RI RI-1040V 2023 free printable template

Show details

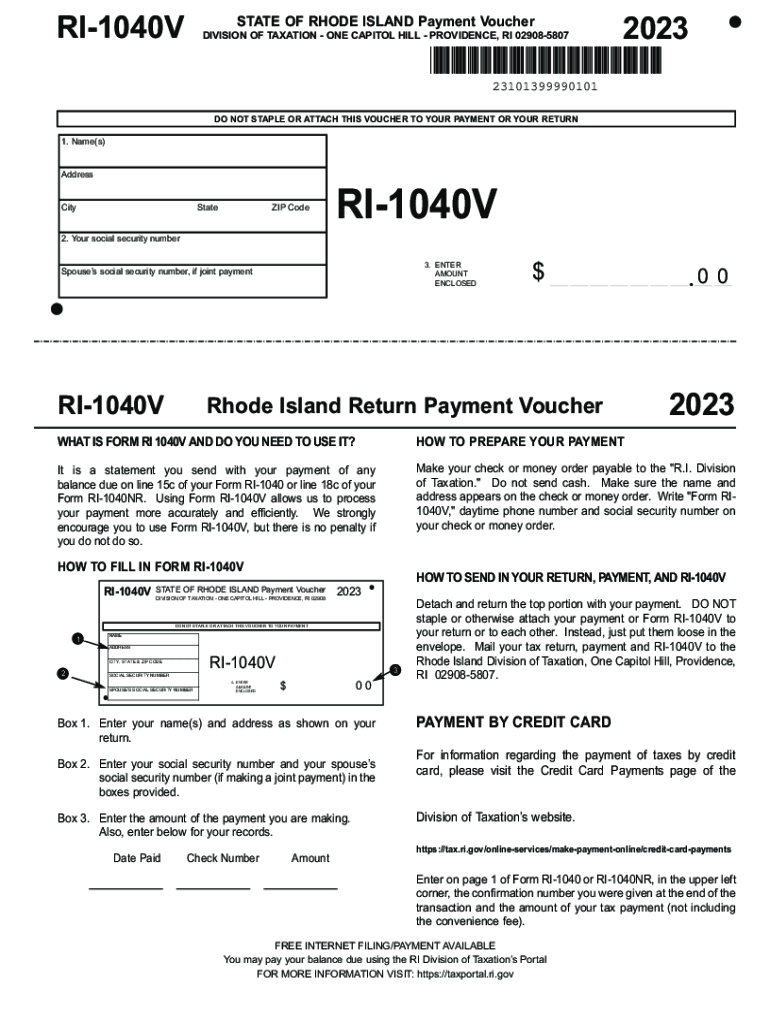

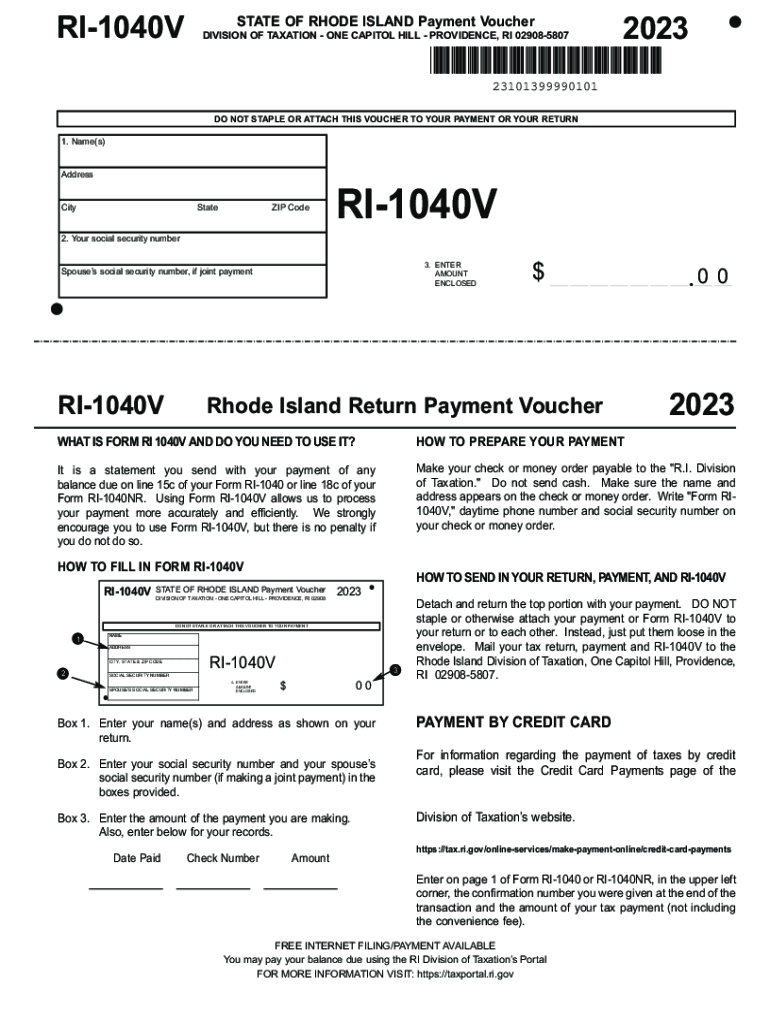

STATE OF RHODE ISLAND Payment VoucherRI1040VDIVISION OF TAXATION ONE CAPITOL HILL PROVIDENCE, RI 029085807202323101399990101

