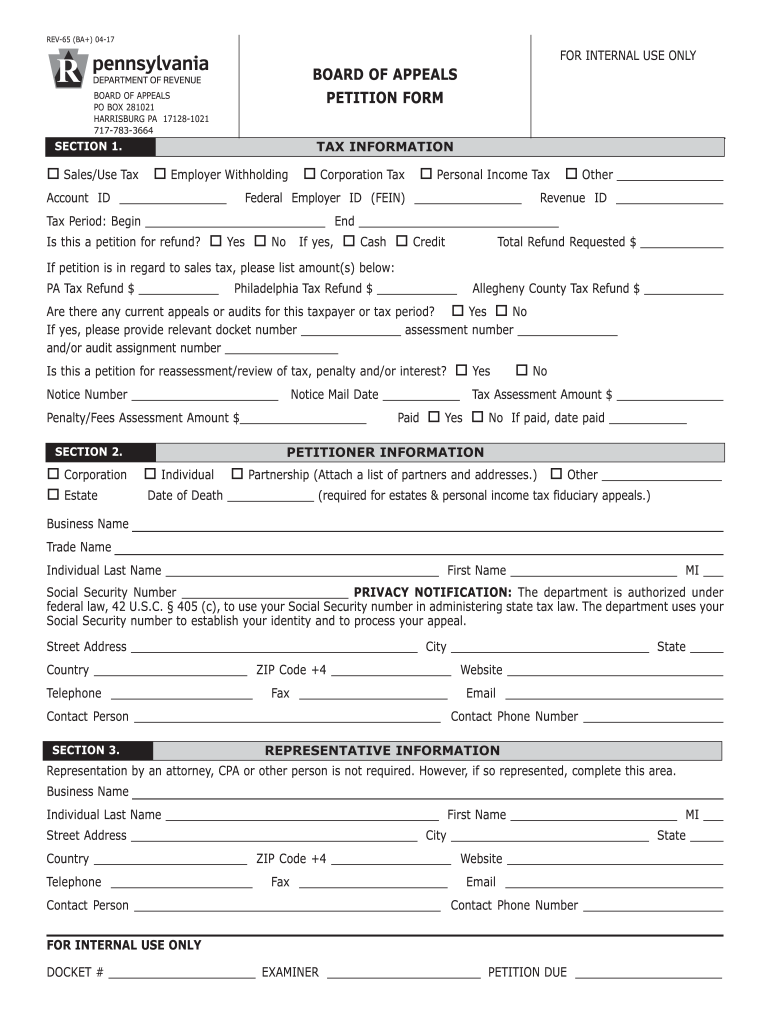

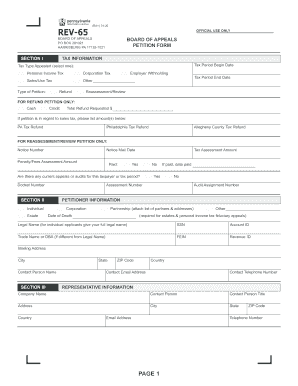

PA DoR REV-65 BA 2017 free printable template

Get, Create, Make and Sign PA DoR REV-65 BA

Editing PA DoR REV-65 BA online

Uncompromising security for your PDF editing and eSignature needs

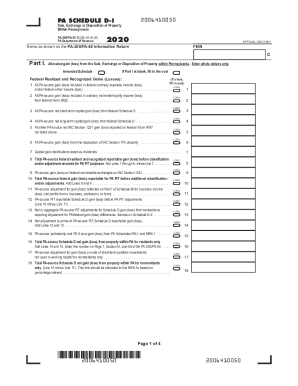

PA DoR REV-65 BA Form Versions

How to fill out PA DoR REV-65 BA

How to fill out PA DoR REV-65 BA

Who needs PA DoR REV-65 BA?

