NY TP-584-I 2021-2026 free printable template

Show details

TP584I (7/21)Department of Taxation and FinanceInstructions for FormTP584Combined Real Estate Transfer Return, Credit Line Mortgage Certificate, and Certification of Exemption from the Payment of

pdfFiller is not affiliated with any government organization

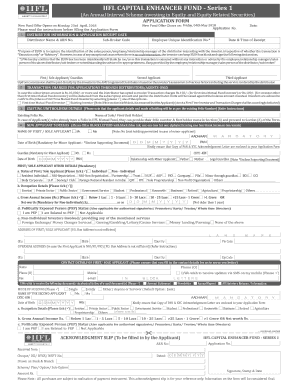

Get, Create, Make and Sign 584 instructions form

Edit your 571295705 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pdffiller form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NY TP-584-I online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit NY TP-584-I. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY TP-584-I Form Versions

Version

Form Popularity

Fillable & printabley

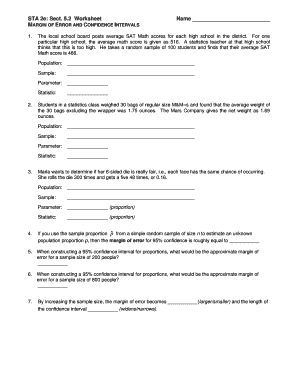

How to fill out NY TP-584-I

How to fill out NY TP-584-I

01

Obtain the NY TP-584-I form from the New York State Department of Taxation and Finance website or your local county clerk's office.

02

Fill in the seller's name and address in the designated section at the top of the form.

03

Provide the buyer's name and address in the next section under the seller's information.

04

Enter the date of the sale or transfer in the appropriate field.

05

Indicate the type of property being transferred (e.g., residential, commercial) in the required section.

06

Complete the section regarding the actual price paid for the property.

07

If applicable, provide details about any financing arrangements or mortgages.

08

Sign and date the form at the bottom, certifying that the information provided is accurate.

09

Submit the completed form to the appropriate tax authorities along with any required fees.

Who needs NY TP-584-I?

01

Individuals or entities transferring real property in New York State.

02

Sellers and buyers of real estate who need to report a transfer of ownership.

03

Title companies and real estate attorneys facilitating property transactions.

Fill

form

: Try Risk Free

People Also Ask about

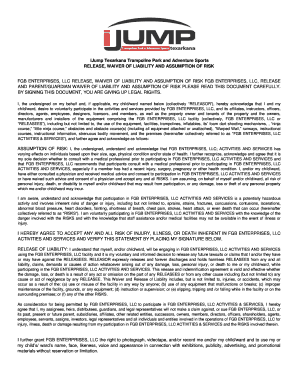

How do I avoid transfer tax in NY?

How To Avoid Paying NYC Transfer Tax? The only way to avoid paying NYC transfer tax is by selling your property through a 1031 exchange. A 1031 exchange allows investors to defer capital gains taxes on investment properties by reinvesting the proceeds from the sale into another qualifying property.

How do you calculate transfer tax in NY?

The combined NYC and NYS Transfer Tax for sellers is between 1.4% and 2.075% depending on the sale price. Sellers pay a combined NYC & NYS Transfer Tax rate of 2.075% for sale prices of $3 million or more, 1.825% for sale prices above $500k and below $3 million, and 1.4% for sale prices of $500k or less.

What is a NYS TP 584?

Form TP-584 must be filed for each conveyance of real property from a grantor/transferor to a grantee/transferee. It may not be necessary to complete all the schedules on Form TP-584. The nature and condition of the conveyance will determine which of the schedules you must complete.

What triggers transfer tax in New York?

The Real Property Transfer Tax (RPTT) is assessed on the sale of real property in New York City when the change or transfer is at least 50 percent of the controlling interest and the value of the sale or transfer amount is more than $25,000.

Who is exempt from transfer tax in NY?

(a) The following shall be exempt from payment of the real estate transfer tax: 1. The state of New York, or any of its agencies, instrumentalities, political subdivisions, or public corporations (including a public corporation created pursuant to agreement or compact with another state or the Dominion of Canada). 2.

Who pays transfer tax in NY buyer or seller?

The base tax and additional base tax are paid by the grantor (seller), and such tax shall not be paid directly or indirectly by the grantee (buyer) except as provided in a contract between seller and buyer. However, if the seller doesn't pay the tax, or is exempt from the tax, the buyer must pay the tax.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit NY TP-584-I from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like NY TP-584-I, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I execute NY TP-584-I online?

pdfFiller has made filling out and eSigning NY TP-584-I easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I edit NY TP-584-I in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing NY TP-584-I and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

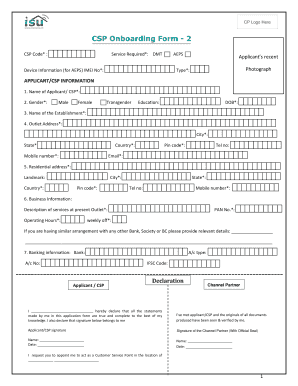

What is NY TP-584-I?

NY TP-584-I is a form used for the notification of the sale, transfer, or conveyance of real property in New York State. It is required for recording the sale with the local county clerk.

Who is required to file NY TP-584-I?

The seller, purchaser, or agent of either party involved in the transfer of real property is required to file NY TP-584-I.

How to fill out NY TP-584-I?

To fill out NY TP-584-I, provide details such as the names and addresses of the seller and buyer, property description, date of transfer, and any applicable tax exemptions or deductions.

What is the purpose of NY TP-584-I?

The purpose of NY TP-584-I is to report the conveyance of real property for tax purposes, ensuring that the state and local governments are informed about property transfers.

What information must be reported on NY TP-584-I?

Required information includes names and addresses of the seller and purchaser, the nature of the transaction, property identification details, date of transfer, and related tax information.

Fill out your NY TP-584-I online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY TP-584-I is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.