CA FTB 5870A 2021 free printable template

Show details

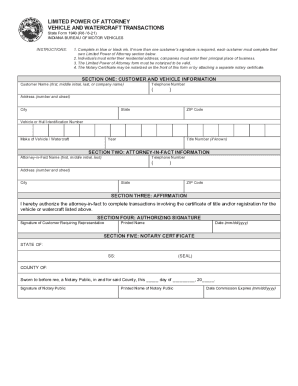

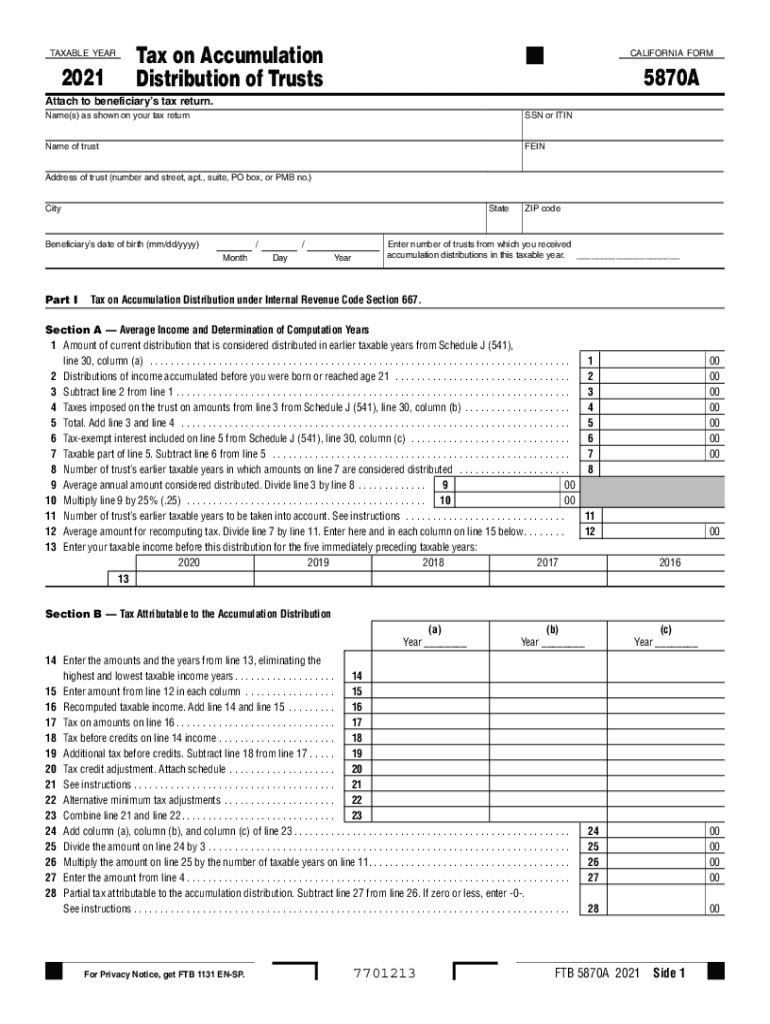

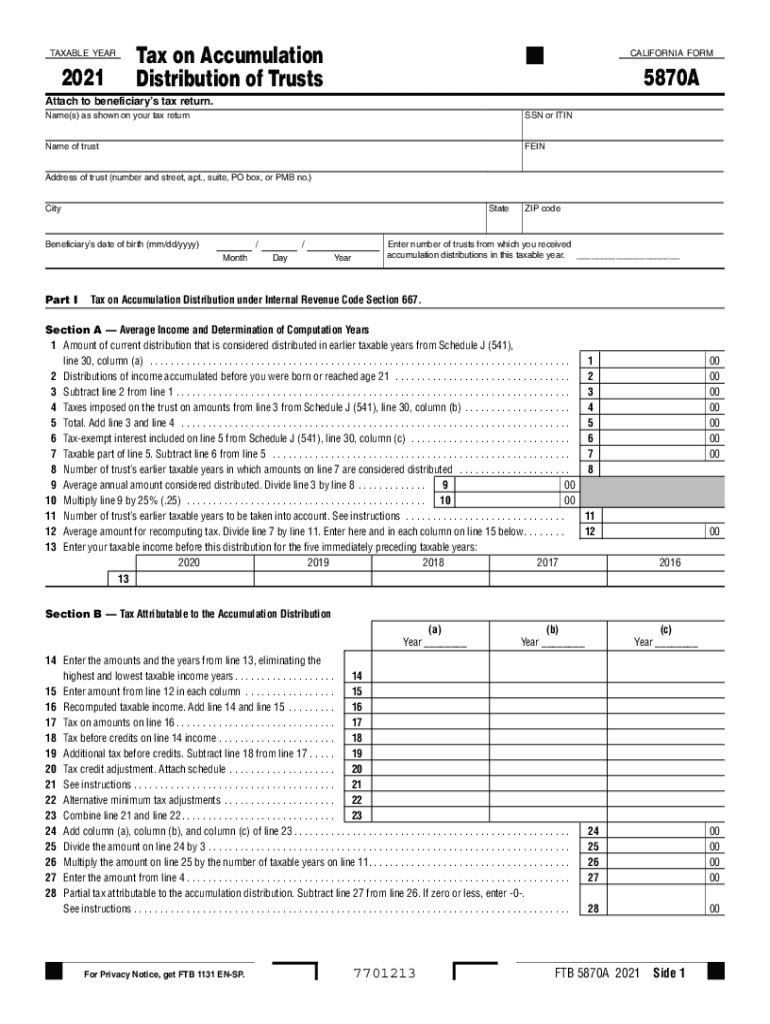

Subtract line 27 from line 26. If zero or less enter -0-. For Privacy Notice get FTB 1131 EN-SP. 7701213 c FTB 5870A 2021 Side 1 Part II Tax on Distributions of Previously Untaxed Trust Income under Revenue and Taxation Code Section 17745 b and d If the income was accumulated over a period of five taxable years or more complete Section A. TAXABLE YEAR Tax on Accumulation Distribution of Trusts CALIFORNIA FORM 5870A Attach to beneficiary s tax return. Name s as shown on your tax return SSN or...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA FTB 5870A

