NE 8-553- 2017 free printable template

Show details

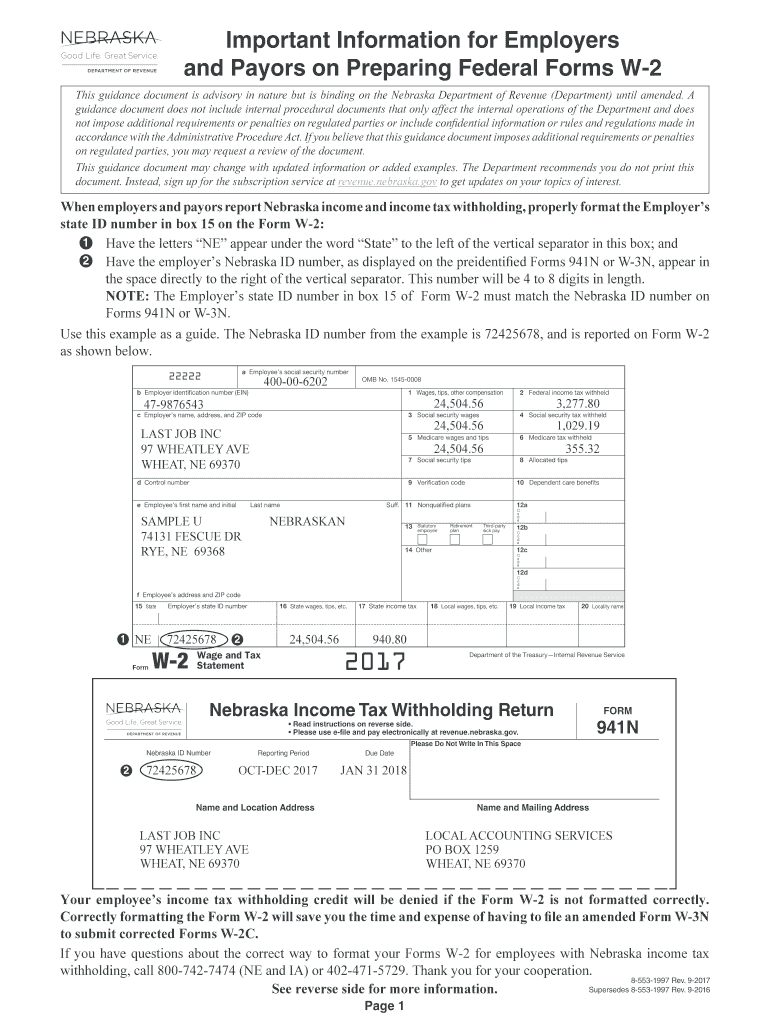

Important Information for Employers

and Mayors on Preparing Federal Forms W2

This guidance document is advisory in nature but is binding on the Nebraska Department of Revenue (Department) until amended.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NE 8-553

Edit your NE 8-553 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NE 8-553 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NE 8-553 online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit NE 8-553. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NE 8-553-1997 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NE 8-553

How to fill out NE 8-553

01

Obtain a copy of form NE 8-553 from the relevant authority or website.

02

Enter your personal details in the designated fields, including your name, address, and contact information.

03

Provide any required identification or identification numbers as specified on the form.

04

Accurately fill out any specific sections related to the purpose of the form, ensuring all necessary information is included.

05

Review the form for accuracy and completeness before submission.

06

Submit the completed form to the appropriate office or through the designated online portal.

Who needs NE 8-553?

01

Individuals or entities who need to fulfill specific regulatory or administrative requirements as specified in the form NE 8-553.

02

Businesses or organizations operating in regulated industries that require compliance documentation.

03

Applicants seeking permits or approvals that necessitate the use of this form.

Fill

form

: Try Risk Free

People Also Ask about

Which form must be filled out before anyone can begin working in the United States?

Use Form I-9 to verify the identity and employment authorization of individuals hired for employment in the United States. All U.S. employers must properly complete Form I-9 for each individual they hire for employment in the United States. This includes citizens and noncitizens.

