MO DoR Form 53-1 2017 free printable template

Show details

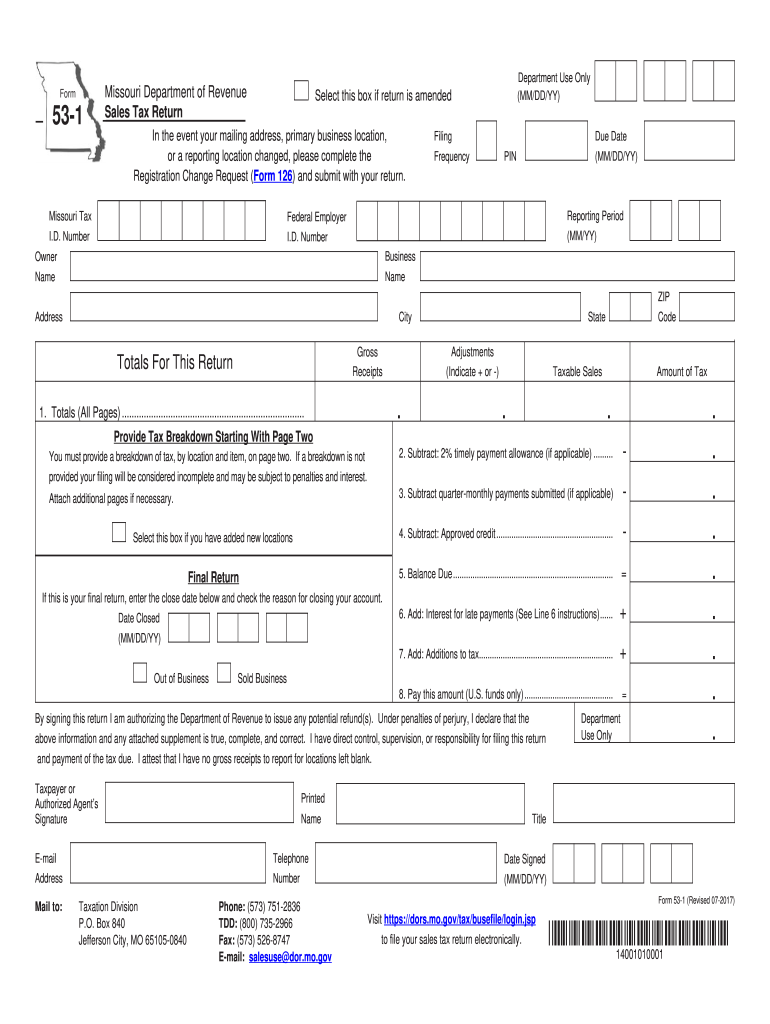

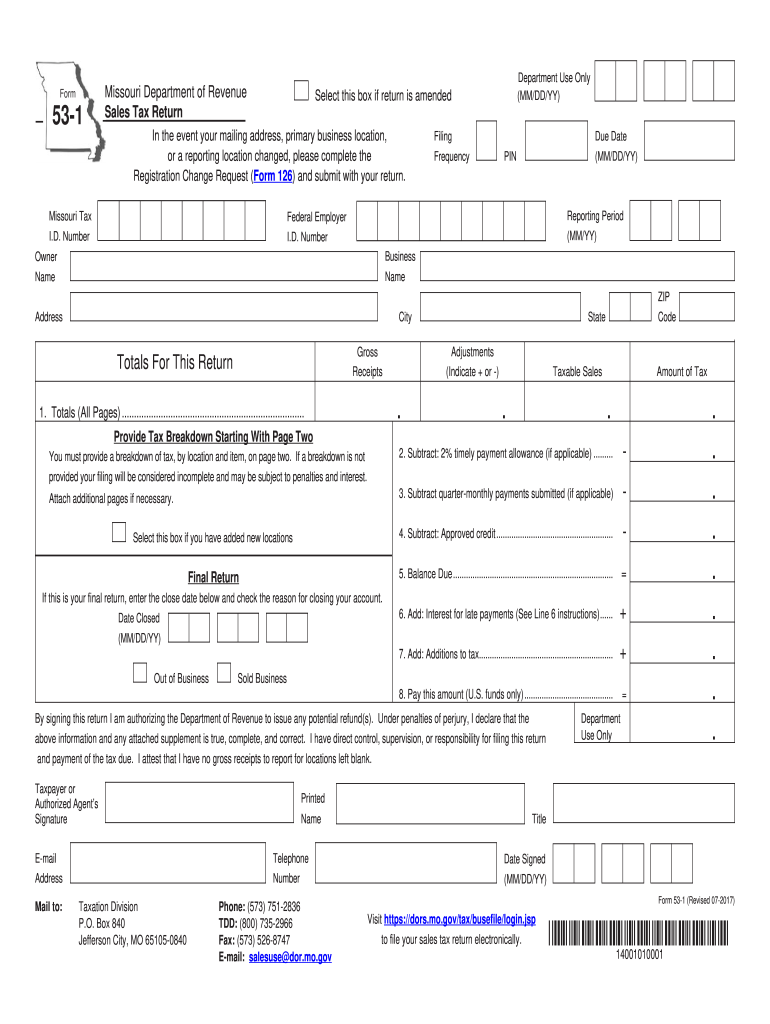

Mo. gov Form 53-1 Revised 07-2017 Visit https //dors. mo. gov/tax/busefile/login.jsp to file your sales tax return electronically. Reset Form Form 53-1 Missouri Department of Revenue Sales Tax Return Department Use Only MM/DD/YY Select this box if return is amended In the event your mailing address primary business location or a reporting location changed please complete the Registration Change Request Form 126 and submit with your return. Missouri Tax Federal Employer I. D. Number Filing...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MO DoR Form 53-1

Edit your MO DoR Form 53-1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MO DoR Form 53-1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MO DoR Form 53-1 online

In order to make advantage of the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit MO DoR Form 53-1. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MO DoR Form 53-1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MO DoR Form 53-1

How to fill out MO DoR Form 53-1

01

Obtain the MO DoR Form 53-1 from the official website or a local Department of Revenue office.

02

Fill in your personal information, including your name, address, and identification number.

03

Provide details of the transaction or activity that requires the form.

04

Enter the date of the transaction and any relevant amounts.

05

Review all information for accuracy before signing the declaration at the bottom of the form.

06

Submit the completed form to the appropriate division at the Missouri Department of Revenue, either in person or by mail.

Who needs MO DoR Form 53-1?

01

Individuals or businesses conducting certain transactions in Missouri that require a formal declaration.

02

Persons needing to report specific tax or revenue-related information to the Missouri Department of Revenue.

03

Tax professionals assisting clients with filing requirements in Missouri.

Fill

form

: Try Risk Free

People Also Ask about

How many cents is tax per dollar in Missouri?

Yes. Missouri sales tax includes a 4.225% state sales tax plus potentially a county sales tax, city sales tax, and special sales tax, depending on the location of the purchase ranging between 0% and 5.45%. As of October 2022, the average estimated combined sales tax rate is 7.91%.

Why is St Louis sales tax so high?

Recent increases are due to special sales taxes for additional public safety funding and expanded economic development initiatives (like the north–south MetroLink expansion, which is unlikely to spur any development).

What is tax 1 in Missouri?

