RI RI-1040V 2016 free printable template

Show details

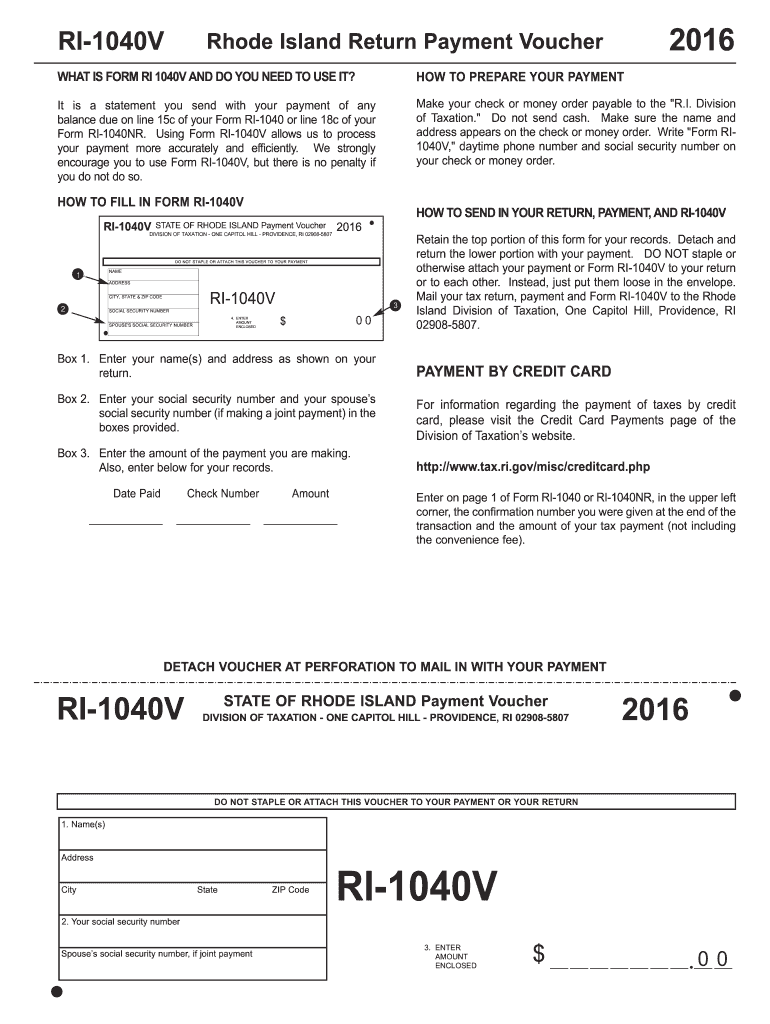

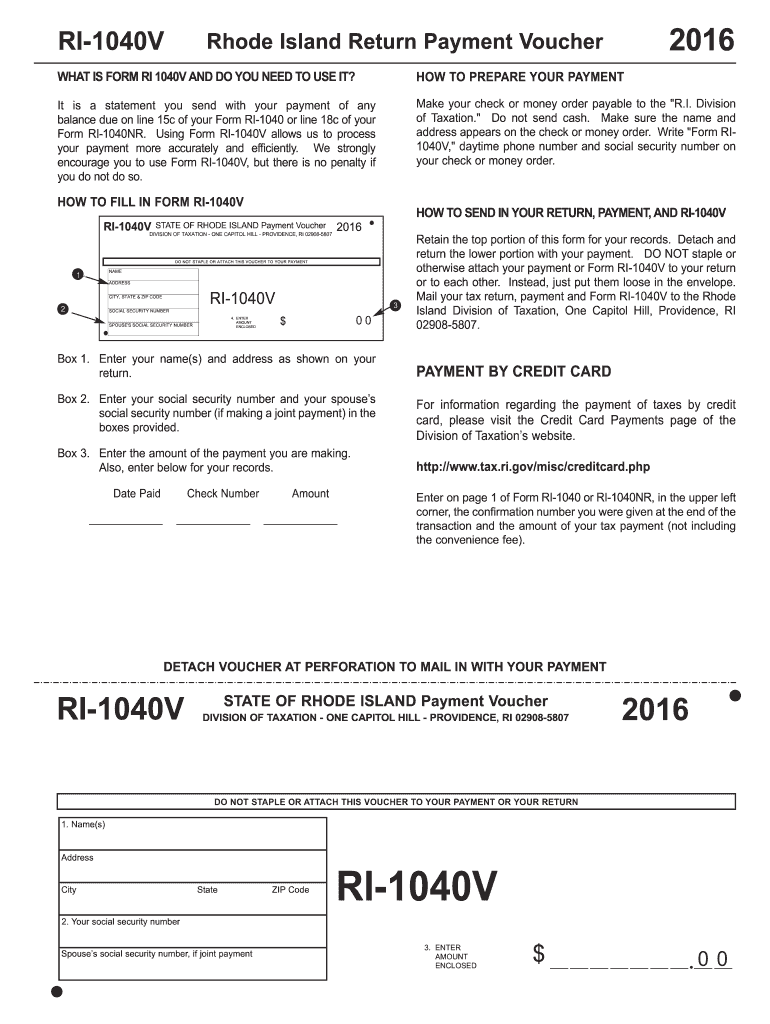

DETACH VOUCHER AT PERFORATION TO MAIL IN WITH YOUR PAYMENT DIVISION OF TAXATION - ONE CAPITOL HILL - PROVIDENCE RI 02908-5807 1. RI-1040V Rhode Island Return Payment Voucher WHAT IS FORM RI 1040V AND DO YOU NEED TO USE IT HOW TO PREPARE YOUR PAYMENT It is a statement you send with your payment of any balance due on line 15c of your Form RI-1040 or line 18c of your Form RI-1040NR. Using Form RI-1040V allows us to process your payment more accurately and efficiently. Write Form RI1040V daytime...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign RI RI-1040V

Edit your RI RI-1040V form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your RI RI-1040V form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit RI RI-1040V online

To use the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit RI RI-1040V. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

RI RI-1040V Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out RI RI-1040V

How to fill out RI RI-1040V

01

Obtain the RI RI-1040V form from the Rhode Island Division of Taxation website or local tax office.

02

Fill in your personal information, including your name, Social Security number, and address.

03

Indicate your filing status (Single, Married Filing Jointly, etc.).

04

Enter the amount of your tax payment in the appropriate section of the form.

05

Include any relevant information regarding any other payments or credits you are applying.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form.

08

Mail the form along with your payment to the address specified in the instructions.

Who needs RI RI-1040V?

01

Individuals who are filing their Rhode Island state income tax and need to make a payment.

02

Taxpayers who owe taxes as a result of their RI-1040 tax return and wish to submit their payment using the RI RI-1040V.

Instructions and Help about RI RI-1040V

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between a w2 and a W3?

What's the difference between Form W-2 and Form W-3? Employees use the information provided by their employer on the Form W-2 to complete and file their personal income tax returns. Employers use Form W-3 to report employee income to the IRS and Social Security Administration.

Is RI 7004 being discontinued?

This series of forms, also known as 'Corporate Tax Vouchers' will begin to phase-out as of January 1, 2023. Starting with tax year 2022, extensions and vouchers must be filed on the Rhode Island BUS-EXT and BUS-V forms. 1 The Division will no longer be using the RI-1120V, RI-1065V, and RI-7004.

