NY TP-584-I 2013 free printable template

Show details

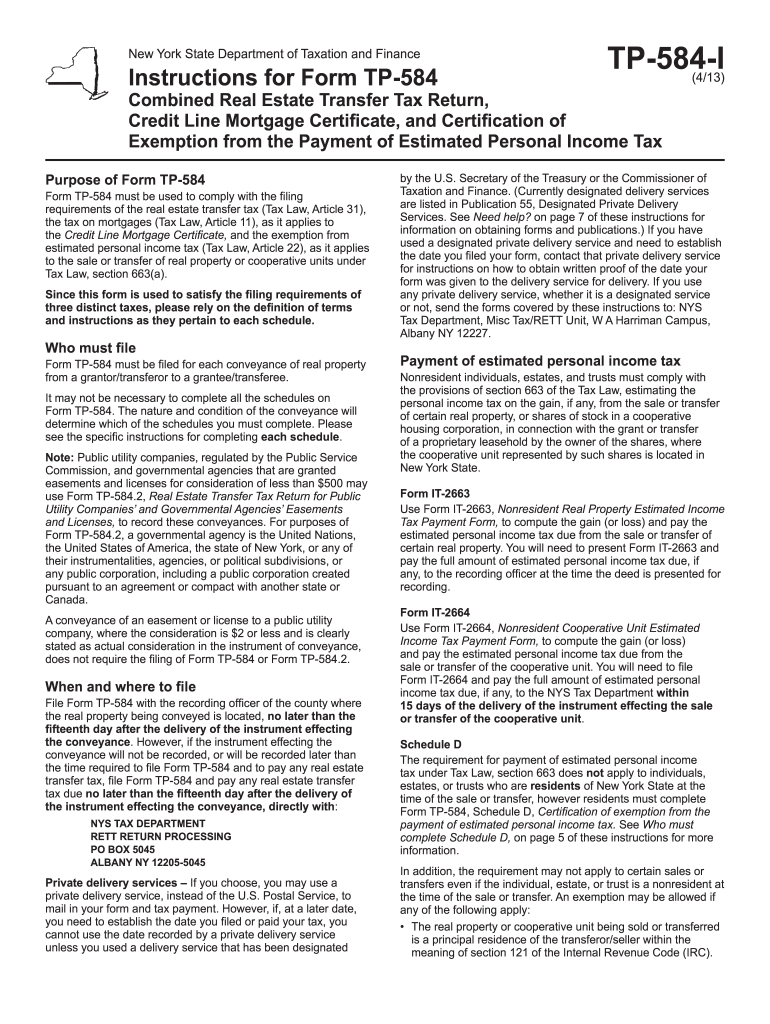

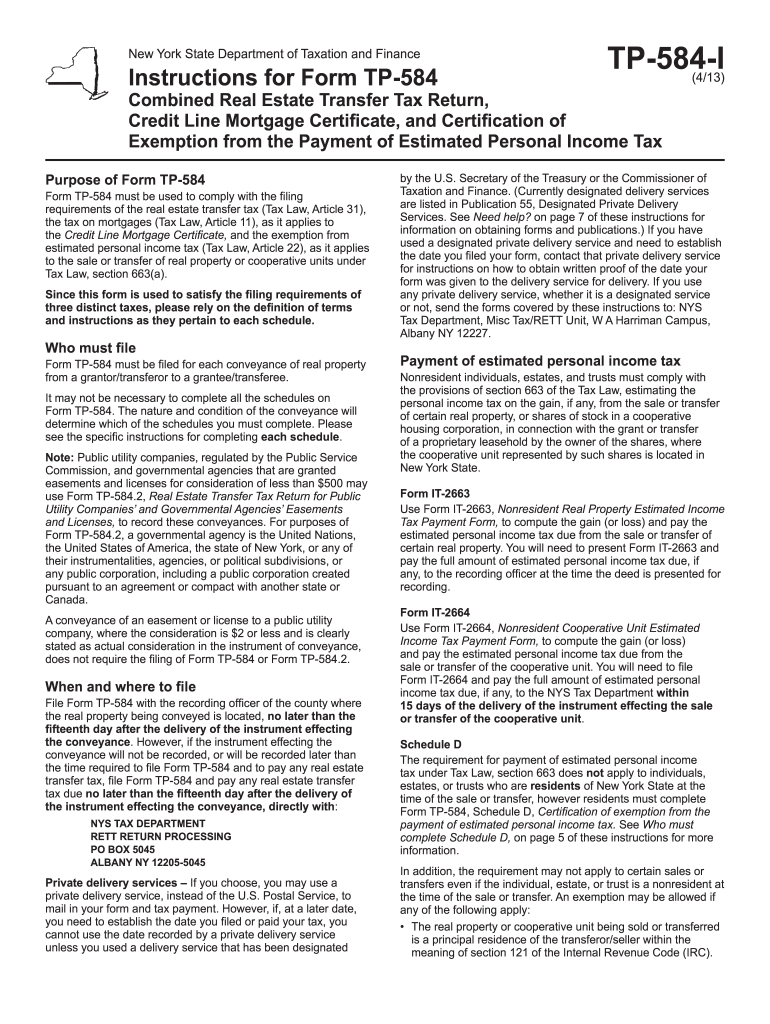

Click here for notice about address change New York State Department of Taxation and Finance Instructions for FormTP584 TP584I (4/13) Combined Real Estate Transfer Return, Credit Line Mortgage Certificate,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY TP-584-I

Edit your NY TP-584-I form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY TP-584-I form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NY TP-584-I online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit NY TP-584-I. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY TP-584-I Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY TP-584-I

How to fill out NY TP-584-I

01

Start by downloading the NY TP-584-I form from the New York State Department of Taxation and Finance website.

02

Fill in the taxpayer's name and address in the designated fields.

03

Provide the tax identification number or Social Security number as required.

04

Enter the date of the sale and the amount of the consideration.

05

List the property details, including the type of property and its description.

06

Complete any additional sections that apply to your specific situation, such as exemptions.

07

Review the form for any errors or omissions before submission.

08

Sign and date the form to verify the information provided is accurate.

Who needs NY TP-584-I?

01

Individuals or entities involved in the transfer of real property in New York State who wish to apply for a tax exemption or report the sale.

02

Real estate brokers or agents facilitating property transactions.

03

Attorneys handling real estate closings for their clients.

Fill

form

: Try Risk Free

People Also Ask about

Who must file 2663?

Married couples who are nonresident transferors/sellers, and who transfer or sell their interest in New York State real property, may file one Form IT-2663 and use one check or money order. The term married includes a marriage between same-sex spouses.

How do you calculate transfer tax in NY?

The combined NYC and NYS Transfer Tax for sellers is between 1.4% and 2.075% depending on the sale price. Sellers pay a combined NYC & NYS Transfer Tax rate of 2.075% for sale prices of $3 million or more, 1.825% for sale prices above $500k and below $3 million, and 1.4% for sale prices of $500k or less.

How much is transfer tax in NY?

The NYC transfer tax rate is between 1% and 1.425% depending on the sale price; and in addition to what you'll owe the city, you'll also have to pay the New York state transfer tax, which is either 0.4% or 0.65% depending on the price of the property.

