Get the free value investing and behavioural finance by parag parikh pdf download

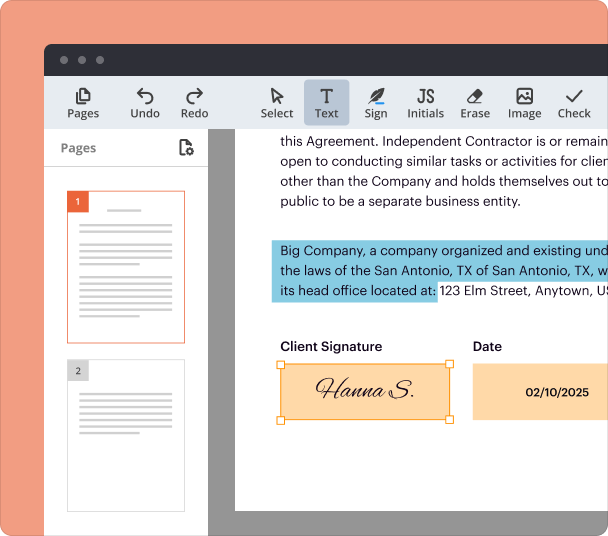

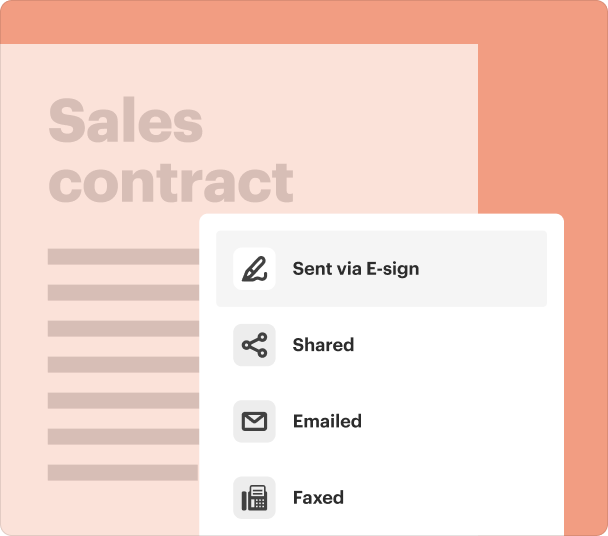

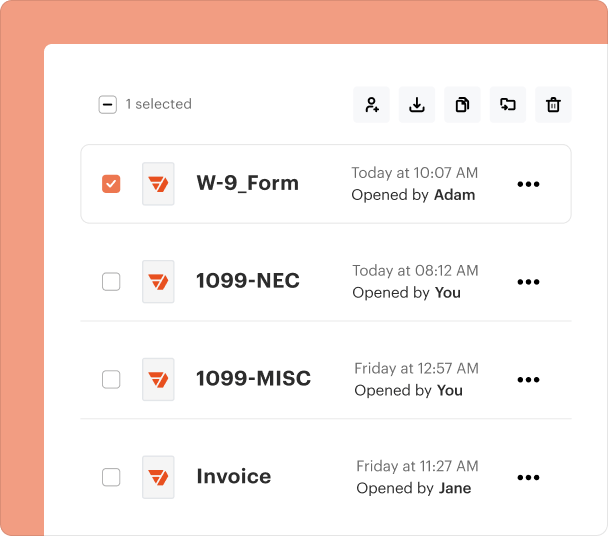

Fill out, sign, and share forms from a single PDF platform

Edit and sign in one place

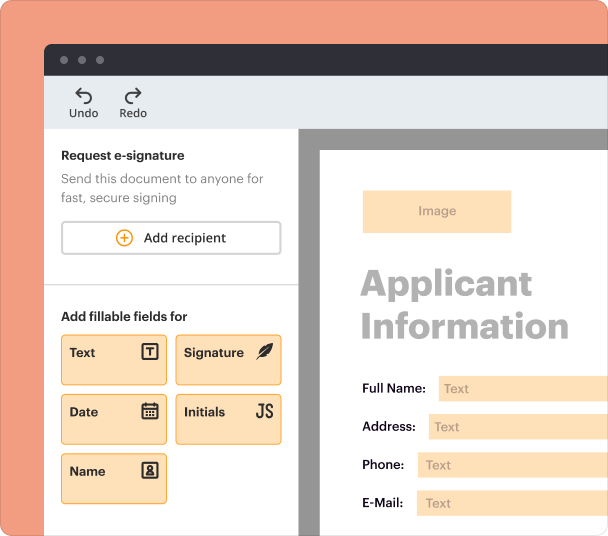

Create professional forms

Simplify data collection

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

Value Investing and Behavioral Finance: A Comprehensive Guide

What is value investing?

Value investing is an investment strategy that involves picking stocks that appear to be trading for less than their intrinsic or book value. It is built on fundamentals, emphasizing the importance of understanding a company's underlying value beyond its market price.

