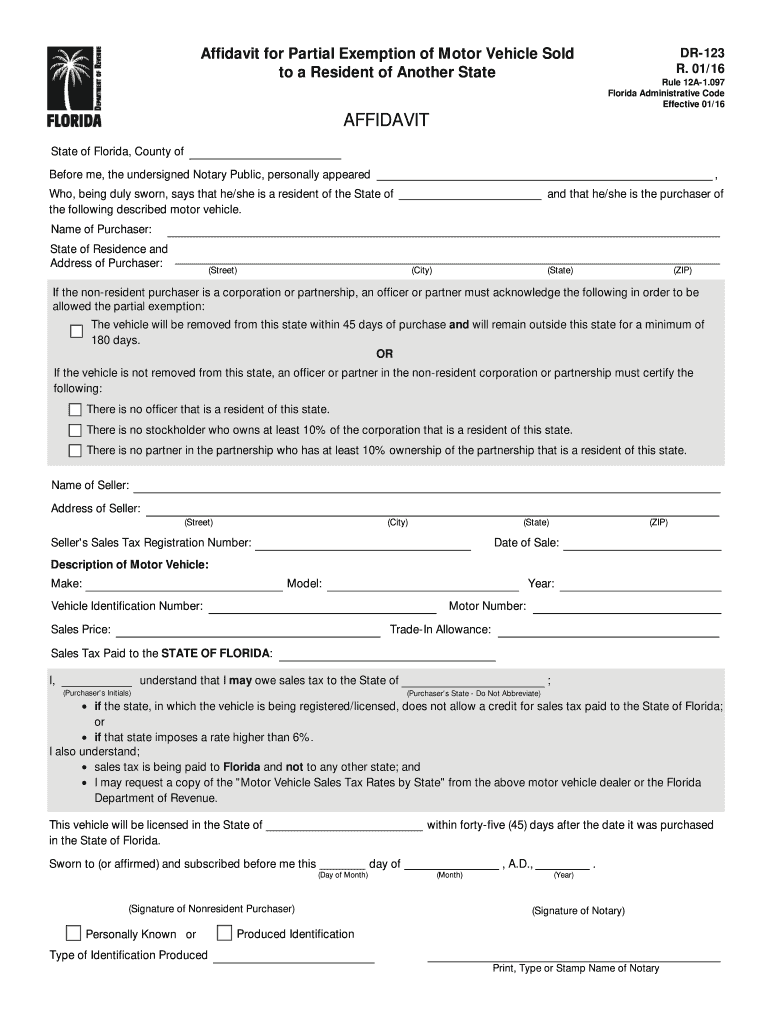

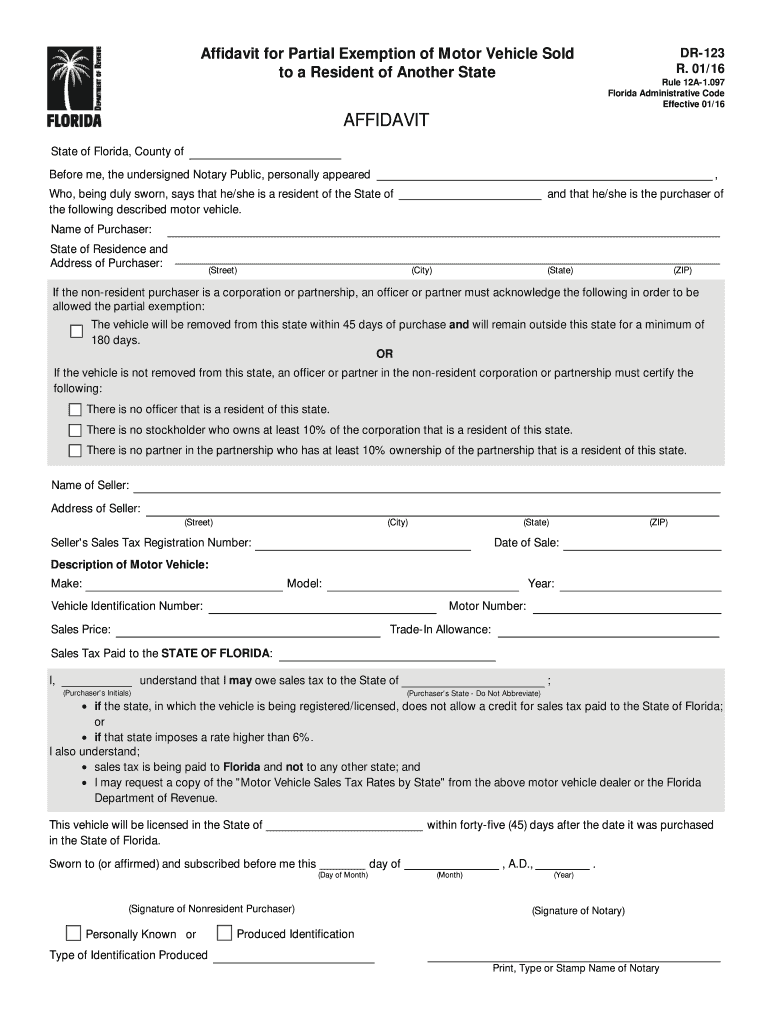

FL DoR DR-123 2016 free printable template

Get, Create, Make and Sign FL DoR DR-123

Editing FL DoR DR-123 online

Uncompromising security for your PDF editing and eSignature needs

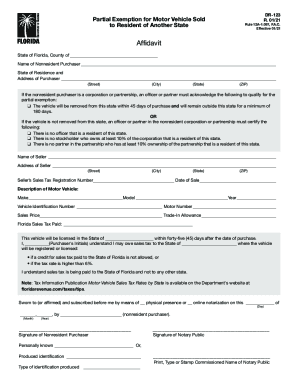

FL DoR DR-123 Form Versions

How to fill out FL DoR DR-123

How to fill out FL DoR DR-123

Who needs FL DoR DR-123?

Instructions and Help about FL DoR DR-123

Welcome to the human performance outliers podcasts with your hosts dr Shaun Baker and Zak bitter at human performance outliers podcasts we dive into a wide range of topics revolving around health nutrition and physical fitness if you enjoy the show and wish to support us please visit patreoncom forward slash HP o podcast if you do not use patreon to still wish to support us please also consider checking out our PayPal page at PayPal dot me forward slash HP o pi the link to both of those can also be found in the show notes finally please consider subscribing to us on your favorite podcast listening platform now on to the next topic yeah we are up get three podcasts we got a knockout I think if we have we heard on three in a day before day one other times the very beginning I think we recorded the first three or four weve done a triple for all experienced at this and Im not nearly as worried just because weve got the bottle then we got dr Jay Wrigley then we got George Henderson down from New Zealand later but then dude I know I got a bus to do a quick one hour consult and we get back in in one so we got we got a knock we got to keep these to about our 15 piece I think today somewhere in our row I get it I get it I get a 500-meter row in there Ive already done my three hundred push-ups so anyway Nevada it is a pleasure and we are recording about his pleasure having you on for you guys dont know Nevada goes by the Paleo pharmacist on Instagram I dont not sure where else youre located but youve got just a really unique interesting story and you know Id like to get into that you know just this is a hint here you probably recognize what this is for you guys