MO DoR Form 53-1 2014 free printable template

Show details

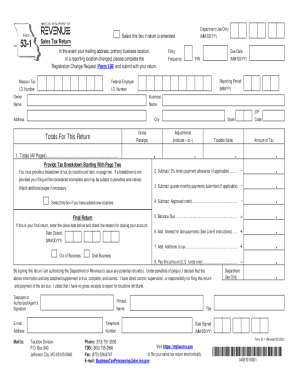

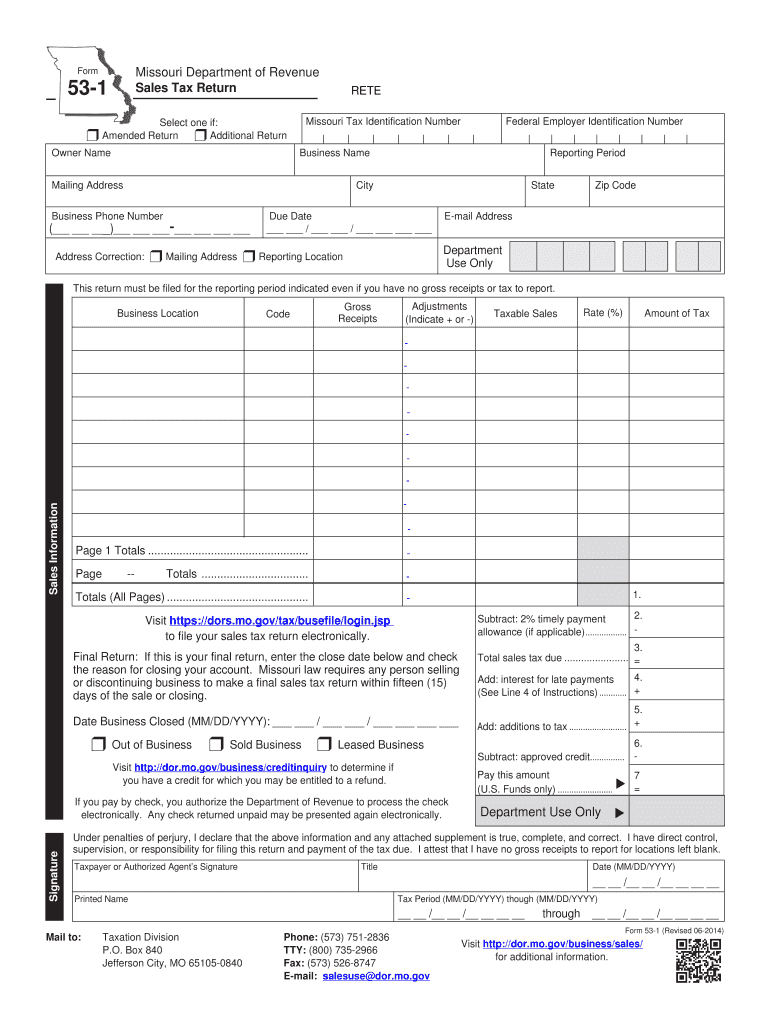

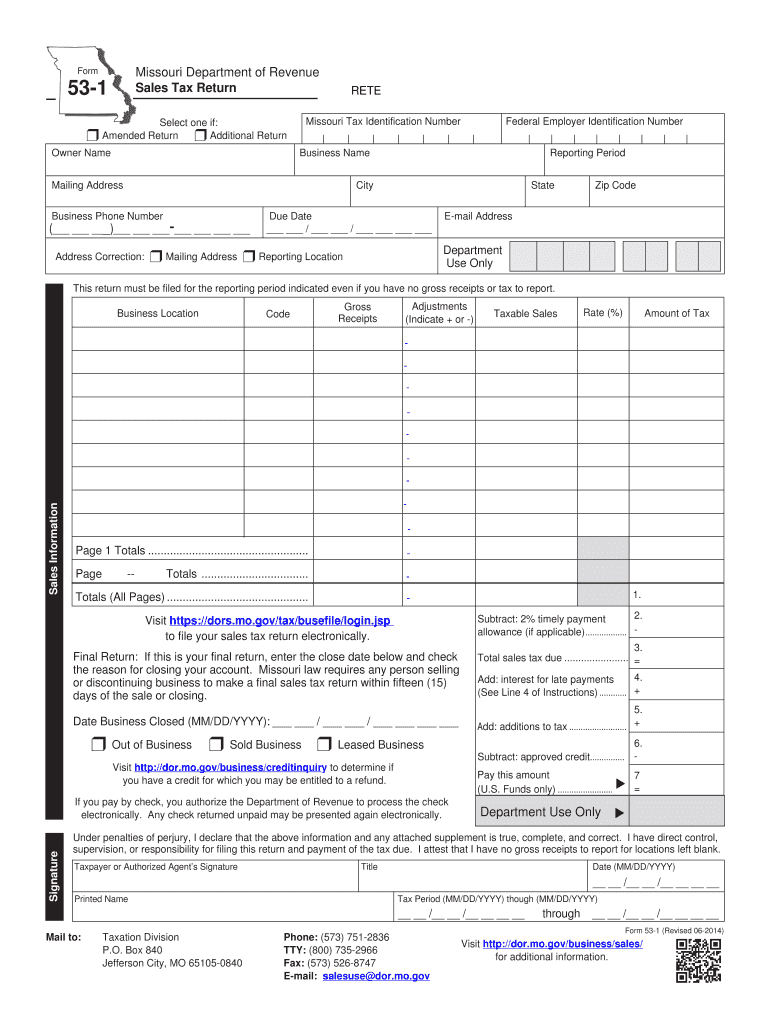

Mo. gov through Form 53-1 Revised 06-2014 for additional information. Reset This Page Only Missouri Tax I. Have you considered filing electronically Click here for more information. Reset Form Print Form CLICK HERE Missouri Department of Revenue Sales Tax Return Form 53-1 for instructions to complete this form. RETE Missouri Tax Identification Number Select one if Federal Employer Identification Number r Amended Return r Additional Return Owner Name Business Name Mailing Address Business...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MO DoR Form 53-1

Edit your MO DoR Form 53-1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MO DoR Form 53-1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MO DoR Form 53-1 online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit MO DoR Form 53-1. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MO DoR Form 53-1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MO DoR Form 53-1

How to fill out MO DoR Form 53-1

01

Obtain a copy of MO DoR Form 53-1 from the Missouri Department of Revenue website or local office.

02

Fill in your personal information at the top of the form, including your name, address, and contact information.

03

Provide the details regarding the vehicle you are registering, such as make, model, year, and VIN.

04

If applicable, indicate any prior ownership or lienholder information.

05

Sign and date the form to certify the information is accurate and complete.

06

Submit the form along with any required additional documentation and fees to your local Department of Revenue office.

Who needs MO DoR Form 53-1?

01

Individuals or businesses registering a vehicle in the state of Missouri.

02

People transferring ownership of a vehicle in Missouri.

03

Anyone who needs to apply for or renew a vehicle title in Missouri.

Fill

form

: Try Risk Free

People Also Ask about

How do I pay sales tax for a small business in Missouri?

You typically pay most of your state business taxes to the Department of Revenue. You can pay many of your taxes through the Department of Revenue's MyTax Missouri online portal. If you need to pay unemployment taxes, you'll pay the Department of Labor and Industrial Relations.

How do I pay taxes if I own a small business?

If you run your business as a sole proprietorship, or as an LLC and you are the sole owner, you can report your business income and expenses on Schedule C along with your personal income tax return.

How does Missouri sales tax work?

The base state sales tax rate in Missouri is 4.23%. Local tax rates in Missouri range from 0% to 5.875%, making the sales tax range in Missouri 4.225% to 10.1%.