-

Definition and fundamental principles of value investing: It focuses on identifying undervalued stocks, employing a long-term strategy to hold investments until they reflect their true value.

-

Historical context: Key figures such as Benjamin Graham and Warren Buffett have influenced value investing, marking significant milestones in its development.

-

Importance of intrinsic value and margin of safety: Investors assess a stock's intrinsic value to ensure they are purchasing it at a price that allows a buffer for potential errors in calculations.

How does behavioral finance link psychology to investments?

Behavioral finance combines psychological theories with conventional economics to explain why and how investors often make irrational financial decisions.

-

Overview of behavioral finance concepts: It studies the impact of psychological biases on financial behaviors, highlighting the deviations from rationality.

-

Cognitive biases influencing investor decisions: Common biases include overconfidence, loss aversion, and anchoring, which can significantly affect trading and investing outcomes.

-

The role of emotions in financial decision-making: Emotions can lead to decisions driven by fear or greed, often resulting in poor investment choices.

What is the impact of psychological factors on value investing?

Psychological factors play a crucial role in value investing, often affecting how investors assess a company's worth and make decisions.

-

How psychological factors impact valuation assessments: Emotions can cloud judgment, leading investors to undervalue or overvalue stocks based on market sentiment.

-

Value investing strategies that mitigate behavioral biases: Strategies such as systematic investing and employing checklists help in reducing emotional decision-making.

-

Case studies demonstrating behavioral influences on value investment outcomes: Analyzing past market events reveals how emotional decisions led to significant investment losses and gains.

How do you fill out the application cum nomination form?

Completing the application cum nomination form for the FLAME Investment Lab requires attention to detail and a thorough understanding of the process.

-

Step-by-step instructions for completing the form: Guide applicants on each section to ensure accurate and complete submissions.

-

Tips on detailing your investment background and expectations: Clarify what information is most impactful and how to present it effectively.

-

Highlighting the importance of accurate information: Stress that presenting accurate personal declaration and sponsor details are critical for a successful application.

How can you customize your application experience?

Tailoring your application enhances your chances of acceptance by aligning your skills and goals with the program's offerings.

-

Identifying key areas of growth: Focus on your interest in Economics, Portfolio Management, or Risk Management to strengthen your application.

-

How to align your experience with the program’s goals: Clearly outline how past experiences relate to what you wish to achieve in the program.

-

The significance of articulating your learning objectives: Effective communication of your aims can make your application stand out.

What are the financial risks in value investing?

Investing in value stocks involves several financial risks that can impact returns.

-

Understanding foreign exchange risks and their implications: Currency volatility can affect investments, especially if they involve international stocks.

-

Strategies to hedge against macroeconomic uncertainties: Techniques such as diversification and options can protect against broader market risks.

-

Evaluating the risks associated with behavioral biases in investment: Misjudgments stemming from emotional responses can lead to significant financial losses.

How to become antifragile in investing?

Adopting antifragile investment strategies allows investors to benefit from volatility rather than merely surviving it.

-

Embracing volatility as a core principle: Understand that market fluctuations can enhance investment performance when managed correctly.

-

Key psychological insights for enhancing investor resilience: Building a narrative around challenges can strengthen an investor’s decision-making process.

-

Practical techniques to develop an antifragile investment mindset: Strategies include continuous learning, adjusting positions as circumstances change, and maintaining a flexible approach.

What next steps should you take after submitting your application?

Finalizing your application is crucial for ensuring a smooth process moving forward.

-

Payment procedures and details for the application process: Familiarize yourself with deadlines and modes of payment acceptable for the application fee.

-

Clearing compliance and regulatory aspects related to your organization: Ensure that all legal requirements are met to avoid delays.

-

How to follow up after submission: Effective follow-up strategies include checking in via email or online portals to confirm receipt of your application.

Frequently Asked Questions about value investing and behavioral finance by parag parikh pdf download form

What is the importance of value investing?

Value investing emphasizes buying stocks at lower prices than their intrinsic value, which can lead to significant long-term returns. It's a disciplined approach that focuses on financial fundamentals rather than market speculation.

How can behavioral finance improve investment decisions?

By understanding cognitive biases and emotional influences, investors can make more rational decisions. Implementing strategies to mitigate these biases leads to better investment outcomes.

What are common mistakes in value investing?

Investors often overlook intrinsic value evaluations or yield to market emotions, leading to poor purchasing decisions. Maintaining a long-term perspective is essential to avoid these pitfalls.

How can I effectively manage financial risks?

Diversification, proper asset allocation, and staying informed about market conditions are key strategies to manage financial risk. Additionally, employing risk assessment tools can help mitigate exposure.

What does it mean to be antifragile in investing?

Being antifragile means thriving amidst volatility and uncertainty. It involves developing a mindset that sees challenges as opportunities for growth and improvement in investment strategies.

pdfFiller scores top ratings on review platforms