In addition to the state tax, St. Louis and Kansas City both collect their own earning taxes of 1%. Residents and anyone who works in either city must pay this tax. They are the only cities in Missouri that collect their own income taxes.

How do you figure out Missouri sales tax?

Missouri Charges an Auto Sales Tax of 4.225% of the Sales Price you Paid for your Car of Truck. Note that, if you traded in your car or truck, subtract the offered deduction from the sales price to figure out the amount for which you will be taxed.

How do I avoid paying sales tax on my car in Missouri?

the vehicle is less than eleven years old and the mileage is less than 150,000 miles; you are a resident of a state other than Missouri; or. you are obtaining a temporary permit for a trailer.

What are the taxes in Missouri?

Missouri has a 4.0 percent corporate income tax rate. Missouri has a 4.225 percent state sales tax rate, a max local sales tax rate of 5.763 percent, an average combined state and local sales tax rate of 8.33 percent. Missouri's tax system ranks 11th overall on our 2022 State Business Tax Climate Index.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find MO DoR Form 53-1?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific MO DoR Form 53-1 and other forms. Find the template you want and tweak it with powerful editing tools.

How do I complete MO DoR Form 53-1 online?

pdfFiller makes it easy to finish and sign MO DoR Form 53-1 online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I fill out MO DoR Form 53-1 using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign MO DoR Form 53-1. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

What is MO DoR Form 53-1?

MO DoR Form 53-1 is a form used for the reporting of specific tax-related information to the Missouri Department of Revenue.

Who is required to file MO DoR Form 53-1?

Individuals and businesses that meet certain criteria established by the Missouri Department of Revenue are required to file MO DoR Form 53-1.

How to fill out MO DoR Form 53-1?

To fill out MO DoR Form 53-1, you need to provide accurate information regarding income, deductions, and other relevant tax details as outlined in the form's instructions.

What is the purpose of MO DoR Form 53-1?

The purpose of MO DoR Form 53-1 is to ensure compliance with state tax laws and to report taxable income and related information to the state.

What information must be reported on MO DoR Form 53-1?

MO DoR Form 53-1 requires reporting of income, deductions, tax credits, and any other information necessary to calculate the correct tax liability.

Fill out your MO DoR Form 53-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MO DoR Form 53-1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.