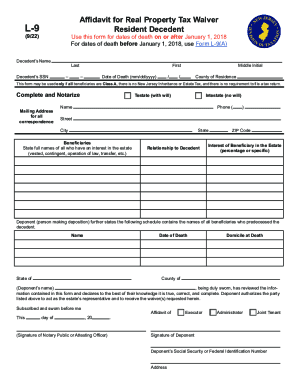

NJ DoT L-9 2019 free printable template

Show details

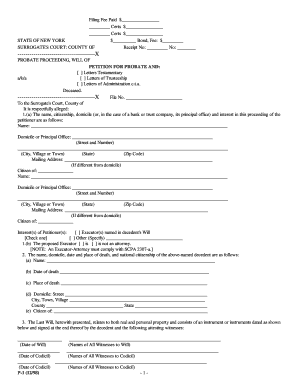

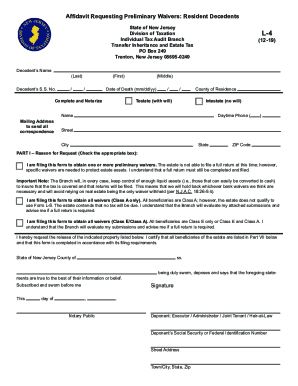

Do not file with the County Clerk. Mail this completed form to NJ Division of Taxation Inheritance and Estate Tax Branch 50 Barrack Street 3rd Floor PO Box 249 Trenton NJ 08695-0249 You can obtain more information about the use of Form L-9 by calling the Inheritance and Estate Tax Branch at 609 292-5033 or by visiting the Division of Taxation website at www. Form L-9 Affidavit for Real Property Tax Waiver Resident Decedent Use this form for dates of death on or after January 1 2018. You may...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NJ DoT L-9

Edit your NJ DoT L-9 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NJ DoT L-9 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NJ DoT L-9 online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit NJ DoT L-9. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NJ DoT L-9 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NJ DoT L-9

How to fill out NJ DoT L-9

01

Obtain the NJ DoT L-9 form from the New Jersey Department of Transportation website or local office.

02

Fill out the top section with your personal information, including name and address.

03

Provide details about the vehicle, including make, model, year, and VIN (Vehicle Identification Number).

04

Indicate the purpose of the application, such as registration or renewal.

05

Sign and date the form at the designated area.

06

Review all entries for accuracy to ensure compliance with NJ DoT requirements.

07

Submit the completed form to the appropriate NJ DoT office either in person or by mail.

Who needs NJ DoT L-9?

01

Anyone looking to register a vehicle in New Jersey.

02

Individuals renewing their vehicle registration.

03

Title holders who need to file a report of a lost or stolen title.

04

Businesses managing a fleet of vehicles that require official registration.

Fill

form

: Try Risk Free

People Also Ask about

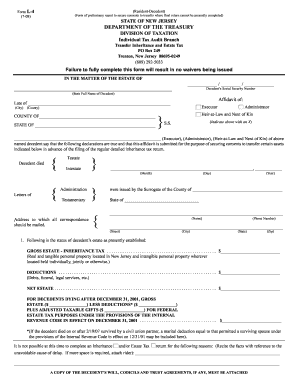

How much money can you inherit before you have to pay taxes on it in NJ?

The inheritance tax is imposed on a beneficiary that receives property valued at $500 or more. Therefore, if you receive something worth $499, you will not be required to pay any inheritance taxes. Life insurance is also exempt.

Do you have to complete an Inheritance Tax form?

for deaths on or after 1 January 2022 you do not need to fill in a HMRC form however you must give details of the assets you need a Grant of Representation for and extra information for Inheritance Tax on the Estate Summary Form (NIPF7) below. if Inheritance Tax is due or full details are needed HMRC use form IHT400.

How do I get a NJ Inheritance Tax waiver?

Waivers (Form 0-1) can only be issued by the Inheritance Tax Branch of the NJ Division of Taxation. It is not a form you can obtain online or fill out yourself. In most circumstances, some kind of return or form must be filed with the Division in order to have a waiver issued.

Who has to file a NJ Inheritance Tax return?

The executor, administrator, or heir-at-law of the estate must file an Inheritance Tax return (if required) within eight (8) months of the date of the decedent's death.

