CA FTB 5870A 2017 free printable template

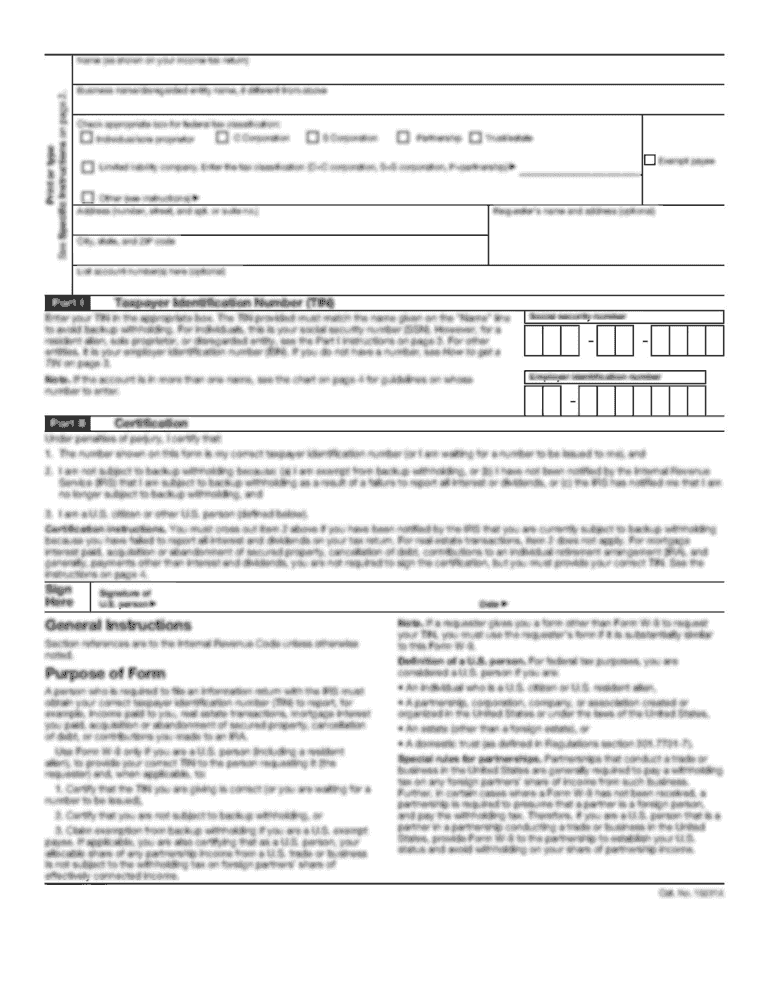

Get, Create, Make and Sign CA FTB 5870A

Editing CA FTB 5870A online

Uncompromising security for your PDF editing and eSignature needs

CA FTB 5870A Form Versions

How to fill out CA FTB 5870A

How to fill out CA FTB 5870A

Who needs CA FTB 5870A?

Instructions and Help about CA FTB 5870A

The following information is provided for educational purposes only and in no way constitutes legal, tax, or financial advice. For legal, tax, or financial advice specific to your business needs, we encourage you to consult with a licensed attorney and×or CPA in your State. The following information is copyright protected. No part of this lesson may be redistributed, copied, modified or adapted without prior written consent of the author. California has a number of ongoing requirements for your LLC to remain in compliance with the State. The first of these is the Statement of Information which we discussed in a prior lesson. Remember your first Statement of Information is due within 90 days of the approval of your LLC. Then, you'll need to file it again every two years. It will be due by the anniversary date of the approval of your LLC. If you have not watched this lesson yet, please do so now. The next requirement is the Annual LLC Franchise Tax of $800. California charges an $800 Annual LLC Franchise Tax on LCS. This tax is due by all LCS regardless of income or the business activity. This is a “prepay tax”, meaning that it pays for the current year. Your first $800 payment for the LLC Franchise Tax is due by 15th day of the 4th month after your LLC is filed. The month your LLC is filed counts as Month 1, regardless if you file on the 1st of the month, the last of the month, or any day of the month, really. This means that if you were to file your LLC on March 22nd, then you must pay the $800 fee no later than June 15th (in this example, March is Month 1, April is Month 2, May is Month 3, and June is Month 4×. Then, every year after your first payment $800 LLC Franchise Tax will be due by April 15th. You pay the $800 LLC Franchise Tax using Form 3522 called the LLC Tax Voucher. We've included this form below in the download section, so that you can see it and get familiar with it. Failure to file before the deadline will result in the State charging late fees and penalties, and they will eventually dissolve your LLC if you do not pay the $800 Annual LLC Franchise Tax. This is not a popular requirement for California, but it is mandatory, and it is the cost of doing business in the State. There's no way to get around this tax. If you want to form an LLC in California, you have to pay this $800 tax within 4 months after you file your LLC and then again by April 15th of each year. Next is Form 3536, the Estimated Fee for LCS. In addition to filing and paying the $800 Annual LLC Franchise Tax, you'll also have to file a return called Form 3536, Estimated Fee for LCS, and pay an additional fee only if your LLC will make $250,000 or more during the tax year. The more you make, the higher the fee. For example, again if you're under $250,000 you don't have to pay this additional fee, but if you're between $250,000 — $500,000, the fee is $900. Between $500,000 and a million it’s ×2,500, etcetera as you can look at the table there. Again, the fees above...

People Also Ask about

What is FTB 5870A?

What does the FTB do?

Where can I get CA state tax forms?

Which 540 form do I use?

Do you need to attach federal return to California return?

Is the IRS and FTB the same?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my CA FTB 5870A in Gmail?

How can I modify CA FTB 5870A without leaving Google Drive?

Can I create an eSignature for the CA FTB 5870A in Gmail?

What is CA FTB 5870A?

Who is required to file CA FTB 5870A?

How to fill out CA FTB 5870A?

What is the purpose of CA FTB 5870A?

What information must be reported on CA FTB 5870A?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.