NY DTF IT-214 2016 free printable template

Show details

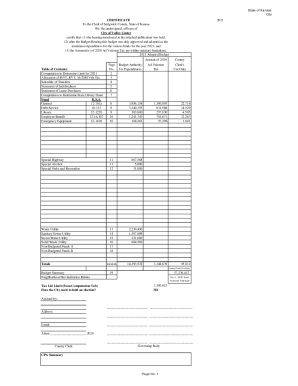

This is the credit for your household. If more than one member of your household is filing Form IT-214 see instructions. Click to continue to Form IT-214 8361362 214001163094 For office use only Page 2 of 3 IT-214 2016 Step 3 Determine household gross income Enter the total of all amounts even if not taxable that you your spouse if married and all other household members received during 2016. 26 IT-214 2016 Page 3 of 3 Your social security number 28 Renters Enter amount from line 22....Homeowners Enter amount from line 27 see instructions. PRINT RESET Department of Taxation and Finance FORM IT-214 2016 Claim for Real Property Tax Credit For Homeowners and Renters IT-214 Welcome to our enhanced fill-in form Step 1 Enter identifying information WARNING PLEASE USE A DIFFERENT PDF VIEWER Your first name MI Your last name for a joint claim enter spouse s name on line below Your date of birth mmddyyyy Your social security number This form contains a two-dimensional 2D barcode. When...you enter your data into this You tried to open this form in an application that is not compatible with some of the features enabled in this form* Spouse s first name MI Spouse s last name Spouse s date of birth mmddyyyy Spouse s social security number form your data is inserted into the barcode. We electronically read the barcode and use ToCurrent solve this problem please use Adobe Reader. follow the instructions below mailing address and street or PO box Apartment number New York State county...of residence that data process your return more efficiently. SELECT COUNTY 1. City Save theorform PDF file in your hard drive and from now on Country work on If you need to fill more than one if notthat Uniteddocument. States village post office ZIP code form make copies and assign a different file name to each form*SELECT COUNTRY Street address of New York residence that qualifies you for this credit if different from above You must enter date s of birth and social security number s http //www....adobe. com/go/getreader/ above. Apartment number 2. If DO you do not have onRETURN your computer you can download it at IT NOT WRITE ON THE ONCE YOU City village or rural route 3. Open the form you just saved with NY except for signatures. Adobe Reader version 5 or1 through higher StepRemember 2 - Determine eligibility For lines 6 or markthe an X barcode in the appropriate we use information in to box. your return* If you need to 1 Were a Newchanges York State resident for all ofmake 2016. make...you must them on your computer and print a1 Yes new copy No of Acrobat Standard or Professional. your form* The barcode will automatically update to include the corrected information 2 Did you occupy the same residence for at least six months during 2016. 2 Yes No 2012 or higher will allow you to save the form data and complete the form in different sessions. when youv11 reprint If you marked an X in the your No boxreturn* on line 1 or 2 stop you do not qualify for this credit. 3 Did you own...real property with a current market value of more than 85 000 during 2016. 3 Yes 4 Can you be claimed as a dependent on another taxpayer s 2016 federal return.

pdfFiller is not affiliated with any government organization

Instructions and Help about NY DTF IT-214

How to edit NY DTF IT-214

How to fill out NY DTF IT-214

Instructions and Help about NY DTF IT-214

How to edit NY DTF IT-214

To edit the NY DTF IT-214 form, you can use pdfFiller's extensive tools. Start by uploading the form to the platform. Utilize the editing features to modify any necessary fields. Once you have completed your changes, you can save, print or submit the form directly through pdfFiller.

How to fill out NY DTF IT-214

Filling out the NY DTF IT-214 form requires attention to detail. Begin by gathering all relevant financial documentation, such as proof of your expenses and income. Follow the steps below to complete the form:

01

Access the form online or download it from the New York State Department of Taxation and Finance website.

02

Fill in your personal information, including name, address, and social security number.

03

Record the relevant payment and purchase details as required in the form.

04

Review your entries for accuracy before submission.

About NY DTF IT previous version

What is NY DTF IT-214?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About NY DTF IT previous version

What is NY DTF IT-214?

The NY DTF IT-214 is a tax form used in New York State aimed at claiming a property tax credit. This form is essential for individuals seeking to reduce their tax liability associated with real property taxes. Understanding the specific use of this form is critical for eligible filers.

What is the purpose of this form?

The purpose of the NY DTF IT-214 form is to allow New York residents to apply for a property tax credit. The credit aids qualifying individuals, alleviating some of the financial burden from property taxes. It is crucial to submit this form accurately to receive the appropriate benefits.

Who needs the form?

Any New York State resident who meets specific criteria—such as income thresholds and property ownership—should fill out the NY DTF IT-214 form. Particularly, those who own or rent residential property and wish to claim the property tax credit must submit this form when filing their state tax returns.

When am I exempt from filling out this form?

You may be exempt from filling out the NY DTF IT-214 if you do not own or rent property, or if your income exceeds the thresholds defined by the New York State Department of Taxation and Finance. Additionally, if you are already receiving a comparable tax credit, you may not need to submit this form.

Components of the form

The NY DTF IT-214 typically includes sections for personal information, income details, and other necessary data related to property taxes. Be prepared to provide accurate tax identification numbers and details of any qualifying payments or purchases that pertain to the property in question.

What are the penalties for not issuing the form?

Failure to submit the NY DTF IT-214 form when required may result in the loss of the property tax credit. Additionally, if the form is submitted incorrectly or late, it can result in penalties imposed by the New York State Department of Taxation and Finance, which can include fines or increased scrutiny in future filings.

What information do you need when you file the form?

When filing the NY DTF IT-214, gather the following information: your Social Security number, tax identification numbers if applicable, proof of property ownership or rental agreements, income statements, and any supporting documents detailing your property taxes paid. This information will be critical to accurately complete the form.

Is the form accompanied by other forms?

The NY DTF IT-214 may need to be filed alongside other related tax forms required by the New York State Department of Taxation and Finance. For example, if claiming certain deductions or credits, you might need to include documentation that validates your eligibility for those items.

Where do I send the form?

Once completed, the NY DTF IT-214 form should be mailed to the address designated by the New York State Department of Taxation and Finance. This information can typically be found in the instructions section of the form or on the official Department of Taxation and Finance's website.

See what our users say