Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

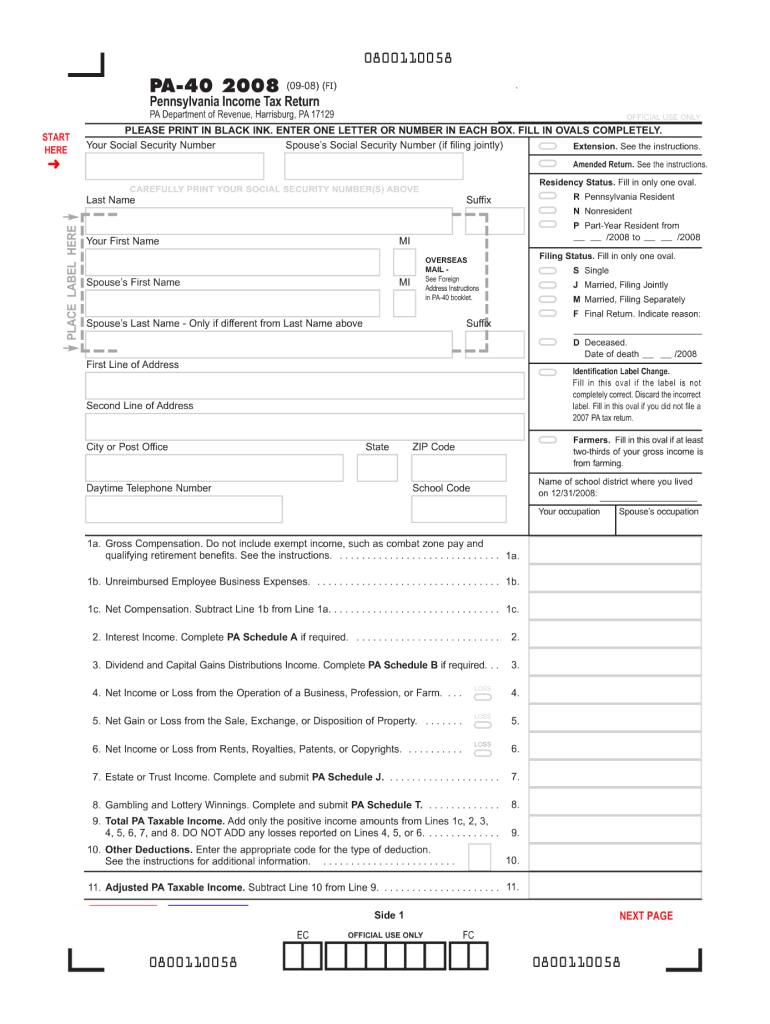

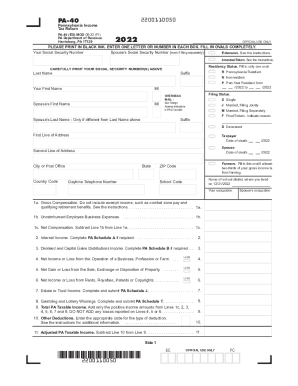

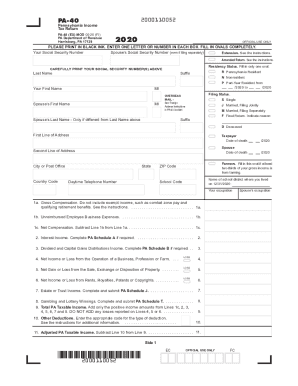

The PA-40 form is the official form used by residents of Pennsylvania to file their state income tax returns. This form is used to report and calculate the amount of income tax owed or the refund due to the taxpayer. The form requires individuals to provide information about their sources of income, deductions, credits, and other relevant information to determine their tax liability.

Who is required to file pa 40 form?

The PA-40 form is used by individuals who are required to file a Pennsylvania personal income tax return. Generally, anyone who is a Pennsylvania resident, has Pennsylvania taxable income, or has earned income from Pennsylvania sources is required to file a PA-40 form. However, there are certain exceptions and specific criteria, so it is recommended to refer to the instructions provided with the form or consult with a tax professional for a more accurate assessment.

How to fill out pa 40 form?

To fill out the PA-40 form, which is the Pennsylvania Personal Income Tax Return form, follow these steps:

1. Gather necessary documents: Before you begin, make sure you have all the required documents and information handy, including your W-2 forms, 1099s, and any other relevant income and expense records.

2. Start with personal information: Fill in your full name, Social Security number, and your spouse's information if filing jointly. Don't forget to provide your current address and contact information.

3. Select the filing status: Indicate your filing status by checking the appropriate box. Options include single, married filing jointly, head of household, etc.