Which of the following forms must be filled out by an employee when he is first hired?

New employees need to fill out a Form I-9 to verify employment eligibility as well as a W-4 for income tax. In states with an income tax, it's necessary to fill out a second W-4.

How much tax is taken out of paycheck in Nebraska?

Your employer will withhold 1.45% in Medicare tax and 6.2% in Social Security tax.Income Tax Brackets. Single FilersNebraska Taxable IncomeRate$0 - $3,3402.46%$3,340 - $19,9903.51%$19,990 - $32,2105.01%1 more row

What is the state withholding tax in Nebraska?

Nebraska State Payroll Taxes The 2022 tax rates range from 2.46% to 6.84%. There are no local taxes, so all of your employees will pay the same state income tax no matter where they live.

Does Nebraska have state withholding tax?

Yes. The wages paid to employees for work done in Nebraska is subject to Nebraska income tax withholding.

What forms do new employees need to fill out in Nebraska?

State copies of 2022 Forms W-2, W-2G, 1099-MISC, 1099-NEC, 1099-R, and the Nebraska Reconciliation of Income Tax Withheld, Form W-3N, are due January 31, 2023. E-file Requirement. Forms W-2, W-2G, 1099-MISC,1099-NEC, and 1099-R for tax year 2022 must be e-filed when the employer has over 50 forms to report.

How do I get a Nebraska employer account number?

Account Number(s) Needed: Apply online or complete Nebraska Tax Application, Form 20 and submit the form by mail to the address supplied, or by fax to 402-471-5927, to receive the number within 15 days. Find an existing ID Number: on Form 510N, Employer's Monthly Withholding Deposit coupon. by contacting the DOR.

Who are exempt from withholding tax?

An individual earning less than P250,000 a year is exempted from withholding tax, where the income is coming only from a single payor (i.e. a tax withholding agent).

What are the 2 forms that employees must complete when they start a new job what is the purpose of each?

Form I-9 and E-Verify System for Employment Eligibility The new employee must provide documentation of identity and work eligibility.

What forms do new employees need to complete?

Here are some of the forms required for hiring new employees: W-4 (or W-9) form. The W-4 form tells employers how much money the employee wants to withhold from their pay for the correct federal tax income. I-9 form. State tax withholding form. Direct deposit form. Internal forms. Personal data for emergencies form.

Are you exempt from Nebraska withholding?

Payees that chose not to have federal income tax withheld on the federal Form W-4P may elect to be exempt from withholding income tax for Nebraska on the Nebraska Form W-4N. Payees completing the Nebraska Form W-4N may skip lines 1 and 2 and write “exempt” on line 3 of the Nebraska Form W-4N.

How many digits is the Nebraska state ID number?

Nebraska driver's licenses and ID cards contain document numbers (circled) that are one letter (A,B,C,E,G,H, or V) followed by eight numbers.

Is tax withholding mandatory?

Employers are required by law to withhold employment taxes from their employees. Employment taxes include federal income tax withholding and Social Security and Medicare Taxes.