that is all right well talk about that as we get into Nevada story but tell us for the listeners who dont know a little bit about your background where you grew up where youre from you got this wonderful southern accent you sound like from Georgia I think is that right no Im actually from Massachusetts about where you grew up worried what your background is and you know about your educational background I know your pharmacist and then well get into your story and well talk about some of the other stuff as things pop up you raise AK yeah lets do it do it alright so I grew up in Foxborough Massachusetts so its where the I know England Patriots a home base for them which is Foxborough is most known for right outside of Boston and I you know grew up just had a normal childhood nothing too dramatic happened and I am a pharmacist and registered nurse I also have a bachelors degree in biochemistry so thats my background Ive always been into science and into the arts and just love helping people so it was natural for me to gravitate into science and in healthcare and currently right now I work as a community pharmacist in the community that I live in all right Foxborough home of the Patriots you guys have you guys that pretty good run Super Bowls over there I still havent forgiven you yet first Super Bowl...

People Also Ask about

What is an affidavit of non vehicle ownership in Florida?

Do 100% disabled vets pay property tax in Florida?

Do disabled veterans get free vehicle registration in Florida?

What benefits does a 100% disabled veteran get in Florida?

How is sales tax calculated on a new car in Florida?

Do 100% disabled veterans pay sales tax on vehicles in Florida?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send FL DoR DR-123 to be eSigned by others?

How do I make edits in FL DoR DR-123 without leaving Chrome?

How can I fill out FL DoR DR-123 on an iOS device?

What is FL DoR DR-123?

Who is required to file FL DoR DR-123?

How to fill out FL DoR DR-123?

What is the purpose of FL DoR DR-123?

What information must be reported on FL DoR DR-123?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.