IRS 8879-S 2017 free printable template

Show details

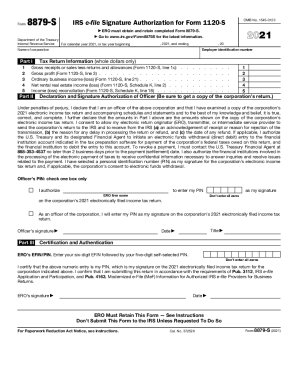

Form 8879-S OMB No. 1545-0123 IRS e-file Signature Authorization for Form 1120S Return completed Form 8879-S to ERO. Provide the officer with a copy of the signed Form 8879-S upon request. copy of the Form 8879-S if changes are made to the return for example based on the officer s review. Retain the completed Form 8879-S for 3 years from the return due date or IRS received date whichever is later. The ERO must receive the completed and signed Form 8879-S from the officer CAUTION before the...electronic return is transmitted or released for transmission. Form 8879-S can be retained electronically in accordance with the recordkeeping guidelines in Rev. Proc. 97-22 which is on page 9 of www.irs.gov/pub/irs-irbs/irb97-13. Cat. No. 37252K Form 8879-S 2017 Page 2 Future Developments Officer Responsibilities For the latest information about developments related to Form 8879-S and its instructions such as legislation enacted after they were published go to The corporate officer will Purpose...of Form A corporate officer and an electronic return originator ERO use Form 8879-S a personal identification number PIN to electronically sign an S corporation s applicable consent to electronic funds withdrawal. A corporate officer who doesn t use Form 8879-S must use Form 8453-S U.S. S Corporation Income Tax Declaration for an IRS e-file Return. For more information see the instructions for Form 8453-S. Don t send this form to the IRS. The ERO must retain Form 8879-S. ERO Responsibilities The...ERO will Enter the name and employer identification number of the corporation at the top of the form Complete Part I using the amounts zero may be entered when appropriate from the corporation s 2017 income tax Enter on the authorization line in Part II individual preparing the return if the ERO is authorized to enter the officer s PIN Give the officer Form 8879-S for completion and review acceptable delivery methods include hand delivery U.S. mail private delivery service email Internet...website and fax and and date. The acceptable delivery methods include hand delivery U.S. mail private delivery service email The corporation s return won t be transmitted to the IRS until the ERO receives the officer s signed Form Important Notes for EROs Don t send Form 8879-S to the IRS unless requested to do so. Verify the accuracy of the corporation s Check the appropriate box in Part II to either authorize the ERO to enter the officer s PIN or choose to enter it in person Indicate or...verify his or her PIN when authorizing the ERO to enter it the PIN must be five digits other than all zeros Sign date and enter his or her title in Part II and Return the completed Form 8879-S to the ERO. Don t send to IRS* to www*irs*gov/Form8879S for the latest information* Go Department of the Treasury Internal Revenue Service For calendar year 2017 or tax year beginning 2017 and ending Part I Tax Return Information Whole dollars only Gross receipts or sales less returns and allowances...Form 1120S line 1c Gross profit Form 1120S line 3.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 8879-S

How to edit IRS 8879-S

How to fill out IRS 8879-S

Instructions and Help about IRS 8879-S

How to edit IRS 8879-S

To edit IRS 8879-S, first download the form from the IRS website or through an authorized provider. Use a PDF editor like pdfFiller to make the necessary changes. Ensure that all fields are updated and accurate, particularly those involving your business information and financial details. Save the edited document to preserve your changes for later submission.

How to fill out IRS 8879-S

Filling out IRS 8879-S requires careful attention to detail. Begin by entering your business's legal name and Employer Identification Number (EIN) at the top of the form. Provide the information as it appears on your tax return, and be sure to sign and date the form at the bottom to certify the accuracy of the information provided. It's crucial to review each section to avoid any errors that could delay processing.

About IRS 8879-S 2017 previous version

What is IRS 8879-S?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 8879-S 2017 previous version

What is IRS 8879-S?

IRS 8879-S is an e-file Signature Authorization for Form 1120S, which is used by an S Corporation. This form is important for the electronic submission of your tax return, providing authorization for a tax professional to file on behalf of the corporation. Understanding that 8879-S is primarily about consent is vital for both the taxpayer and the tax preparer.

What is the purpose of this form?

The purpose of IRS 8879-S is to give the taxpayer's electronic signature to their tax preparer. This authorization facilitates the e-filing process of Form 1120S, making it quicker and more efficient compared to traditional paper filing. Additionally, it serves to verify that the signer has reviewed the tax return and agrees with its contents prior to submission.

Who needs the form?

Any S Corporation that wishes to file its tax return electronically needs IRS 8879-S. The corporation's officer must sign the form, thus empowering their tax professional to file the return electronically. This ensures compliance and expedites the processing of the corporation’s tax return.

When am I exempt from filling out this form?

Taxpayers may be exempt from filling out IRS 8879-S if they are not filing electronically. If a corporation decides to file its tax return using paper methods, this form is not required. However, using the form generally streamlines the process and is recommended for efficiency.

Components of the form

IRS 8879-S consists of several key components, including the business's name, EIN, and a declaration section where the signer attests to the accuracy of the information. There is also a space for the tax preparer's details and a signature line for the taxpayer. Each section must be completed accurately to ensure proper processing.

What are the penalties for not issuing the form?

Failing to issue IRS 8879-S can result in delays in processing the corporation's tax return. Without this authorization, the tax preparer cannot electronically submit the return, which may lead to late filing penalties for the corporation. Additionally, incorrect filings may require amended returns, complicating compliance further.

What information do you need when you file the form?

When filing IRS 8879-S, you will need the corporation's legal name, EIN, and the preparer’s information. It is also essential to have the completed Form 1120S available for review, as this form validates the details you are authorizing for e-filing.

Is the form accompanied by other forms?

IRS 8879-S is specifically linked to Form 1120S and should accompany it when submitted. While IRS 8879-S itself does not need to be submitted with Form 1120S if filing electronically, it is critical for the e-filing process as it validates the submission and the information on the return.

Where do I send the form?

IRS 8879-S is not sent to the IRS directly. Instead, it is retained by the tax professional as part of their records when e-filing Form 1120S on behalf of the corporation. It is crucial to keep a copy for your records in case of future inquiries or compliance checks.

See what our users say