RI DoT RI-1041 2014 free printable template

Show details

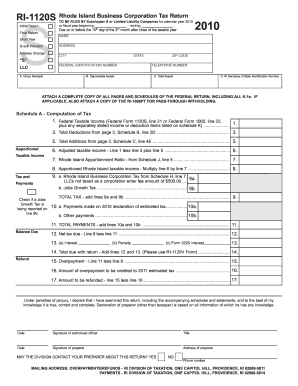

Modified federal total income. Combine lines 1 and 4 add net increases or subtract net decreases. Federal total deductions from Federal Form 1041 lines 16 and 21 see instructions. 6 RI taxable income. Subtract line 6 from line 5. 7 Rhode Island income tax from RI-1041 Tax Computation Worksheet. State of Rhode Island and Providence Plantations 2014 RI-1041 Fiduciary Income Tax Return You must check a box Name of estate or trust Estates or Trusts Name and title of fiduciary Bankruptcy Estate...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign form ri 1041 2014

Edit your form ri 1041 2014 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form ri 1041 2014 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form ri 1041 2014 online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form ri 1041 2014. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

RI DoT RI-1041 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form ri 1041 2014

How to fill out RI DoT RI-1041

01

Obtain the RI DoT RI-1041 form from the Rhode Island Department of Transportation website or local office.

02

Carefully read the instructions provided with the form to understand the requirements.

03

Fill in your personal information, including your name, address, and contact details in the designated sections.

04

Provide specific information regarding your vehicle, such as the make, model, year, and VIN (Vehicle Identification Number).

05

Complete any additional sections relevant to the purpose of the form (e.g., if it is for a registration, title, or permit).

06

Review all entries for accuracy and completeness to ensure there are no mistakes.

07

Sign and date the form as required.

08

Submit the completed form along with any required documentation and payment to the appropriate Department of Transportation office.

Who needs RI DoT RI-1041?

01

Individuals looking to register a vehicle in Rhode Island.

02

Anyone requesting a title for a vehicle.

03

People applying for permits related to vehicle operation in Rhode Island.

04

Residents who need to update their vehicle information with the RI DoT.

Fill

form

: Try Risk Free

People Also Ask about

Who is the fiduciary on form 1041?

Typically, the fiduciary- whether it's the executor or personal representative of the estate or the trustee of the trust- they are responsible for preparing and filing the fiduciary income tax return, the Form 1041.

What is a fiduciary tax form?

The fiduciary of a domestic decedent's estate, trust, or bankruptcy estate files Form 1041 to report: The income, deductions, gains, losses, etc. of the estate or trust. The income that is either accumulated or held for future distribution or distributed currently to the beneficiaries.

What is fiduciary income tax?

In simplest terms, fiduciary income tax is the income taxation of a person's estate or trust assets. Determining the taxable income for both estates and trusts may be similar to that of an individual, but there are noteworthy variations.

Is RI 7004 being discontinued?

This series of forms, also known as 'Corporate Tax Vouchers' will begin to phase-out as of January 1, 2023. Starting with tax year 2022, extensions and vouchers must be filed on the Rhode Island BUS-EXT and BUS-V forms. 1 The Division will no longer be using the RI-1120V, RI-1065V, and RI-7004.

What is the threshold for fiduciary income tax?

The fiduciary (or one of the fiduciaries) must file Form 541 for a trust if any of the following apply: Gross income for the taxable year of more than $10,000 (regardless of the amount of net income) Net income for the taxable year of more than $100.

What is the fiduciary tax in Rhode Island?

This is the tax that is paid on income received by estates and trusts. The fiduciary of a domestic decedent's estate, trust, or bankruptcy estate files Form RI-1041 to report: The income, deductions, gains, losses, etc. of the estate or trust.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit form ri 1041 2014 online?

The editing procedure is simple with pdfFiller. Open your form ri 1041 2014 in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I edit form ri 1041 2014 on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign form ri 1041 2014 on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

Can I edit form ri 1041 2014 on an Android device?

With the pdfFiller Android app, you can edit, sign, and share form ri 1041 2014 on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is RI DoT RI-1041?

RI DoT RI-1041 is a tax form used in the state of Rhode Island for reporting the income of estates and trusts.

Who is required to file RI DoT RI-1041?

Estates and trusts that have gross income exceeding a certain threshold, or those that have taxable income or are required to file under federal law, must file RI DoT RI-1041.

How to fill out RI DoT RI-1041?

To fill out RI DoT RI-1041, you need to provide the name and address of the estate or trust, report income, deductions, and credits, and calculate the tax due based on the provided information.

What is the purpose of RI DoT RI-1041?

The purpose of RI DoT RI-1041 is to ensure that estates and trusts comply with state tax laws by reporting their income and calculating any taxes owed.

What information must be reported on RI DoT RI-1041?

The information that must be reported includes the name and address of the trust or estate, the Federal Employer Identification Number (FEIN), sources of income, deductions, and any applicable tax credits.

Fill out your form ri 1041 2014 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Ri 1041 2014 is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.