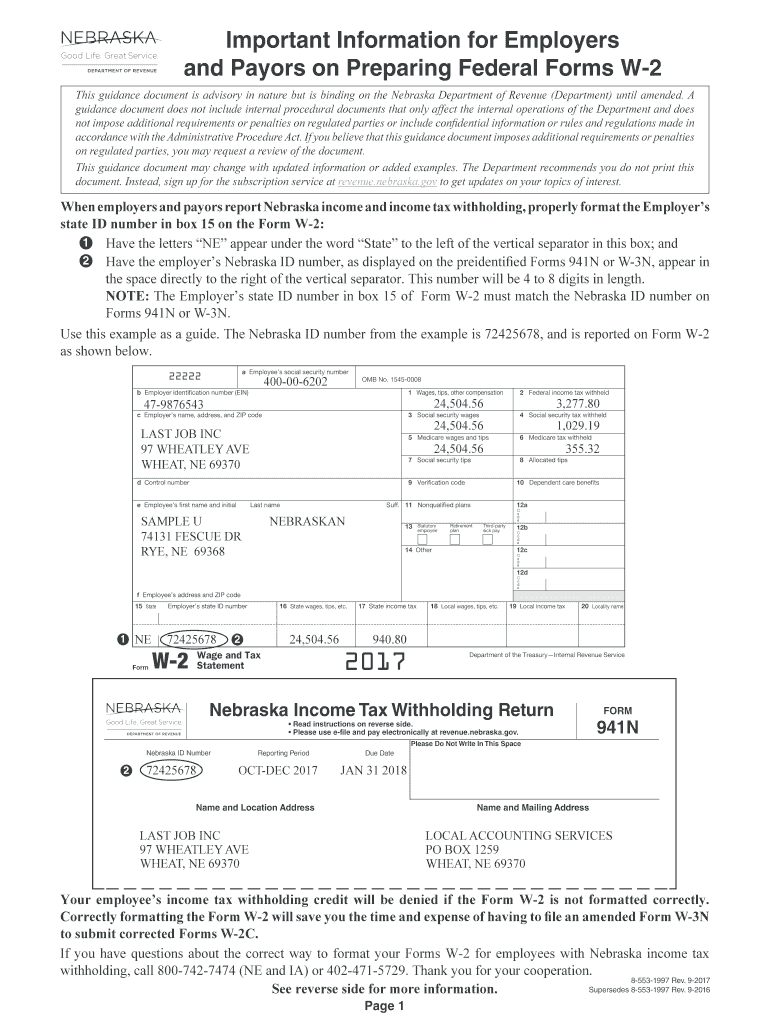

What is Nebraska withholding ID number?

Your Nebraska ID number will be used as your User ID on this filing system. Your Personal Identification Number (PIN) is printed under line 13 on the Nebraska Income Tax Withholding Return, Form 941N, which you will receive by mail.

Is Nebraska a mandatory withholding state?

Nebraska Income Tax Withholding The state requires employers to withhold income tax from the wages of residents and nonresidents under the Nebraska Revenue Act of 1967. If an employee is working in more than one state, the employer may be required to withhold for more than one state for the same employee.

What is Nebraska Form 20?

If you need to add sales and use tax collection to your existing Nebraska ID Number you will need to submit a Form 20, Nebraska Tax Application to the Nebraska Department of Revenue by mail or fax.

Where do I find my Nebraska state ID number?

If you already have a Nebraska Identification Number, you can find it on previous correspondence from the Nebraska Department of Revenue, by contacting the agency at 800-742-7474, or by visiting their Contact Us page for email.

How do I figure withholding tax?

Complete a new Form W-4, Employee's Withholding Allowance Certificate, and submit it to your employer. Complete a new Form W-4P, Withholding Certificate for Pension or Annuity Payments, and submit it to your payer. Make an additional or estimated tax payment to the IRS before the end of the year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get NE 8-553?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific NE 8-553 and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I make changes in NE 8-553?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your NE 8-553 to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I complete NE 8-553 on an Android device?

Complete your NE 8-553 and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is NE 8-553?

NE 8-553 is a specific form used for reporting certain information to the relevant tax authority in Nebraska.

Who is required to file NE 8-553?

Individuals or entities that meet specific criteria outlined by the state tax authority, typically related to income tax or sales tax obligations, are required to file NE 8-553.

How to fill out NE 8-553?

To fill out NE 8-553, taxpayers should gather the required information, follow the guidelines provided on the form, and ensure all relevant sections are completed accurately before submission.

What is the purpose of NE 8-553?

The purpose of NE 8-553 is to collect specific tax-related information from taxpayers to support the administration and enforcement of state tax laws.

What information must be reported on NE 8-553?

NE 8-553 typically requires reporting of personal identification information, income details, deductions, and any relevant credits or taxes owed.

Fill out your NE 8-553 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NE 8-553 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.