Do I have to file a NJ inheritance tax return?

The executor, administrator, or heir-at-law of the estate must file an Inheritance Tax return (if required) within eight (8) months of the date of the decedent's death.

What is a L-9?

Form L-9 – Affidavit for Real Property Tax Waiver: Resident Decedent.

Will NJ get rid of inheritance tax?

On January 1, 2018, under current law, the New Jersey Estate Tax will no longer be imposed for individuals who die on or after that date. The New Jersey Estate Tax originated in 1934.

What is NJ Form L-9 for?

Form L-9 is an affidavit executed by the executor, administrator or joint tenant requesting the issuance of a tax waiver for real property located in New Jersey which was held by a resident decedent.

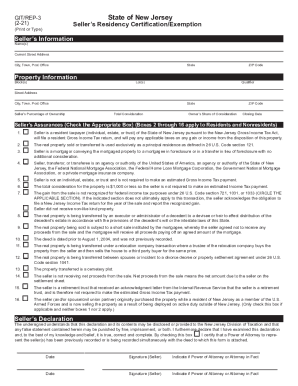

Who is exempt from NJ inheritance tax?

New Jersey recognizes four classes of beneficiaries: A, C, B & E. The rates of tax imposed by the state depends upon the class the beneficiary is in; the rates of tax are imposed by the state. Class A beneficiaries are exempt from tax. Class C beneficiaries are not exempt for this class.

Is an Inheritance Tax waiver required in NJ?

Therefore, a waiver is not necessary. Non-resident decedents (bank accounts): Inheritance Tax and Estate Tax waivers are not required for intangible assets of a non-resident decedent. Waivers are required for real property located in New Jersey which was owned by a non-resident decedent (except as in #1 above).

Who must file a NJ Inheritance Tax return?

The executor, administrator, or heir-at-law of the estate must file an Inheritance Tax return (if required) within eight (8) months of the date of the decedent's death.

How do I waive an inheritance tax?

How to avoid inheritance tax Make a will. Make sure you keep below the inheritance tax threshold. Give your assets away. Put assets into a trust. Put assets into a trust and still get the income. Take out life insurance. Make gifts out of excess income. Give away assets that are free from Capital Gains Tax.

Do you have to pay taxes on inheritance money in NJ?

New Jersey has had an Inheritance Tax since 1892, when a tax was imposed on property transferred from a deceased person to a beneficiary. Inheritance Tax is based on who specifically will receive or has received a decedent's assets, and how much each beneficiary is entitled to receive.

Do I need to submit an inheritance tax return?

For deaths occurring on or after 1 January 2022, it will no longer be necessary to file a short-form IHT return for excepted estates. The executors will now only need to make a declaration to confirm the value of the estate as part of the application for probate.

Do I need to file a NJ inheritance tax return?

An estate is required to file a New Jersey estate tax return, if the value of the decedent's gross estate exceeds $675,000. In addition, New Jersey also imposes an inheritance tax on assets that pass to someone other than a spouse or a lineal ascendant or descendant.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit NJ DoT L-9 online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your NJ DoT L-9 to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Can I create an electronic signature for signing my NJ DoT L-9 in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your NJ DoT L-9 and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I fill out the NJ DoT L-9 form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign NJ DoT L-9 and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is NJ DoT L-9?

NJ DoT L-9 is a form used in New Jersey for reporting specific transportation-related data and costs associated with state-funded transportation projects.

Who is required to file NJ DoT L-9?

Entities that receive funding or grants for transportation projects from the New Jersey Department of Transportation (NJ DoT) are required to file the NJ DoT L-9.

How to fill out NJ DoT L-9?

To fill out NJ DoT L-9, complete the required sections with accurate data regarding expenses, project details, and any other necessary information as specified in the form guidelines.

What is the purpose of NJ DoT L-9?

The purpose of NJ DoT L-9 is to ensure transparency and accountability in the use of state funds for transportation projects, allowing NJ DoT to track expenditures and project progress.

What information must be reported on NJ DoT L-9?

Information that must be reported on NJ DoT L-9 includes project identification details, budgeted and actual expenditures, funding sources, and any discrepancies or adjustments.

Fill out your NJ DoT L-9 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NJ DoT L-9 is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.