Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

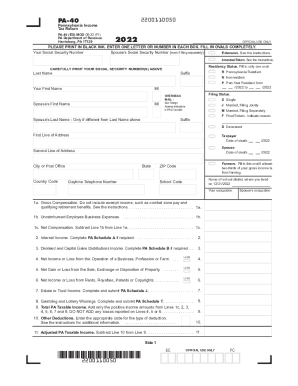

The PA-40 form is the official tax form used by residents of Pennsylvania to file their state income tax returns. It is used to report and calculate the amount of income tax owed or refunded to individual taxpayers in Pennsylvania. The form is typically filed annually, and it includes various sections for reporting income, deductions, and credits.

Who is required to file pa 40 form?

The PA-40 form, also known as the Pennsylvania Personal Income Tax Return, is required to be filed by individuals who are residents of Pennsylvania and have earned income during the tax year. Additionally, non-residents who have earned income from Pennsylvania sources are also required to file this form.

How to fill out pa 40 form?

To fill out the PA-40 form correctly, follow these steps:

Step 1: Personal Information

Provide your name, address, and social security number at the top of the form.

Step 2: Filing Status

Indicate your filing status by checking the appropriate box. Options include single, married filing jointly, married filing separately, head of household, and qualifying widow(er) with dependent child.

Step 3: Exemptions

Enter the number of exemptions you are claiming in the appropriate field based on your situation. You may be eligible for exemptions such as personal, spouse, dependent, or blind.

Step 4: Income

Report your income from various sources including wages, salaries, interest, dividends, retirement income, rental income, and self-employment income. Ensure that you accurately enter the amounts and check the appropriate boxes for the source of income.

Step 5: Deductions

Determine if you will be choosing standard deductions or itemizing deductions. If you decide to itemize, enter the amounts for various deductions such as medical expenses, taxes paid, mortgage interest, charitable contributions, and other relevant deductions.

Step 6: Tax Liability

Calculate your tax liability by following the instructions in the form or using tax software. Enter the calculated amount in the appropriate field.

Step 7: Tax Payments & Credits

Enter any tax payments you have made throughout the year, including estimated tax payments, withholding from wages, and any credits you may be eligible for (e.g., child tax credit, education credits, etc.). Make sure to properly document and enter these amounts.

Step 8: Refund or Amount Due

Calculate if you will receive a refund or have an amount due. If you are expecting a refund, subtract your tax liabilities and any outstanding debts. If you owe additional taxes, add up your liabilities and any amount due. Indicate the amount in the appropriate field.

Step 9: Sign and Date

Sign and date the form to certify your information is accurate.

Step 10: Attachments and Mailing

Attach any required additional documents (e.g., W-2 forms, 1099 forms, schedules, etc.) to the completed PA-40 form. Ensure all necessary information is included. Mail your completed form and attachments to the appropriate address provided on the form or the official Pennsylvania Department of Revenue website.

It is recommended to consult a tax professional or utilize tax software for accurate and personalized guidance when filling out tax forms.

What is the purpose of pa 40 form?

The PA-40 form is used for filing a Pennsylvania individual income tax return. It is used by residents, non-residents, and part-year residents of Pennsylvania to report their income, deductions, and credits for the tax year. The form calculates the tax liability or refund owed by the taxpayer to the state.

What information must be reported on pa 40 form?

The PA-40 form is used to report income, deductions, and tax credits for individuals filing their Pennsylvania Personal Income Tax Return. The specific information that must be reported on the form includes:

