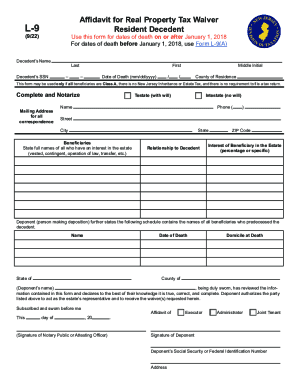

NJ DoT L-9 2017 free printable template

Get, Create, Make and Sign forms - nj division

How to edit forms - nj division online

Uncompromising security for your PDF editing and eSignature needs

NJ DoT L-9 Form Versions

How to fill out forms - nj division

How to fill out NJ DoT L-9

Who needs NJ DoT L-9?

Instructions and Help about forms - nj division

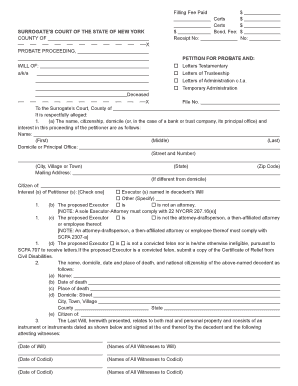

Hello and welcome to the Kenneth Burke am a law of his legal podcast in this issue we talk about inheritance taxes now in New Jersey there is no inheritance tax if money's going to children grandchildren spouse stepchildren if money is going to brothers or sisters the first $25,000 is tax-free anything after that is taxed the rate from between $25,000 to 1 million seven hundred fifty thousand is eleven percent and thereafter there's an increase in the tax rates charities which are called classy beneficiaries hospitals nonprofits there's no tax but any other natural persons their taxes fifteen percent on the first seven hundred thousand and sixteen percent after that for each person now even if there is no inheritance tax do New Jersey has an estate attacks and amounts over six hundred seventy-five thousand dollars therefore even if no federal state taxes do the estate must still file a federal state tax return plus the New Jersey estate tax return for the purpose of federal state gift tax in the year 2009 the amount in which someone can leave two children or other individuals without incurring any tax at all is 3.5 million dollars in the year 2010 there will be now a federal estate tax but then in a year 2011 it's reduced down to 1 million dollars the amount permitted to be gifted with that incurring a Federal gift tax was increased to thirteen thousand dollars a year to nine however the amount permitted to gift to become eligible for Medicaid is zero there's still a five-year look-back period New Jersey law requires that they copied the federal state tax return the file with the inheritance tax branch within 30 days after the filing of the original return with the federal government also New Jersey law requires that the inheritance tax branch is to receive a copy of any communication that the executor receives from the federal government making it making any change in the final return of performing increase in reducing the tax let's do for other information on inheritance taxes let's see you contact an attorney knowledgeable in inheritance taxes in probate contact and walks of counts per camera 73 257 205 00 2053 Woodridge avenue Edison New Jersey website w IN j laws com that's NJ l AWS com or website central jersey elder law thank you

People Also Ask about

How much money can you inherit before you have to pay taxes on it in NJ?

Do you have to complete an Inheritance Tax form?

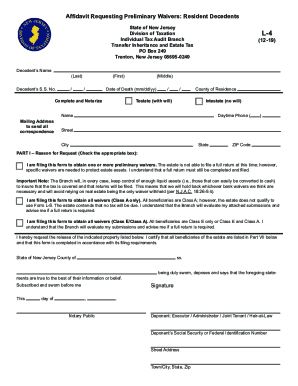

How do I get a NJ Inheritance Tax waiver?

Who has to file a NJ Inheritance Tax return?

Do I have to file a NJ inheritance tax return?

What is a L-9?

Will NJ get rid of inheritance tax?

What is NJ Form L-9 for?

Who is exempt from NJ inheritance tax?

Is an Inheritance Tax waiver required in NJ?

Who must file a NJ Inheritance Tax return?

How do I waive an inheritance tax?

Do you have to pay taxes on inheritance money in NJ?

Do I need to submit an inheritance tax return?

Do I need to file a NJ inheritance tax return?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my forms - nj division in Gmail?

Where do I find forms - nj division?

How do I complete forms - nj division on an iOS device?

What is NJ DoT L-9?

Who is required to file NJ DoT L-9?

How to fill out NJ DoT L-9?

What is the purpose of NJ DoT L-9?

What information must be reported on NJ DoT L-9?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.