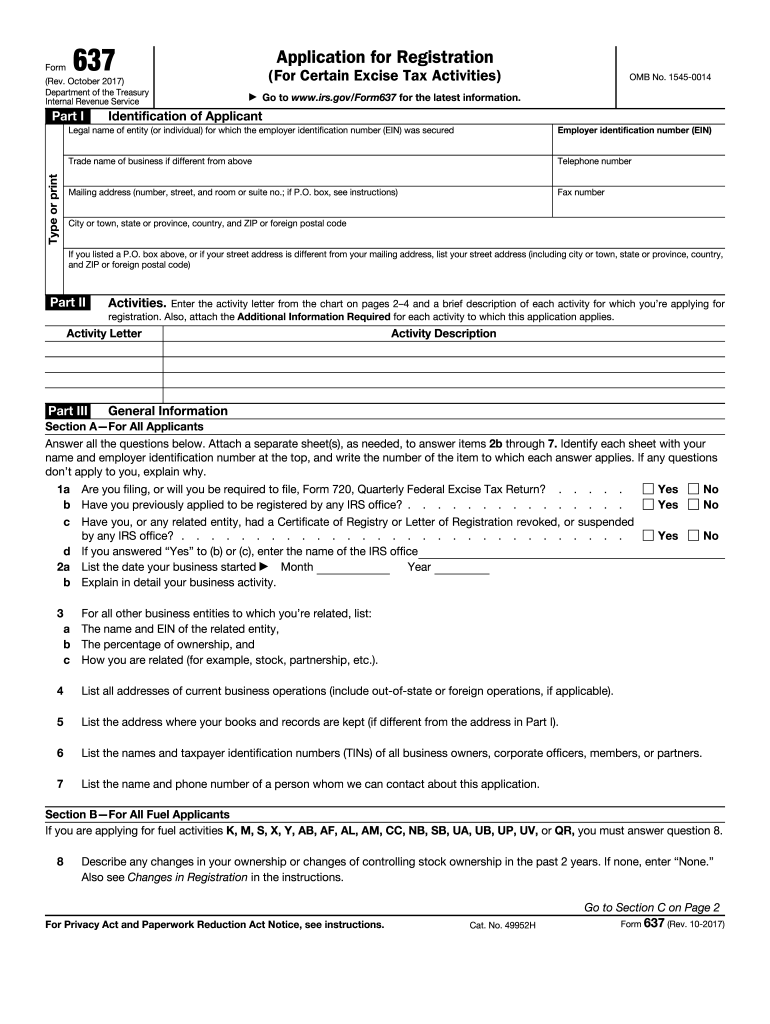

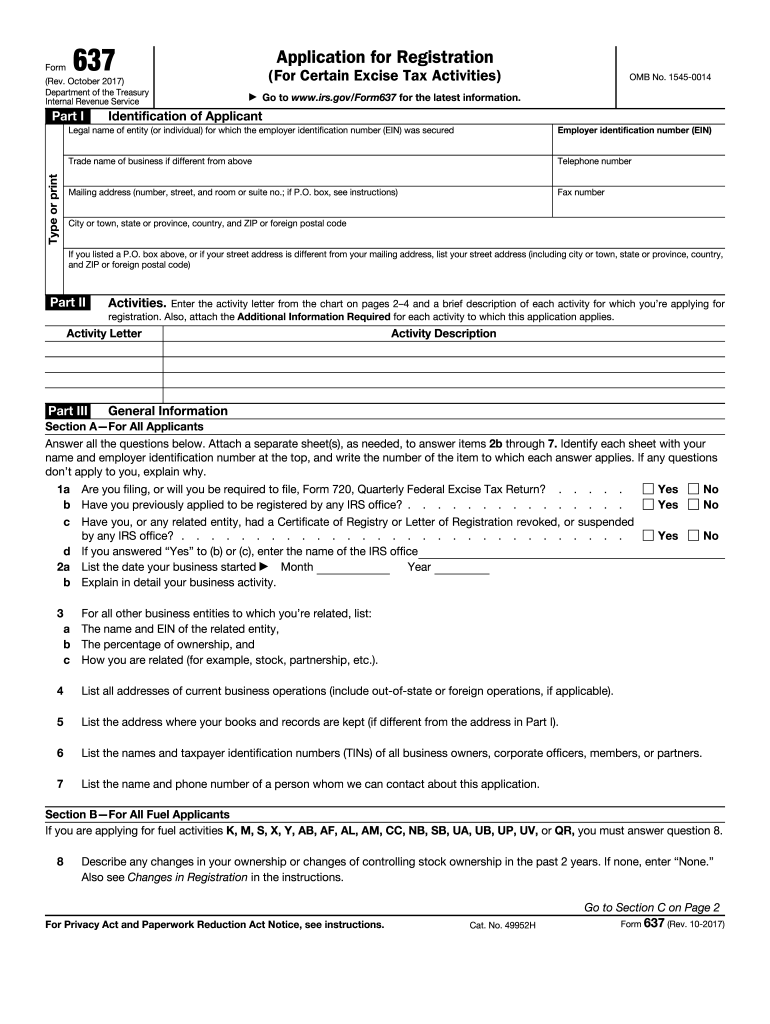

IRS 637 2017 free printable template

Get, Create, Make and Sign IRS 637

Editing IRS 637 online

Uncompromising security for your PDF editing and eSignature needs

IRS 637 Form Versions

How to fill out IRS 637

How to fill out IRS 637

Who needs IRS 637?

Instructions and Help about IRS 637

Alright guys if you watch my previous video I gave an introduction on how to do taxes by hand introduction to what the 1040 form looks like etc now I'm going to show you how I personally did my taxes by hand with the free fillable forms at the IRS provides so here's what I start off I think about the form and I jot down in a spreadsheet what I expect I'm going to have to worry about so in the income section 1040 form I know I've got my w-2 from my work and my wife had two jobs she worked one job at the beginning of the year and one job at the end of the year, so I'm going to have wages from 3 jobs on my form again this is a joint a married filing joint return for me and my wife I also have a YouTube channel and I earn a little of ad revenue trust me it's not very much, so I'm going to have some self-employment income now Google self-employment income tax return, and you'll find out it, you file that on Schedule C so Schedule C is an attachment to your tax return you put in a lot of numbers on Schedule C with the details of your business, and then you take the final value your profit, and you transfer that over into this form for your income from self-employment job I also know I have some rental income I own a house and this year I rent it out to my spare bedrooms to two buddies of mine, so I googled that, and I figured out I'm going to have to fill out Schedule C to figure my total rental profit which will then come over from Schedule C and be input onto my 1040 form I also own a little a couple of thousand dollars worth of stocks, so I'm going to have some dividends to put on here, and finally