RI DoT RI-1041 2016 free printable template

Show details

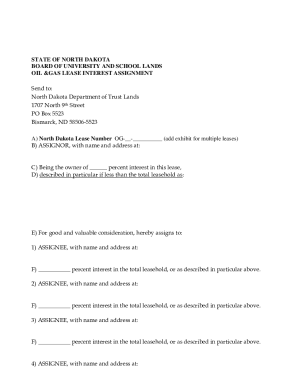

State of Rhode Island and Providence Plantations2016 RI1041Fiduciary Income Tax Return

You must check a

box:Name of estate or trustEstates and

TrustsName and title of fiduciaryAmended

ReturnAddress

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign RI DoT RI-1041

Edit your RI DoT RI-1041 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your RI DoT RI-1041 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing RI DoT RI-1041 online

Follow the steps down below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit RI DoT RI-1041. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

RI DoT RI-1041 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out RI DoT RI-1041

How to fill out RI DoT RI-1041

01

Obtain the RI DoT RI-1041 form from the Rhode Island Department of Transportation website or local office.

02

Fill out the personal information section, including your name, address, and contact details.

03

Provide vehicle information such as make, model, year, and Vehicle Identification Number (VIN).

04

Indicate the type of application you are submitting (e.g., registration, renewal, etc.).

05

Review the fees associated with your application and include payment details if required.

06

Sign and date the form, confirming that the information provided is accurate to the best of your knowledge.

07

Submit the completed form either online, by mail, or in person at a Rhode Island DoT office, following the specific submission guidelines.

Who needs RI DoT RI-1041?

01

Anyone who owns a vehicle in Rhode Island and needs to register it or renew their registration is required to fill out the RI DoT RI-1041 form.

02

Individuals looking to update their vehicle information, such as a change of address or ownership transfer, also need to use this form.

Fill

form

: Try Risk Free

People Also Ask about

Who is the fiduciary on form 1041?

Typically, the fiduciary- whether it's the executor or personal representative of the estate or the trustee of the trust- they are responsible for preparing and filing the fiduciary income tax return, the Form 1041.

What is a fiduciary tax form?

The fiduciary of a domestic decedent's estate, trust, or bankruptcy estate files Form 1041 to report: The income, deductions, gains, losses, etc. of the estate or trust. The income that is either accumulated or held for future distribution or distributed currently to the beneficiaries.

What is fiduciary income tax?

In simplest terms, fiduciary income tax is the income taxation of a person's estate or trust assets. Determining the taxable income for both estates and trusts may be similar to that of an individual, but there are noteworthy variations.

Is RI 7004 being discontinued?

This series of forms, also known as 'Corporate Tax Vouchers' will begin to phase-out as of January 1, 2023. Starting with tax year 2022, extensions and vouchers must be filed on the Rhode Island BUS-EXT and BUS-V forms. 1 The Division will no longer be using the RI-1120V, RI-1065V, and RI-7004.

What is the threshold for fiduciary income tax?

The fiduciary (or one of the fiduciaries) must file Form 541 for a trust if any of the following apply: Gross income for the taxable year of more than $10,000 (regardless of the amount of net income) Net income for the taxable year of more than $100.

What is the fiduciary tax in Rhode Island?

This is the tax that is paid on income received by estates and trusts. The fiduciary of a domestic decedent's estate, trust, or bankruptcy estate files Form RI-1041 to report: The income, deductions, gains, losses, etc. of the estate or trust.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send RI DoT RI-1041 to be eSigned by others?

When you're ready to share your RI DoT RI-1041, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Where do I find RI DoT RI-1041?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the RI DoT RI-1041 in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I edit RI DoT RI-1041 online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your RI DoT RI-1041 to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

What is RI DoT RI-1041?

RI DoT RI-1041 is a form used by the Rhode Island Division of Taxation for reporting the income tax for pass-through entities such as partnerships and S corporations.

Who is required to file RI DoT RI-1041?

Pass-through entities operating in Rhode Island, such as partnerships and S corporations, are required to file RI DoT RI-1041 if they have income apportioned to Rhode Island.

How to fill out RI DoT RI-1041?

To fill out RI DoT RI-1041, gather all necessary financial information of the pass-through entity, complete the form sections regarding income, deductions, and taxable income, and ensure all member or shareholder details are accurately reported.

What is the purpose of RI DoT RI-1041?

The purpose of RI DoT RI-1041 is to report and pay income tax on behalf of the members or shareholders of a pass-through entity for their share of income derived from the entity.

What information must be reported on RI DoT RI-1041?

Information that must be reported on RI DoT RI-1041 includes the entity's income, deductions, credits, and the respective shares of income allocated to each member or shareholder.

Fill out your RI DoT RI-1041 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

RI DoT RI-1041 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.