DO NOT STAPLE OR ATTACH THIS VOUCHER TO YOUR PAYMENT OR YOUR RETURN

1.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign RI RI-1040V

Edit your RI RI-1040V form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your RI RI-1040V form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit RI RI-1040V online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit RI RI-1040V. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

RI RI-1040V Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out RI RI-1040V

How to fill out RI RI-1040V

01

Obtain the RI RI-1040V form from the Rhode Island Division of Taxation website or a local tax office.

02

Fill in your personal information at the top of the form, including your name, address, and Social Security number.

03

Indicate the tax year for which you are submitting the payment.

04

Calculate the total amount of tax you owe for the year based on your tax return.

05

Write the payment amount in the designated box on the form.

06

Sign and date the form to certify that the payment is accurate.

07

Include any additional documentation if required, such as a copy of your tax return.

08

Send the completed RI RI-1040V form along with your payment to the address specified in the instructions.

Who needs RI RI-1040V?

01

Individuals who owe additional payments on their Rhode Island personal income tax.

02

Taxpayers who are filing their Rhode Island tax return and are making a payment.

03

Residents and non-residents who are required to pay Rhode Island state income tax.

Video instructions and help with filling out and completing your rhode taxation

Instructions and Help about RI RI-1040V

Fill

form

: Try Risk Free

People Also Ask about

How do I pay my taxes by phone?

To pay by telephone, call toll-free 1.888.473.0835.

Can I file RI taxes online?

With 1040NOW, you can prepare and file your federal and Rhode Island personal income tax returns online at no charge if: You live in Rhode Island and your federal adjusted gross income for 2021 was $32,000 or less.

Is Ri accepting tax returns?

PROVIDENCE, R.I. – The Rhode Island Division of Taxation has officially begun accepting and processing electronically filed Rhode Island resident and nonresident personal income tax returns for the 2020 tax year. The agency has also officially begun accepting and processing paper returns for the 2020 tax year.

Can I file my taxes by myself online?

Yes, you can file an original Form 1040 series tax return electronically using any filing status. Filing your return electronically is faster, safer, and more accurate than mailing your tax return because it's transmitted electronically to the IRS computer systems.

What is RI state income tax?

Rhode Island Tax Rates, Collections, and Burdens Rhode Island has a graduated individual income tax, with rates ranging from 3.75 percent to 5.99 percent. Rhode Island also has a 7.00 percent corporate income tax rate.

Where do I file my RI state tax return?

You have the following options to pay your tax: Mail in a check. You need to attach Payment Voucher (Form RI-1040V) One Capitol Hill. Electronic Filing. Providence, RI 02908-5806. Send credit card payment through third-party website. Send e-payment through state website.

What is the tax deadline for Rhode Island?

This will move the federal filing deadline for personal income tax to Monday, April 18, 2022. To streamline the filing process for Rhode Island taxpayers, the Rhode Island Division of Taxation will also be instituting an April 18, 2022 deadline.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the RI RI-1040V form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign RI RI-1040V. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

How do I complete RI RI-1040V on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your RI RI-1040V from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

How do I fill out RI RI-1040V on an Android device?

On Android, use the pdfFiller mobile app to finish your RI RI-1040V. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is RI RI-1040V?

RI RI-1040V is a Rhode Island state tax form used for individuals to report their income and calculate their tax liability.

Who is required to file RI RI-1040V?

Individuals who have income that meets Rhode Island's filing requirements and owe taxes for the state are required to file RI RI-1040V.

How to fill out RI RI-1040V?

To fill out RI RI-1040V, you must provide personal information, report your income, calculate deductions, and determine your tax liability based on the instructions provided on the form.

What is the purpose of RI RI-1040V?

The purpose of RI RI-1040V is to ensure that residents of Rhode Island correctly report their income and pay any taxes due to the state.

What information must be reported on RI RI-1040V?

On RI RI-1040V, you must report your total income, any allowable deductions, and your calculated tax liability as well as any payments made or refunds due.

Fill out your RI RI-1040V online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

RI RI-1040v is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.