How do I avoid transfer tax in NY?

How To Avoid Paying NYC Transfer Tax? The only way to avoid paying NYC transfer tax is by selling your property through a 1031 exchange. A 1031 exchange allows investors to defer capital gains taxes on investment properties by reinvesting the proceeds from the sale into another qualifying property.

What is Form TP 584 NYC?

Form TP-584-NYC must be used to comply with the filing requirements of the real estate transfer tax (Tax Law Article 31); the tax on mortgages (Tax Law Article 11), as it applies to the Credit Line Mortgage Certificate; and the exemption from estimated personal income tax (Tax Law Article 22), as it applies to the sale

How would you calculate the transfer tax?

Depending on where you live, you might have to pay city, county, and state transfer taxes. In California, the state charges a transfer tax of 0.11% of the value of the property (payable to the county). Different cities also charge their own transfer tax on top of that. For example, Santa Monica charges $3 per $1,000.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my NY TP-584-I in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your NY TP-584-I along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How do I edit NY TP-584-I online?

The editing procedure is simple with pdfFiller. Open your NY TP-584-I in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I make edits in NY TP-584-I without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit NY TP-584-I and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

What is NY TP-584-I?

NY TP-584-I is a form used in New York State for the reporting of real estate transfer taxes when property transactions occur.

Who is required to file NY TP-584-I?

The seller and buyer of real property in New York State are required to file NY TP-584-I.

How to fill out NY TP-584-I?

To fill out NY TP-584-I, you need to provide information about the property, the parties involved in the transaction, and details about the sale, such as purchase price and date of transaction.

What is the purpose of NY TP-584-I?

The purpose of NY TP-584-I is to document and report the transfer of real property and calculate the applicable transfer taxes.

What information must be reported on NY TP-584-I?

The information that must be reported on NY TP-584-I includes the names and addresses of the buyer and seller, the property location, sale price, and transaction date.

Fill out your NY TP-584-I online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY TP-584-I is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.