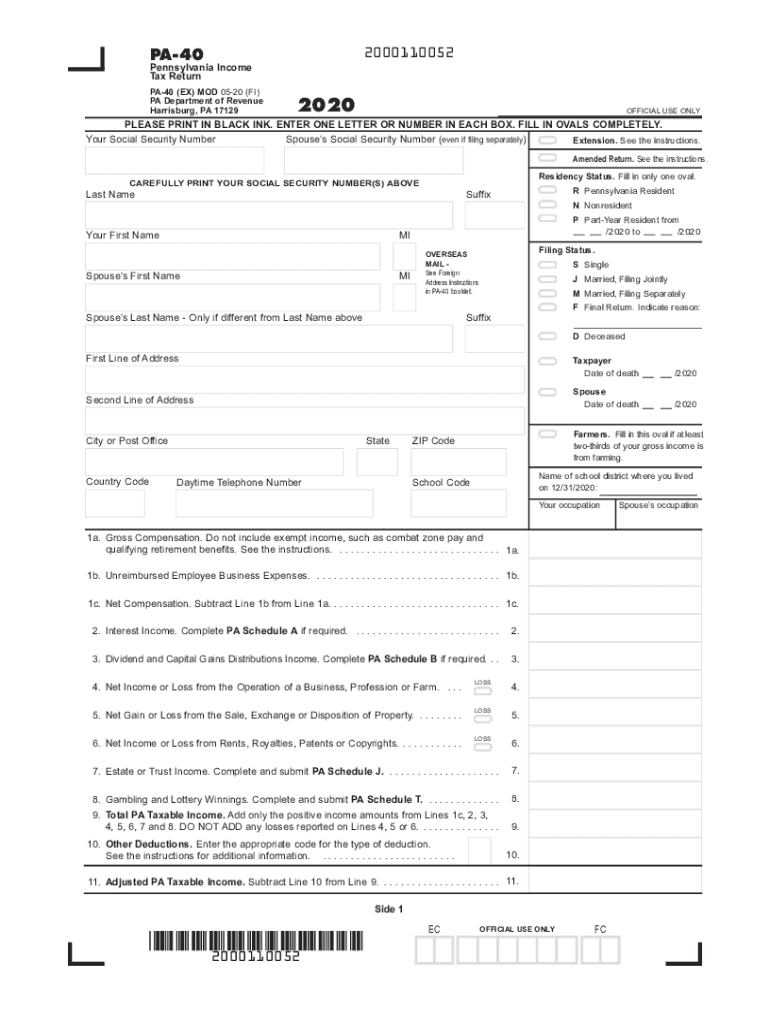

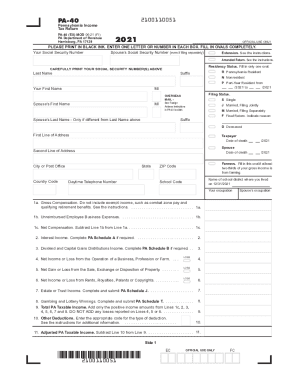

Who needs the PA Form 40?

The PA Form 40 is a Pennsylvania Income Tax Return form. It is to be submitted by Pennsylvania residents and part-year residents, and individuals who are residents of the State but who expect to have taxable income from sources within Pennsylvania.

What is the PA-40 Form for?

The Pennsylvania Income Tax Return is completed on a yearly basis in order to calculate, report income to tax authorities, and pay the due amount of taxes. The reported income may be those obtained through wages, interest, dividends, capital gains and other profits.

When is the PA form 40 due?

The Pennsylvania Income Tax Return form must be filed prior to the fifteenth day of the fourth month after the end of the tax year. In case the taxpayer fails to submit PA-40 form and all the required attachments on time, an extension for filing can be requested.

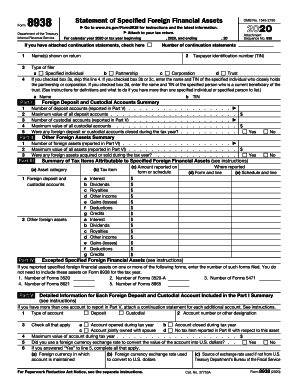

Is the Form PA-40 accompanied by any other forms?

Yes, the PA-40 is to be filed as a single package with the following forms:

- PA Schedule G-R in case the taxpayer is claiming a resident credit for taxes paid to other states or countries;

- PA Schedule W-2S, or copies of or original W-2 form;

- Copies of the 1099-R forms and other statements that show compensation and any PA tax withheld;

- PA Schedule OC (and the supporting documents when claiming any of the restricted tax credits under PA law);

- PA Schedule RK-1 or NRK-1, etc.

How to complete the Form PA-40?

The taxpayer must reveal such information about themselves and their spouse while completing the PA-40 form:

- Social Security numbers,

- Full names;

- Address (including city, state, zip code)

- Contact telephone number;

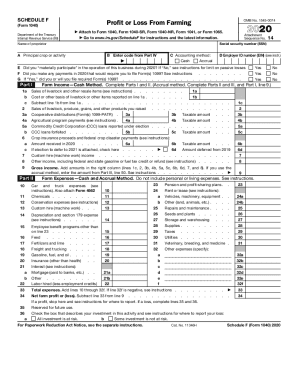

- The next section of the two-page form requires indicating a lot of financial details:

- Gross and net compensation;

- Interest income;

- Dividends and capital gains,

- Net income or loss from operating a business, property transactions, rents, royalties, patents, etc;

- Gambling and lottery winnings;

- Total and adjusted taxable income;

- Estimated tax paid;

- Donations, etc.

- Finally, the form should be dated and signed by the taxpayer and their spouse in case of filing a joint return.

Where to send the completed form PA-40?

The mailing instructions for the filled out Income Tax Return can be checked here.