Get the free irs form 656 lpdffillercom 2017

Instructions and Help about IRS 656-L

How to edit IRS 656-L

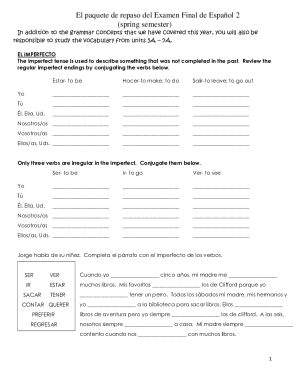

How to fill out IRS 656-L

About IRS 656-L 2017 previous version

What is IRS 656-L?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about irs form 656 lpdffillercom

What should I do if I need to correct an error after submitting my irs form 656 lpdffillercom?

If you discover an error after submitting your irs form 656 lpdffillercom, you can file an amended version of the form. Make sure to clearly indicate the corrections made and provide any additional required support documents. It’s advisable to follow up with the IRS to ensure your corrected form has been received and processed.

How can I track the status of my submitted irs form 656 lpdffillercom?

To track the status of your submitted irs form 656 lpdffillercom, you can use the IRS online tools or contact their helpline. Be prepared to provide your personal information to verify your identity. This helps in checking the receipt and processing of your form.

What are the common reasons for rejection of the irs form 656 lpdffillercom when e-filing?

Common reasons for rejection of the irs form 656 lpdffillercom during e-filing can include incorrect taxpayer identification numbers, missing signatures, or failure to meet eligibility criteria. Always double-check your entries before submission to minimize rejection risks.

Is an e-signature acceptable when filing the irs form 656 lpdffillercom?

Yes, an e-signature is generally acceptable for filing the irs form 656 lpdffillercom, as long as it complies with IRS requirements. Ensure you meet any specific authentication measures set by the IRS to validate your electronic signature.