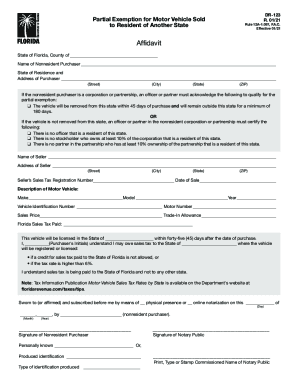

FL DoR DR-123 2009 free printable template

Show details

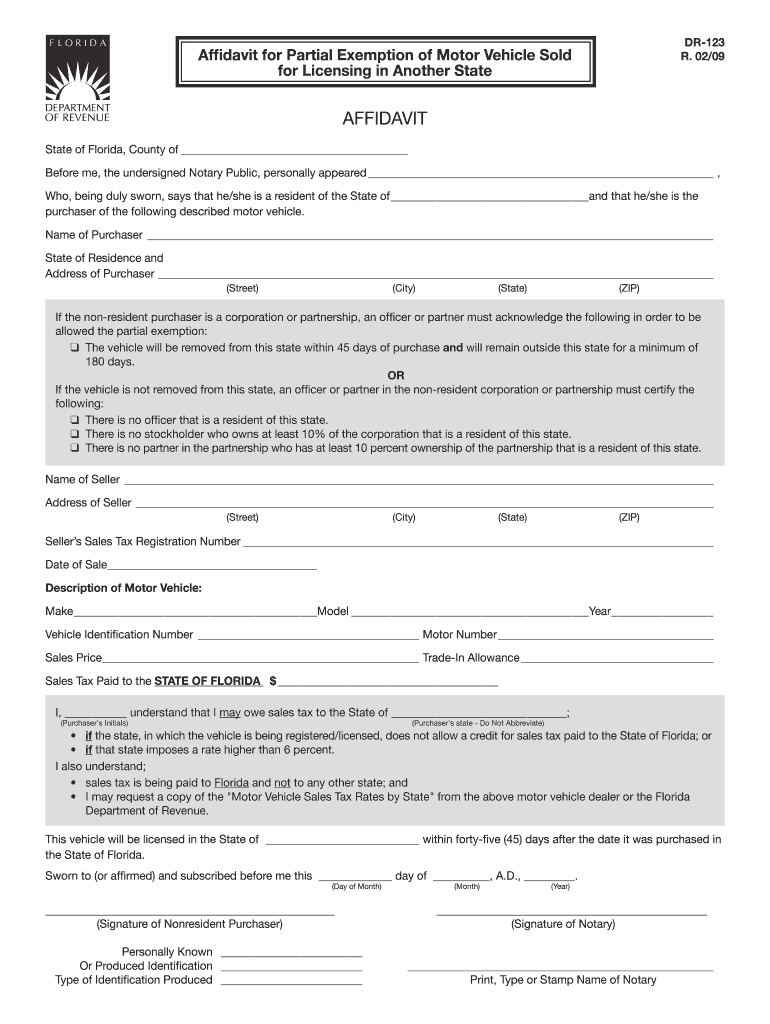

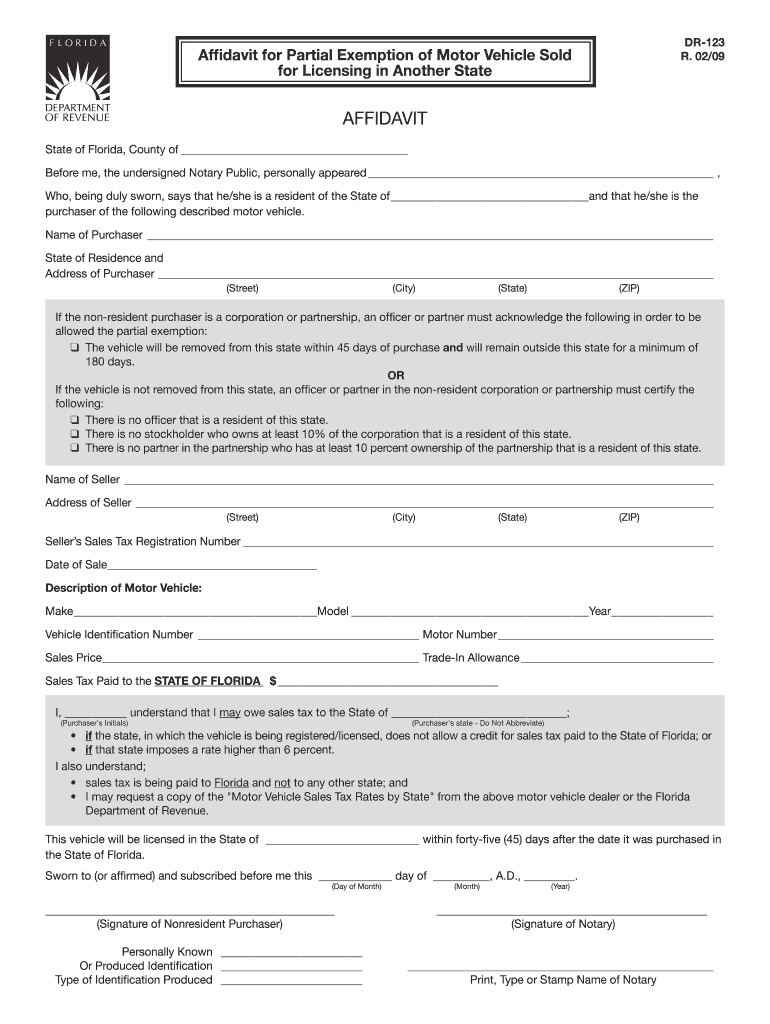

DR-123 R. 02/09 Affidavit for Partial Exemption of Motor Vehicle Sold for Licensing in Another State Affidavit State of Florida County of Before me the undersigned Notary Public personally appeared Who being duly sworn says that he/she is a resident of the State of and that he/she is the purchaser of the following described motor vehicle. Name of Purchaser State of Residence and Address of Purchaser Street City State ZIP If the non-resident purchaser is a corporation or partnership an officer...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign FL DoR DR-123

Edit your FL DoR DR-123 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your FL DoR DR-123 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit FL DoR DR-123 online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit FL DoR DR-123. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

FL DoR DR-123 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out FL DoR DR-123

How to fill out FL DoR DR-123

01

Obtain the FL DoR DR-123 form from the Florida Department of Revenue website or local office.

02

Fill in your name, address, and contact information at the top of the form.

03

Provide your Social Security Number or Federal Employer Identification Number (EIN) in the designated section.

04

Indicate the type of return you are filing, based on the instructions provided.

05

Complete all required sections regarding income, deductions, and credits as applicable to your situation.

06

Double-check all entries for accuracy and ensure all necessary documentation is attached.

07

Sign and date the form at the bottom before submitting it.

Who needs FL DoR DR-123?

01

Individuals or businesses in Florida who need to report and pay specific taxes.

02

Those who are applying for a tax exemption or special tax treatment.

03

Tax professionals helping clients with tax filings in Florida.

Instructions and Help about FL DoR DR-123

Fill

form

: Try Risk Free

People Also Ask about

What is the excise tax on vehicles in Florida?

Motor Vehicle Registration and Taxes Florida's 6 percent use tax applies to and is due on motor vehicles brought into this state within 6 months from the date of purchase. If the purchaser resides in a county that imposes a discretionary sales surtax, that tax will also apply.

What is a notarized statement of non ownership vehicle in Florida?

A statement of non-ownership is a specific legal document confirming that you don't own a vehicle. It's used in many situations, including the following ones: A person you sold your car to has made a traffic violation or got a parking fine, and you are the one who receives the notice.

