NE 8-553- 2021-2026 free printable template

Show details

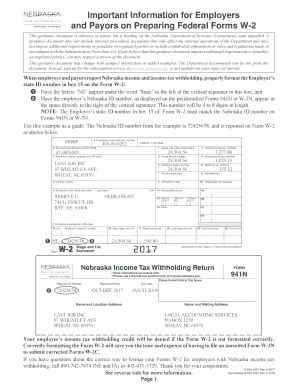

Important Information for Employers and Mayors on Preparing Federal Forms W2 This guidance document is advisory in nature but is binding on the Nebraska Department of Revenue (Department) until amended.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ne w2 formatting employers print

Edit your ne w2 formatting payors printable form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ne w2 formatting payors print form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NE 8-553 online

To use our professional PDF editor, follow these steps:

1

Sign into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit NE 8-553. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NE 8-553-1997 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NE 8-553

How to fill out NE 8-553

01

Obtain the NE 8-553 form from the relevant authority or website.

02

Fill in your personal details at the top of the form, including your name and contact information.

03

Provide the required identification numbers as specified in the instructions.

04

Complete the sections that pertain to your specific situation, ensuring all fields are filled accurately.

05

Review the form for any errors or omissions before submitting.

06

Sign and date the form where indicated.

07

Submit the completed form to the appropriate office as directed.

Who needs NE 8-553?

01

Individuals applying for specific permits or services in Nebraska that require submission of the NE 8-553 form.

02

Businesses that need to comply with regulations requiring the use of NE 8-553.

Fill

form

: Try Risk Free

People Also Ask about

Which form must be filled out before anyone can begin working in the United States?

Use Form I-9 to verify the identity and employment authorization of individuals hired for employment in the United States. All U.S. employers must properly complete Form I-9 for each individual they hire for employment in the United States. This includes citizens and noncitizens.

Which of the following forms must be filled out by an employee when he is first hired?

New employees need to fill out a Form I-9 to verify employment eligibility as well as a W-4 for income tax. In states with an income tax, it's necessary to fill out a second W-4.

How much tax is taken out of paycheck in Nebraska?

Your employer will withhold 1.45% in Medicare tax and 6.2% in Social Security tax.Income Tax Brackets. Single FilersNebraska Taxable IncomeRate$0 - $3,3402.46%$3,340 - $19,9903.51%$19,990 - $32,2105.01%1 more row

What is the state withholding tax in Nebraska?

Nebraska State Payroll Taxes The 2022 tax rates range from 2.46% to 6.84%. There are no local taxes, so all of your employees will pay the same state income tax no matter where they live.

Does Nebraska have state withholding tax?

Yes. The wages paid to employees for work done in Nebraska is subject to Nebraska income tax withholding.

What forms do new employees need to fill out in Nebraska?

State copies of 2022 Forms W-2, W-2G, 1099-MISC, 1099-NEC, 1099-R, and the Nebraska Reconciliation of Income Tax Withheld, Form W-3N, are due January 31, 2023. E-file Requirement. Forms W-2, W-2G, 1099-MISC,1099-NEC, and 1099-R for tax year 2022 must be e-filed when the employer has over 50 forms to report.

How do I get a Nebraska employer account number?

Account Number(s) Needed: Apply online or complete Nebraska Tax Application, Form 20 and submit the form by mail to the address supplied, or by fax to 402-471-5927, to receive the number within 15 days. Find an existing ID Number: on Form 510N, Employer's Monthly Withholding Deposit coupon. by contacting the DOR.

Who are exempt from withholding tax?

An individual earning less than P250,000 a year is exempted from withholding tax, where the income is coming only from a single payor (i.e. a tax withholding agent).

What are the 2 forms that employees must complete when they start a new job what is the purpose of each?

Form I-9 and E-Verify System for Employment Eligibility The new employee must provide documentation of identity and work eligibility.

What forms do new employees need to complete?

Here are some of the forms required for hiring new employees: W-4 (or W-9) form. The W-4 form tells employers how much money the employee wants to withhold from their pay for the correct federal tax income. I-9 form. State tax withholding form. Direct deposit form. Internal forms. Personal data for emergencies form.

Are you exempt from Nebraska withholding?

Payees that chose not to have federal income tax withheld on the federal Form W-4P may elect to be exempt from withholding income tax for Nebraska on the Nebraska Form W-4N. Payees completing the Nebraska Form W-4N may skip lines 1 and 2 and write “exempt” on line 3 of the Nebraska Form W-4N.

How many digits is the Nebraska state ID number?

Nebraska driver's licenses and ID cards contain document numbers (circled) that are one letter (A,B,C,E,G,H, or V) followed by eight numbers.

Is tax withholding mandatory?

Employers are required by law to withhold employment taxes from their employees. Employment taxes include federal income tax withholding and Social Security and Medicare Taxes.

What is Nebraska withholding ID number?

Your Nebraska ID number will be used as your User ID on this filing system. Your Personal Identification Number (PIN) is printed under line 13 on the Nebraska Income Tax Withholding Return, Form 941N, which you will receive by mail.

Is Nebraska a mandatory withholding state?

Nebraska Income Tax Withholding The state requires employers to withhold income tax from the wages of residents and nonresidents under the Nebraska Revenue Act of 1967. If an employee is working in more than one state, the employer may be required to withhold for more than one state for the same employee.

What is Nebraska Form 20?

If you need to add sales and use tax collection to your existing Nebraska ID Number you will need to submit a Form 20, Nebraska Tax Application to the Nebraska Department of Revenue by mail or fax.

Where do I find my Nebraska state ID number?

If you already have a Nebraska Identification Number, you can find it on previous correspondence from the Nebraska Department of Revenue, by contacting the agency at 800-742-7474, or by visiting their Contact Us page for email.

How do I figure withholding tax?

Complete a new Form W-4, Employee's Withholding Allowance Certificate, and submit it to your employer. Complete a new Form W-4P, Withholding Certificate for Pension or Annuity Payments, and submit it to your payer. Make an additional or estimated tax payment to the IRS before the end of the year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my NE 8-553 directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your NE 8-553 and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I fill out NE 8-553 using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign NE 8-553 and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I edit NE 8-553 on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign NE 8-553 on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is NE 8-553?

NE 8-553 is a specific form used by certain entities or individuals to report specific financial or operational information to the relevant authorities.

Who is required to file NE 8-553?

Entities or individuals who meet specific criteria outlined by the governing body are required to file NE 8-553.

How to fill out NE 8-553?

To fill out NE 8-553, one must provide accurate information as requested in each section of the form, ensuring all required fields are completed.

What is the purpose of NE 8-553?

The purpose of NE 8-553 is to collect data for regulatory, compliance, and monitoring purposes as mandated by the authorities.

What information must be reported on NE 8-553?

NE 8-553 requires reporting of specific financial data, operational metrics, and other relevant information as defined by the filing requirements.

Fill out your NE 8-553 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NE 8-553 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.