Edit your CA FTB 5870A form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA FTB 5870A form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CA FTB 5870A online

Follow the guidelines below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit CA FTB 5870A. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA FTB 5870A Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA FTB 5870A

How to fill out CA FTB 5870A

01

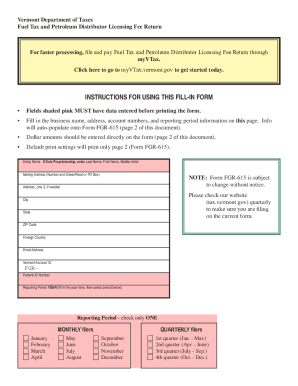

Begin by downloading the CA FTB 5870A form from the California Franchise Tax Board website.

02

Fill out your personal information at the top of the form, including your name, address, and Social Security number.

03

Provide details about your business or the income sources that require you to fill out this form.

04

Indicate the tax year for which you are filing.

05

Complete the sections regarding income, deductions, and any other relevant financial information.

06

Review the filled form to ensure all information is accurate and complete.

07

Sign and date the form at the designated area.

08

Submit the form by mailing it to the address provided in the instructions or filing it electronically if applicable.

Who needs CA FTB 5870A?

01

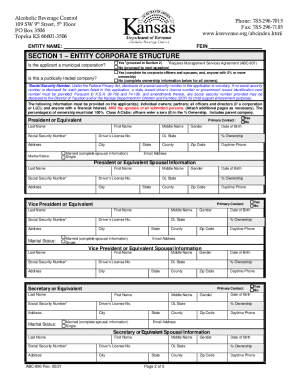

Individuals who have a business income or gain that is subject to California taxes.

02

Taxpayers who have specific tax situations, such as certain types of partnerships or LLCs that require additional reporting.

Fill

form

: Try Risk Free

People Also Ask about

What is FTB 5870A?

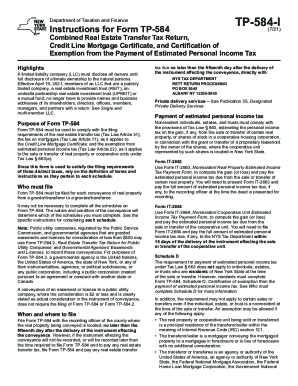

Purpose. Use form FTB 5870A to figure the additional tax under IRC Section 667 or R&TC Sections 17745(b) and (d) on an accumulation distribution made by a foreign trust and certain domestic trusts in the current year.

What does the FTB do?

The Franchise Tax Board (FTB) is the agency responsible for collecting state personal income taxes in California.

Where can I get CA state tax forms?

To order forms by phone: Call (800) 338-0505. Select 1 for Personal Income Tax, 2 for Business Entity Information. Select "Forms and Publications" Follow the recorded instructions, and enter the 3 digit code listed below, when instructed.

Which 540 form do I use?

Common California Income Tax Forms & Instructions The most common California income tax form is the CA 540. This form is used by California residents who file an individual income tax return. This form should be completed after filing your federal taxes, using Form 1040.

Do you need to attach federal return to California return?

California Franchise Tax Board requires the federal return to be attached to the California return as follows: Form 540: Federal return is required if federal return includes supporting forms or schedules other than Schedule A or Schedule B. Form 540NR: Federal return is required for all Form 540NR returns.

Is the IRS and FTB the same?

While the IRS enforces federal income tax obligations, the California Franchise Tax Board (FTB) enforces state income tax obligations.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find CA FTB 5870A?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific CA FTB 5870A and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

Can I create an electronic signature for signing my CA FTB 5870A in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your CA FTB 5870A and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I fill out CA FTB 5870A on an Android device?

Use the pdfFiller mobile app and complete your CA FTB 5870A and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is CA FTB 5870A?

CA FTB 5870A is a California form used by taxpayers to report an adjustment to their tax liability due to changes resulting from federal audit adjustments.

Who is required to file CA FTB 5870A?

Taxpayers who have made changes to their federal tax returns that also affect their California tax liability are required to file CA FTB 5870A.

How to fill out CA FTB 5870A?

To fill out CA FTB 5870A, taxpayers must provide their identification information, details of the federal adjustment, and any necessary computations that illustrate the change in California tax liability.

What is the purpose of CA FTB 5870A?

The purpose of CA FTB 5870A is to enable the California Franchise Tax Board to determine the correct tax liability for a taxpayer based on adjustments made to their federal tax return.

What information must be reported on CA FTB 5870A?

The form requires reporting information such as the taxpayer's name, Social Security Number, the tax year affected, details of the federal adjustment, and any calculations related to changes in tax liability.

Fill out your CA FTB 5870A online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA FTB 5870a is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.