What is Rhode Island form RI 1099E?

PURPOSE: Form RI-1099E is used to report Rhode Island Pass-through Entity Election Tax paid on Form RI-PTE on that portion of Rhode Island income attributable to individu- als.

What is the RI 706 form?

Form RI-706 is to be used by the executor(s)/administrator(s)/personal representative(s) of a. decedent to determine the Rhode Island estate tax due under R.I. Gen. Laws.

Is form W-3 required?

Form W-3 is an annual filing, so the IRS and SSA require employers to fill out and submit it once each year.

What is a RI W3 form?

Form RI-W3 - Transmittal of Wage and Tax Statements. INFORMATION FOR EMPLOYERS FILING TRANSMITTAL OF WAGE AND TAX STATEMENTS. 1. The employer's name and address should be pre-printed on the form. If incorrect, any necessary changes may be made directly on the form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get RI RI-1040V?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific RI RI-1040V and other forms. Find the template you need and change it using powerful tools.

Can I create an electronic signature for the RI RI-1040V in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I complete RI RI-1040V on an Android device?

Complete RI RI-1040V and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is RI RI-1040V?

RI RI-1040V is a tax form used by residents of Rhode Island for the purpose of making payments towards their state income tax.

Who is required to file RI RI-1040V?

Individuals who are residents of Rhode Island and have a tax liability based on their state income tax return are required to file RI RI-1040V.

How to fill out RI RI-1040V?

To fill out RI RI-1040V, taxpayers must provide their personal information, including name, address, Social Security number, and the amount of tax due as indicated on their state income tax return.

What is the purpose of RI RI-1040V?

The purpose of RI RI-1040V is to facilitate the payment of state income taxes owed by residents of Rhode Island, ensuring that payments are correctly applied to the taxpayer's account.

What information must be reported on RI RI-1040V?

RI RI-1040V must include the taxpayer's full name, address, Social Security number, the amount owed, and any applicable payment details.

Fill out your RI RI-1040V online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

RI RI-1040v is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.