What is an affidavit of non use vehicle in Florida?

A non-use affidavit, on which the applicant certifies that the vehicle was not in use for the period from the previous registration (or purchase) until the effective date of the Florida IRP registration. When needed, the Bureau will provide this form to the applicant.

Do 100% disabled veterans pay sales tax on vehicles in Florida?

Yes for some disabled veterans and families. Voters approved this new sales and use tax exemption in the November 2020 election, which became effective January 1, 2021. You must submit a copy of your letter from the Department of Veterans Affairs certifying this disability to our office.

How do I avoid paying tax on a gifted car in Florida?

If you live in Florida and you gift a car to a family member, a bill of sale gift or affidavit will exempt you from taxes. If you do have to pay taxes on your gifted vehicle, the state uses the vehicle's fair market value to calculate the amount you have to pay.

What is proof of ownership of a car in Florida?

A certificate of title in either electronic or paper form is the proof of ownership of a vehicle, mobile home, or vessel in the state of Florida. Most vehicles, mobile homes, or vessels are required to be titled, with the exception of mopeds, motorized bicycles, and trailers weighing less than 2,000 pounds.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit FL DoR DR-123 from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including FL DoR DR-123, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

Can I create an electronic signature for the FL DoR DR-123 in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your FL DoR DR-123 in seconds.

Can I edit FL DoR DR-123 on an iOS device?

Use the pdfFiller mobile app to create, edit, and share FL DoR DR-123 from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is FL DoR DR-123?

FL DoR DR-123 is a form used in Florida for reporting certain tax information to the Department of Revenue.

Who is required to file FL DoR DR-123?

Entities or individuals engaged in specific taxable activities in Florida may be required to file FL DoR DR-123.

How to fill out FL DoR DR-123?

To fill out FL DoR DR-123, follow the guidelines provided in the instructions included with the form, ensuring all relevant sections are completed accurately.

What is the purpose of FL DoR DR-123?

The purpose of FL DoR DR-123 is to provide the Florida Department of Revenue with necessary information for tax assessment and compliance.

What information must be reported on FL DoR DR-123?

The information required on FL DoR DR-123 generally includes details about the taxpayer's identification, taxable activities, and applicable tax calculations.

Fill out your FL DoR DR-123 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

FL DoR DR-123 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.