Instructions and Help about PA DoR REV-65 BA

A for me is the compulsory document you are required to fill out if you're making onto the court to sort out fine during a divorce the form is available online at the hm courts and tribunals service website along with some guidance notes that you might want to print offs that you can refer to them when you are completing the form whilst the forms daunting at first glance most people are able to tackle it well my advice into do it in small chunks rather than trying to tackle the whole thing in one sitting you might find it useful to go through and identify the information you are going to need to gather so that toucan complete the form both parties tithe divorce completed for me and these are then exchanged reviewed and used to provide the factual information which will help to reach an agreeable financial settlement between the parties you can ask your solicitor to complete the for me on your behalf however most solicitors will encourage you to complete a draft version of the form on your own in the first instancethat'’s because you will have accestithehe relevant information the more information you can obtain without involving your lawyer the cheaper this process will be even if your case is notion court you might be asked to complete for me, it provides such comprehensive way of showing your financial information that many solicitors will ask you to complete Olaf you are trying to reach an agreement amicably without asking the court to get involved this is known as voluntary financial disclosure if the case is in court then it is compulsory to completed for me the court will send out an order that will specify how long you have to do this usually you have at least six weeks to complete and return the form however we always advise clients not to leave it until the last minute as some information required will not be at your fingertips and may require you to request reports from your bank or pension provider for example to obtain pension transfer values it is important that you complete before me fully, and accurately you have a duty to the court to provide the information it requests as the form States if your fans who have been deliberately untruthful criminal proceedings may be brought against you for fraud under the Fraud 2006 the opening section of the forgathers general information about you your children and your living arrangements section two goes on together financial details starting with series of questions about the property you own you need to complete the sections to show your share of the family human this section you will need to include details of your mortgage company the amount of mortgage outstanding the property value and the estimated costs of sale next you are asked for details about your bank accounts and other savings and investments you should include all details for accounts in your name or joint accounts held with your partner or anybody else you should also include details of any monies owed to you insurance...

People Also Ask about

Who has to file a PA estate tax return?

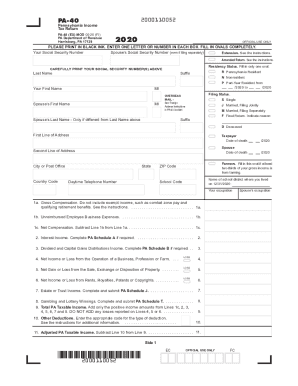

How do I get a PA-40 form?

Who must file a PA-40?

What is PA form Rev 516?

What is a form PA 40?

What is a PA rev 1543?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my PA DoR REV-65 BA directly from Gmail?

How do I edit PA DoR REV-65 BA online?

How can I edit PA DoR REV-65 BA on a smartphone?

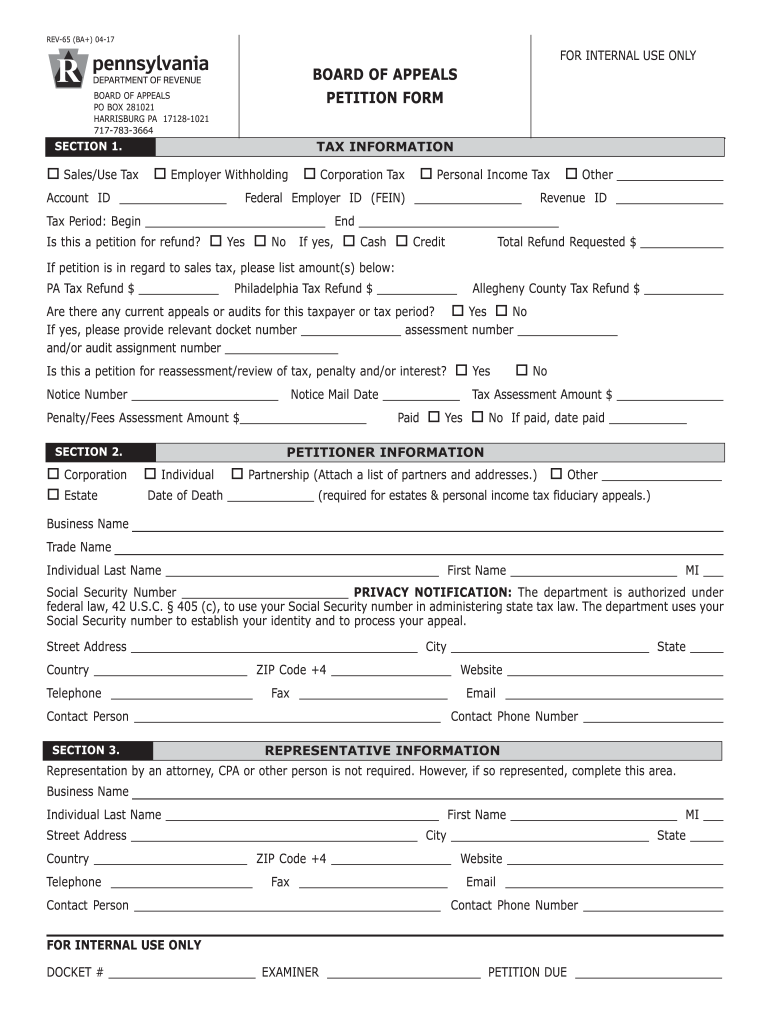

What is PA DoR REV-65 BA?

Who is required to file PA DoR REV-65 BA?

How to fill out PA DoR REV-65 BA?

What is the purpose of PA DoR REV-65 BA?

What information must be reported on PA DoR REV-65 BA?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.