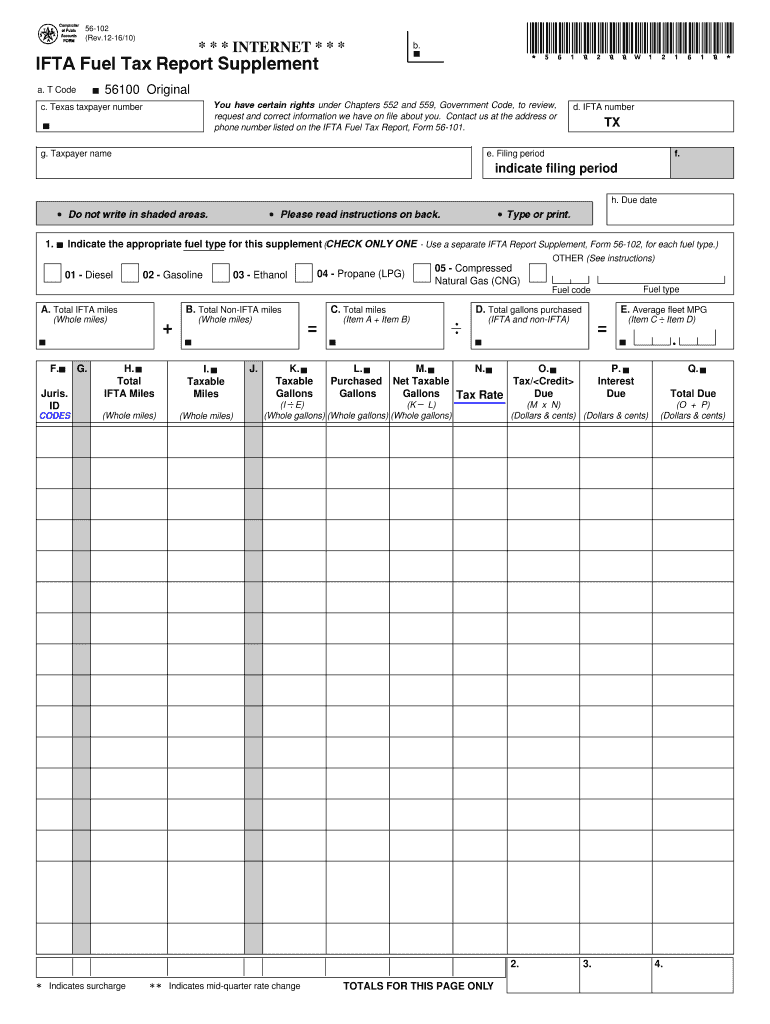

TX Comptroller 56-102 2016 free printable template

Show details

Contact us at the address or phone number listed on the IFTA Fuel Tax Report Form 56-101. You have certain rights g. AB CD Use a separate Form 56-102 for each fuel type. 56-102 Rev.12-16/10 IFTA Fuel Tax Report Supplement PRINT FORM CLEAR FIELDS 5610200W121610 Instructions in English b. I Please read instructions on back. Type or print. Indicate the appropriate fuel type for this supplement CHECK ONLY ONE - Use a separate IFTA Report Supplement Form 56-102 for each fuel type. Comptroller....

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TX Comptroller 56-102

Edit your TX Comptroller 56-102 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TX Comptroller 56-102 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit TX Comptroller 56-102 online

Follow the guidelines below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit TX Comptroller 56-102. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX Comptroller 56-102 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TX Comptroller 56-102

How to fill out TX Comptroller 56-102

01

Obtain the TX Comptroller 56-102 form from the official website or your local office.

02

Review the instructions on the form carefully before beginning.

03

Fill in your entity's name as it appears on official documents.

04

Provide the entity's Texas Taxpayer Number in the designated field.

05

Enter your entity's federal Employer Identification Number (EIN).

06

Complete the information for the type of exemption you are applying for.

07

Include any additional supporting documentation required for your specific exemption type.

08

Review all filled information for accuracy and completeness.

09

Sign and date the form where indicated.

10

Submit the form to the appropriate office as instructed, either by mail or electronically.

Who needs TX Comptroller 56-102?

01

Individuals or businesses seeking a sales tax exemption in Texas.

02

Non-profit organizations that qualify for sales tax exemptions.

03

Government entities that are exempt from paying sales tax.

04

Entities purchasing goods that are intended for resale in Texas.

Fill

form

: Try Risk Free

People Also Ask about

How do I get my IFTA in Minnesota?

In order to obtain an IFTA license in Minnesota you must contact the DVS IFTA office or one of the 10 deputy registrar offices. There is currently a $28 annual filing charge and an additional $2.50 for each set of decals. You are required to have one set of decals for each vehicle.

What is the IFTA 100 MN form?

Form IFTA-100 summarizes the amount of tax due or the amount to be credited for the various fuel types computed on each Form IFTA-101 and is used to determine the total amount due/credit, including any appropriate penalty and interest. Instructions Enter the ending date of the quarter covered by this return.

How do I get a Texas IFTA sticker?

How to Apply for an IFTA License. Motor carriers are encouraged to apply for an IFTA license through the Comptroller's Webfile system. With Webfile it's easy to submit the application electronically from the convenience of a home or office without the delays associated with mailing paper applications.

How do I register for IFTA NY?

If New York State is your base jurisdiction, follow the steps below to get your initial IFTA license and decals. File Form IFTA-21, New York State International Fuel Tax Agreement (IFTA) Application. Buy a set of two decals for each qualified motor vehicle you operate under your IFTA license.

Can I drive without IFTA sticker in Texas?

Operating a motor vehicle in Texas without a valid IFTA license, interstate trucker license or fuel trip permit may subject you to a penalty under Subchapter E of the Texas Motor Fuels Tax Code.

What is the full form of IFTA?

International Fuel Tax Agreement (IFTA)

Do you need IFTA to drive in Texas?

If you were wondering whether or not you're exempt, know that you must register and file for IFTA if you have: Any vehicle with two axles and a gross vehicle weight of over 11,797 kilograms or 26,000 pounds. A vehicle of any weight but with three or more axles. A vehicle that exceeds 11,797 kilograms or 26,000 pounds.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute TX Comptroller 56-102 online?

pdfFiller has made it simple to fill out and eSign TX Comptroller 56-102. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I create an eSignature for the TX Comptroller 56-102 in Gmail?

Create your eSignature using pdfFiller and then eSign your TX Comptroller 56-102 immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I edit TX Comptroller 56-102 straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing TX Comptroller 56-102, you can start right away.

What is TX Comptroller 56-102?

TX Comptroller 56-102 is a tax form used in Texas for reporting unclaimed property.

Who is required to file TX Comptroller 56-102?

Entities holding unclaimed property, such as businesses and financial institutions, are required to file TX Comptroller 56-102.

How to fill out TX Comptroller 56-102?

To fill out TX Comptroller 56-102, you must enter your name, address, type of business, and details of the unclaimed property being reported, including owner information.

What is the purpose of TX Comptroller 56-102?

The purpose of TX Comptroller 56-102 is to report and remit unclaimed property to the state of Texas, ensuring that rightful owners can reclaim their assets.

What information must be reported on TX Comptroller 56-102?

Information that must be reported on TX Comptroller 56-102 includes the owner name, last known address, property description, value of the property, and your business details.

Fill out your TX Comptroller 56-102 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TX Comptroller 56-102 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.