I've got a bank account which I earn interest which is also a taxable income, so you just got to think about how do I earn income and realize you're going to have to put that all on your tax return that will give me my total gross income then I'll move on to adjusted gross income now I know my wife went to school on spring of this year, so she might have student loan interest or tuition and fees that can she can deduct, so I'm going to put those here for now, but I don't know all the details of how that works, so I'm going to come back to that later I also know that I have some self-employment income part of that is deductive and there's a specific line item for that let's see deductible part of self-employment tax attached Schedule SD all I know is that I have to I have self-employment income, so I'm probably going to have to worry about that this is just the planning phase this will give me my adjusted gross income now I'll move on to the tax and credit section I'm going to have some deductions I know I own a house I paid property taxes and mortgage interest I'm probably going to itemize my deductions but if I don't itemize how you at least take the standard deduction which is something like twelve thousand dollars for me and my wife so itemized deductions exemptions you get one exemption for you yourself for yourself your spouse and any dependents, so...

People Also Ask about

Why would I need to file a form 720?

What is a 720 form for life insurance?

Who is required to file IRS form 720?

What is the purpose of form 720?

Who must file form 720 excise tax?

What is form 720 for trucking company?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send IRS 637 for eSignature?

How do I execute IRS 637 online?

How do I complete IRS 637 on an iOS device?

What is IRS 637?

Who is required to file IRS 637?

How to fill out IRS 637?

What is the purpose of IRS 637?

What information must be reported on IRS 637?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.