How do I pay Missouri sales tax online?

If you are a registered MyTax Missouri user, please log in to your account to file your return. If you are not a registered MyTax Missouri user, you can file and pay the following Business taxes online using a credit card or E-Check (electronic bank draft).

Do I need to file sales tax in Missouri?

A seller not engaged in business is not required to collect Missouri tax but the purchaser in these instances is responsible for remitting use tax to Missouri. A purchaser is required to file a use tax return if the cumulative purchases subject to use tax exceed two thousand dollars in a calendar year.

How do I file sales tax in Missouri?

You have three options for filing and paying your Missouri sales tax: File online – File online at the Missouri Department of Revenue. File by mail – You can use Form 53-1 and file and pay through the mail. AutoFile – Let TaxJar automate your sales tax filing and remittance.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete MO DoR Form 53-1 online?

With pdfFiller, you may easily complete and sign MO DoR Form 53-1 online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I edit MO DoR Form 53-1 in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing MO DoR Form 53-1 and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How do I edit MO DoR Form 53-1 on an Android device?

With the pdfFiller Android app, you can edit, sign, and share MO DoR Form 53-1 on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is MO DoR Form 53-1?

MO DoR Form 53-1 is a document used for reporting various tax-related information to the Missouri Department of Revenue.

Who is required to file MO DoR Form 53-1?

Businesses and individuals who meet certain tax criteria and want to report specific information related to their tax obligations in Missouri are required to file MO DoR Form 53-1.

How to fill out MO DoR Form 53-1?

To fill out MO DoR Form 53-1, you need to provide personal and business information, such as your name, address, tax identification number, and specific financial data relevant to the reporting period.

What is the purpose of MO DoR Form 53-1?

The purpose of MO DoR Form 53-1 is to ensure that the Missouri Department of Revenue receives accurate and complete information regarding tax liabilities from taxpayers.

What information must be reported on MO DoR Form 53-1?

Information that must be reported on MO DoR Form 53-1 includes tax identification details, income, deductions, tax credits, and any other specific financial information requested by the form.

Fill out your MO DoR Form 53-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MO DoR Form 53-1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.