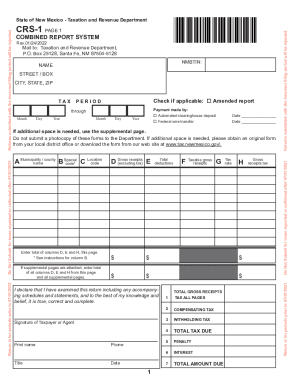

NM TRD CRS-1 2014 free printable template

Show details

Each CRS-1 Form is due on or before the 25th of the month following the end of the tax period being reported. Certain taxpayers are required to file the CRS-1 Form electronically. Food retailers do NOT enter on the CRS-1 Form any receipts for sales paid for by federal food cards. Do not make address changes on the CRS-1 Form. Use the Registration Update Form ACD-31075. NAME CRS ID NO. If you are filing the CRS-1 Long Form including any supplemental pages enter on Line 1 the total of Column H...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NM TRD CRS-1

Edit your NM TRD CRS-1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NM TRD CRS-1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NM TRD CRS-1 online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit NM TRD CRS-1. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NM TRD CRS-1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NM TRD CRS-1

How to fill out NM TRD CRS-1

01

Obtain the NM TRD CRS-1 form from the New Mexico Taxation and Revenue Department website or your local office.

02

Begin by filling out the top section with your name, address, and taxpayer identification number.

03

Provide the details of the tax year for which you are filing.

04

Complete the income section by reporting all applicable sources of income.

05

Fill in any deductions or credits you wish to claim, ensuring to attach any required documentation.

06

Review the form for accuracy and completeness before signing and dating it.

07

Submit the completed form via mail or electronically according to the instructions provided.

Who needs NM TRD CRS-1?

01

Individuals and businesses in New Mexico who are required to report their income and claim tax credits or deductions.

02

Taxpayers who have received a notice from the New Mexico Taxation and Revenue Department indicating they need to complete the form.

Instructions and Help about NM TRD CRS-1

Fill

form

: Try Risk Free

People Also Ask about

How do I get a seller's permit in New Mexico?

A New Mexico Sellers Permit can only be obtained through an authorized government agency. Depending on the type of business, where you're doing business and other specific regulations that may apply, there may be multiple government agencies that you must contact in order to get a New Mexico Sellers Permit.

What do I need to get a CRS number in New Mexico?

New Mexico Tax Account Numbers If you are a new business, register online with the New Mexico Taxation and Revenue Department to retrieve your CRS Identification Number and filing frequency. Your filing frequency refers to the frequency at which you need to make withholding tax payments to the agency.

What is CRS-1?

CRS-1 consists of specially refined asphalt dispersed in water without the use of clay or similar substances as emulsifying or stabilizing agents. The cationic emulsified asphalt furnished under this specification shall be an emulsion of asphalt cement, water, and emulsifying agent.

Who needs a CRS number New Mexico?

All businesses that sell retail, engage in leasing of property or performance of services in New Mexico must register for a New Mexico CRS Identification Number and pay gross receipts tax to the state (and localities, if relevant).

How many digits is a NM CRS number?

New Mexico Taxation & Revenue Department (CRS) ID Number: 01-999999-99-9 (11 digits) first two digits should be 01,02, or 03. Apply online at the NM Taxpayer Access Point portal to receive the ID number in 2 days.

Do you have to have a CRS number in New Mexico?

Combined Reporting System number: All New Mexico businesses need a CRS number from the state Taxation and Revenue Department, which uses it to track major business taxes. This number is your state tax ID.

What is CRS New Mexico?

The Taxation and Revenue Department replaced its Combined Reporting System (CRS) in 2021 with a system that features separate returns for withholding, gross receipts and other business tax programs.

What is CRS in WIFI?

Carrier Routing System (CRS) is a modular and distributed core router developed by Cisco Systems Inc that enables service providers to deliver data, voice, and video services over a scalable IP Next-Generation Network (NGN) infrastructure.

What is New Mexico CRS?

The Taxation and Revenue Department replaced its Combined Reporting System (CRS) in 2021 with a system that features separate returns for withholding, gross receipts and other business tax programs.

How do I get a New Mexico CRS ID number?

You can apply for a Business Tax Identification Number Online at our website tap.state.nm.us. You will click “Apply for a New Mexico Business Tax ID” and follow the prompts.

Who must pay New Mexico gross receipts tax?

Businesses that do not have a physical presence in New Mexico, including marketplace providers and sellers, also are subject to Gross Receipts Tax if they have at least $100,000 of taxable gross receipts in the previous calendar year.

What is a crs1?

CRS-1 consists of specially refined asphalt dispersed in water without the use of clay or similar substances as emulsifying or stabilizing agents. The cationic emulsified asphalt furnished under this specification shall be an emulsion of asphalt cement, water, and emulsifying agent.

What does CRS mean in New Mexico?

System redesigned to ease compliance, administration The Taxation and Revenue Department replaced its Combined Reporting System (CRS) in 2021 with a system that features separate returns for withholding, gross receipts and other business tax programs.

What is New Mexico compensating tax?

The compensating tax is imposed at a rate of 5.125% on certain property used in New Mexico and 5% on certain services used in New Mexico.

How do I close my business in NM?

If you are dissolving or withdrawing a corporation from the State of New Mexico, you must request a Corporate Certificate of No Tax Due from the New Mexico Taxation and Revenue Department. You may also contact the Secretary of State (SOS) for information regarding any further requirements administered by that agency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit NM TRD CRS-1 in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your NM TRD CRS-1, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I complete NM TRD CRS-1 on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your NM TRD CRS-1. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

How do I edit NM TRD CRS-1 on an Android device?

The pdfFiller app for Android allows you to edit PDF files like NM TRD CRS-1. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is NM TRD CRS-1?

NM TRD CRS-1 is a tax form used in New Mexico for reporting certain types of gross receipts and related deductions to the New Mexico Taxation and Revenue Department (TRD).

Who is required to file NM TRD CRS-1?

Any business or individual engaged in activities that generate gross receipts in New Mexico is required to file NM TRD CRS-1, including those who have a New Mexico gross receipts tax obligation.

How to fill out NM TRD CRS-1?

To fill out NM TRD CRS-1, you need to provide your business information, report your gross receipts, claim any allowable deductions, and calculate your net taxable gross receipts, then submit it to the New Mexico TRD.

What is the purpose of NM TRD CRS-1?

The purpose of NM TRD CRS-1 is to report gross receipts and calculate the appropriate tax liability for businesses operating in New Mexico.

What information must be reported on NM TRD CRS-1?

On NM TRD CRS-1, you must report total gross receipts, allowable deductions, and calculate the taxable gross receipts and taxes due, including any relevant exemptions or credits.

Fill out your NM TRD CRS-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NM TRD CRS-1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.