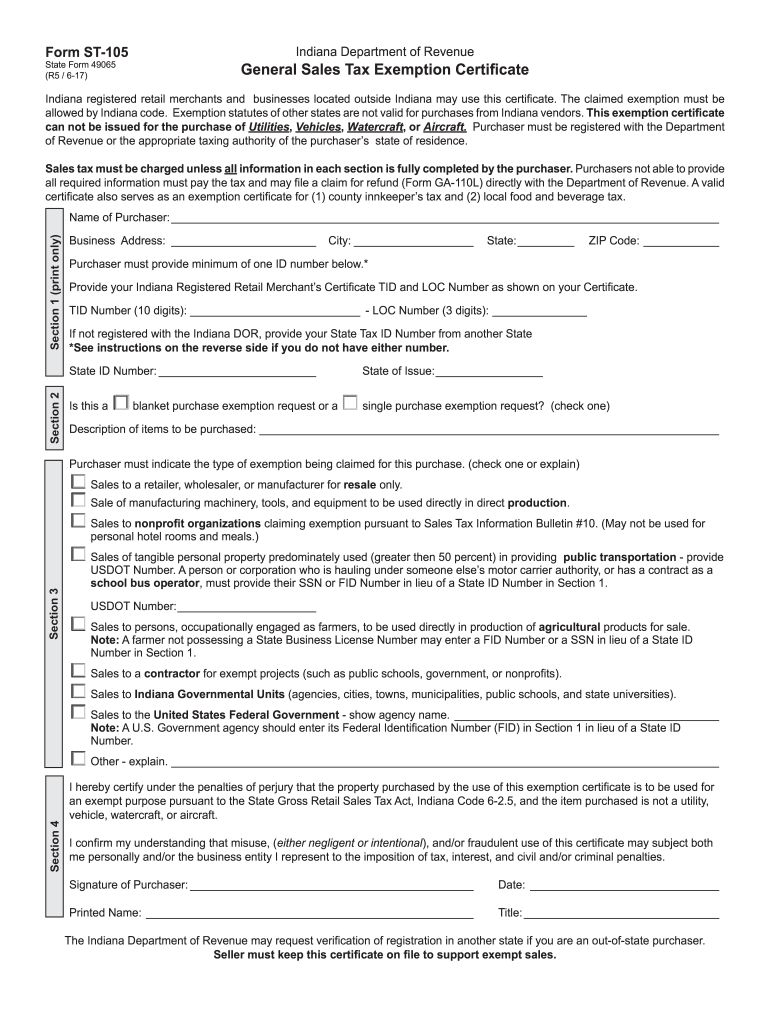

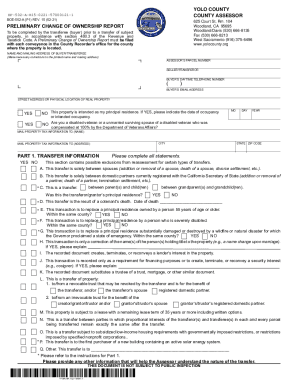

Who uses the Form ST-105?

Indiana registered retail merchants and businesses located outside Indiana may use this form. Purchaser must be registered with the Department of Revenue or the appropriate taxing authority of the purchaser’s state of residence. The purchaser may be exempt from the sales tax only if it fully completes all information in each section of the Form ST-105.

What is the purpose of the Form ST-105?

The form ST-105 is an exemption certificate. The claimed exemption must be allowed by Indiana code. The exemption certificate cannot be issued for the purchase of utilities, vehicles, watercraft, or aircraft.

What information should be provided?

The purchaser must complete all four sections of the ST-105.

Section 1: This section requires an identification number. In most cases it will be an Indiana Department of Revenue issued Taxpayer Identification Number (TID#) used for Indiana sales and/or withholding tax reporting. If the purchaser is from another state and does not possess an Indiana TID#, a resident state’s business license, or State issued ID# must be provided. A farmer should provide his SS# or FID# in the State ID# space. Public transportation haulers operating under another motor carrier authority, or with a contract as a school bus operator, must indicate their SS# or FID# in the State ID# space. Nonprofit organization must show their FID# in the State ID# space.

Section 2: The purchaser checks a box to indicate if this is a single purchase or blanket exemption and describes the product being purchased.

Section 3: The purchaser must check the reason for exemption.

Section 4: Purchaser should sign and date the form. The signer must print his name and title.

Where do I send the Form ST-105?

The seller must keep this completed form on file to support exempt sales.