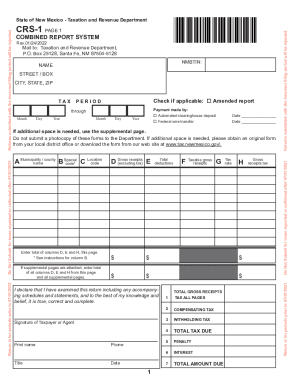

NM TRD CRS-1 2017 free printable template

Show details

Each CRS-1 Form is due on or before the 25th of the month following the end of the tax period being reported. Certain taxpayers are required to ile the CRS-1 Form electronically. Food retailers do NOT enter on the CRS-1 Form any receipts for sales paid for by federal food cards. Do not make address changes on the CRS-1 Form. Use the Form ACD-31075 Business Tax Registration Update. Be sure to include the total from Column H from the CRS-1 Long Form and any supplemental pages you may be...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NM TRD CRS-1

Edit your NM TRD CRS-1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NM TRD CRS-1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NM TRD CRS-1 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit NM TRD CRS-1. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NM TRD CRS-1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NM TRD CRS-1

How to fill out NM TRD CRS-1

01

Obtain the NM TRD CRS-1 form from the New Mexico Taxation and Revenue Department website or office.

02

Begin by filling out your personal information, including your name, address, and Social Security number or taxpayer identification number.

03

Indicate the type of tax return you are filing and the applicable tax period.

04

Input the necessary financial information, such as income details, deductions, and credits.

05

Review the calculations to ensure accuracy.

06

Sign and date the form.

07

Submit the completed form to the New Mexico Taxation and Revenue Department by the deadline.

Who needs NM TRD CRS-1?

01

Individuals or businesses who owe taxes in New Mexico.

02

Taxpayers seeking to report income or calculate their tax liability.

03

Those eligible for tax credits or deductions in New Mexico.

Fill

form

: Try Risk Free

People Also Ask about

What do I need to get a CRS number in New Mexico?

New Mexico Tax Account Numbers If you are a new business, register online with the New Mexico Taxation and Revenue Department to retrieve your CRS Identification Number and filing frequency. Your filing frequency refers to the frequency at which you need to make withholding tax payments to the agency.

What does CRS mean in New Mexico?

System redesigned to ease compliance, administration The Taxation and Revenue Department replaced its Combined Reporting System (CRS) in 2021 with a system that features separate returns for withholding, gross receipts and other business tax programs.

What is CRS New Mexico?

The Taxation and Revenue Department replaced its Combined Reporting System (CRS) in 2021 with a system that features separate returns for withholding, gross receipts and other business tax programs.

How do I close my business in NM?

If you are dissolving or withdrawing a corporation from the State of New Mexico, you must request a Corporate Certificate of No Tax Due from the New Mexico Taxation and Revenue Department. You may also contact the Secretary of State (SOS) for information regarding any further requirements administered by that agency.

How do I get a seller's permit in New Mexico?

A New Mexico Sellers Permit can only be obtained through an authorized government agency. Depending on the type of business, where you're doing business and other specific regulations that may apply, there may be multiple government agencies that you must contact in order to get a New Mexico Sellers Permit.

What is CRS-1?

CRS-1 consists of specially refined asphalt dispersed in water without the use of clay or similar substances as emulsifying or stabilizing agents. The cationic emulsified asphalt furnished under this specification shall be an emulsion of asphalt cement, water, and emulsifying agent.

How do I get a CRS number in New Mexico?

New Mexico Tax Account Numbers If you are a new business, register online with the New Mexico Taxation and Revenue Department to retrieve your CRS Identification Number and filing frequency. Your filing frequency refers to the frequency at which you need to make withholding tax payments to the agency.

What does crs mean in SpaceX?

Cargo Resupply (CRS) – SpaceX.

What is a CRS in New Mexico?

During registration, each business will be provided with a State Tax ID number, also known as a Combined Reporting System (CRS) ID Number. This registration it is used to report and pay tax collected on gross receipts from business conducted in New Mexico.

How do I get a New Mexico CRS ID number?

You can apply for a Business Tax Identification Number Online at our website tap.state.nm.us. You will click “Apply for a New Mexico Business Tax ID” and follow the prompts.

Do you have to have a CRS number in New Mexico?

Combined Reporting System number: All New Mexico businesses need a CRS number from the state Taxation and Revenue Department, which uses it to track major business taxes. This number is your state tax ID.

What is a crs1?

CRS-1 consists of specially refined asphalt dispersed in water without the use of clay or similar substances as emulsifying or stabilizing agents. The cationic emulsified asphalt furnished under this specification shall be an emulsion of asphalt cement, water, and emulsifying agent.

What is CRS in WIFI?

Carrier Routing System (CRS) is a modular and distributed core router developed by Cisco Systems Inc that enables service providers to deliver data, voice, and video services over a scalable IP Next-Generation Network (NGN) infrastructure.

How many digits is a NM CRS number?

New Mexico Taxation & Revenue Department (CRS) ID Number: 01-999999-99-9 (11 digits) first two digits should be 01,02, or 03. Apply online at the NM Taxpayer Access Point portal to receive the ID number in 2 days.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit NM TRD CRS-1 online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your NM TRD CRS-1 to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Can I create an electronic signature for the NM TRD CRS-1 in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your NM TRD CRS-1.

How do I fill out the NM TRD CRS-1 form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign NM TRD CRS-1 and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is NM TRD CRS-1?

NM TRD CRS-1 is a tax return form used for reporting certain tax information by businesses in New Mexico.

Who is required to file NM TRD CRS-1?

Businesses that are subject to gross receipts tax in New Mexico are required to file NM TRD CRS-1.

How to fill out NM TRD CRS-1?

To fill out NM TRD CRS-1, you need to provide details such as gross receipts, deductions, and any applicable tax credits, following the instructions provided by the New Mexico Taxation and Revenue Department.

What is the purpose of NM TRD CRS-1?

The purpose of NM TRD CRS-1 is to report the gross receipts and calculate the tax due, ensuring compliance with state tax laws.

What information must be reported on NM TRD CRS-1?

Information that must be reported on NM TRD CRS-1 includes total gross receipts, allowable deductions, and any tax credits the business is eligible for.

Fill out your NM TRD CRS-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NM TRD CRS-1 is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.