4. Report income: Carefully report your income from all sources, including wages, salaries, tips, interest, dividends, rental income, and any other sources of income. Ensure all amounts are accurately and clearly entered into the appropriate fields.

5. Claim deductions and exemptions: Deductions can help reduce your taxable income. Enter your deductions, such as student loan interest, self-employment tax, retirement contributions, etc. Additionally, claim any exemptions you qualify for, such as dependents or personal exemptions.

6. Calculate your tax: After entering all your income and deductions, calculate your tax liability by using the Pennsylvania tax tables provided with the form. Cross-reference your income and filing status to find the corresponding tax amount.

7. Withholdings and payments: Enter any state income tax already withheld from your paychecks in the appropriate field. If you made any estimated tax payments throughout the year, enter those as well.

8. Tax credits: Identify if you qualify for any tax credits and record them accurately on the form. Common tax credits in Pennsylvania include the child tax credit, education tax credit, and property tax relief credit.

9. Calculate the final tax due or refund: Subtract your tax credits and any payments made from your calculated tax liability. This will give you the final amount you owe or the refund you are due. If you owe additional tax, make sure to include payment with your return.

10. Sign and date the form: Once you have completed the form, don't forget to sign and date it. If you are filing jointly, both spouses must sign the form.

11. Attach necessary documents: If you are including any additional schedules or supporting documentation, make sure to attach them securely to the PA-40 form.

12. Make copies: Before sending the form, make copies of the completed form and all attachments for your records.

13. Submit the form: Mail the completed PA-40 form, along with any payment if applicable, to the Pennsylvania Department of Revenue at the designated address. It is recommended to use certified mail or electronic filing for faster processing and proof of submission.

Remember to carefully review your completed PA-40 form for accuracy and to double-check that all necessary schedules and supplemental documents are attached before sending it to the Department of Revenue.

What is the purpose of pa 40 form?

The PA-40 form is a tax form used by residents of Pennsylvania to file their state income tax return. It is used to report and calculate state-level taxes owed by individuals based on their income, deductions, and other tax-related information. The form is submitted to the Pennsylvania Department of Revenue and is required for all residents who have an income that is subject to state taxation.

What information must be reported on pa 40 form?

The PA-40 form, also known as the Pennsylvania Personal Income Tax Return, requires the following information to be reported:

1. Personal information: This includes the taxpayer's name, Social Security number, and contact information.

2. Filing status: The taxpayer must indicate their filing status, such as single, married filing jointly, married filing separately, head of household, etc.

3. Income: All sources of income for the tax year must be reported, including wages, salaries, tips, self-employment income, rental income, interest, dividends, etc. Any taxable refunds, credits, or offsets should also be included.

4. Deductions: Taxpayers can claim deductions to reduce their taxable income. Common deductions reported on the PA-40 form include those for federal income tax, state and local taxes, mortgage interest, medical expenses, charitable contributions, etc.

5. Credits: Taxpayers should report any tax credits they are eligible for, including the Pennsylvania Property Tax and Rent Rebate Program, education credits, earned income credit, etc.

6. Tax liability and payments: Taxpayers must calculate their total tax liability for the year and report any tax payments or credits already made, such as estimated tax payments, withholding tax, or any other credits.

7. Health care coverage: Taxpayers must indicate whether they had health care coverage for themselves and their dependents throughout the year, or if they qualify for any exemptions.

8. Other information: Depending on the individual's circumstances, there may be additional forms or schedules that need to be completed and attached to the PA-40 form, such as Schedule C (Profit or Loss from Business) for self-employed individuals or Schedule D (Capital Gains and Losses) for reporting investment gains or losses.

It's important to thoroughly review the instructions provided with the PA-40 form or consult a tax professional to ensure accurate reporting and compliance with Pennsylvania tax laws.

When is the deadline to file pa 40 form in 2023?

The deadline to file the PA-40 form in 2023 is typically April 18th. However, please note that tax deadlines may vary slightly from year to year, so it is recommended to double-check with the Pennsylvania Department of Revenue or consult a tax professional for the most accurate and up-to-date information.

What is the penalty for the late filing of pa 40 form?

The penalty for late filing of the PA-40 form varies depending on the amount of tax owed and the length of the delay. The penalty is calculated at 5% per month, up to a maximum of 25% of the tax due. Additionally, interest will be charged on any late payments at a rate of 3% above the prime rate. It is important to file your PA-40 form on time to avoid these penalties and interest charges.

How can I edit 2008 pa 40 form from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your 2008 pa 40 form into a dynamic fillable form that you can manage and eSign from any internet-connected device.

Can I create an eSignature for the 2008 pa 40 form in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your 2008 pa 40 form and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I complete 2008 pa 40 form on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your 2008 pa 40 form. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.