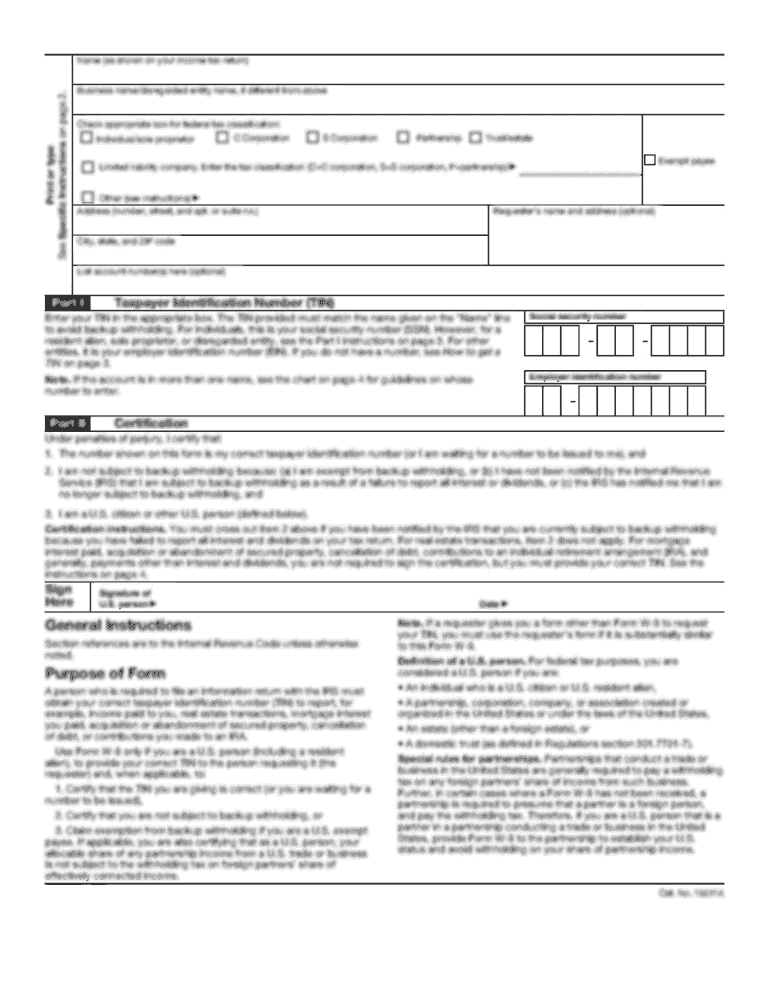

1. Personal information: This includes your full name, Social Security number, address, and filing status.

2. Income: You must report all sources of income, including wages, self-employment income, rental income, dividends, interest, and any other taxable income received during the tax year.

3. Deductions: You can claim various deductions to reduce your taxable income, including deductions for mortgage interest, property taxes, medical expenses, charitable contributions, and certain business expenses.

4. Tax credits: There are several tax credits available in Pennsylvania, such as the Earned Income Tax Credit, Child Tax Credit, and Property Tax/Rent Rebate Program. You must provide information on these credits if applicable.

5. Withholding and estimated payments: If you have had taxes withheld from your wages or made estimated tax payments throughout the year, you need to report the total amounts on the form.

6. Tax liability and refunds: Based on the provided information, you will calculate your tax liability or refund. This includes determining your tax due or overpayment and any penalty or interest owed.

7. Additional schedules and attachments: Depending on your specific circumstances, you may need to attach additional schedules or forms, such as Schedule PA-40 A for additional income, Schedule PA-40 B for non-resident or part-year resident taxpayers, or Schedule SP for special tax forgiveness.

It is important to review the specific instructions provided with the PA-40 form and consult a tax professional if you have any questions or are unsure about certain entries.

When is the deadline to file pa 40 form in 2023?

The specific deadline to file the PA-40 form in 2023 is not available at the moment. However, typically the deadline for filing Pennsylvania state income tax returns is April 15th, unless it falls on a weekend or holiday. It's always recommended to check with the Pennsylvania Department of Revenue website or consult a tax professional for the most accurate and up-to-date information regarding tax filing deadlines.

What is the penalty for the late filing of pa 40 form?

The penalty for the late filing of a PA 40 form (Pennsylvania Personal Income Tax Return) is typically a late filing fee. As of 2021, the penalty for late filing is 5% per month (or part of a month) that the return is late, up to a maximum of 25% of the total tax due. However, if you file your return within 60 days after the due date, the penalty is reduced to 1% per month (or part of a month).

It's important to note that interest will also be charged on any unpaid tax from the due date until the date of payment. The interest rate is determined annually, and for 2021, it is set at 3%.

How do I make edits in pa 40 2015 form without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your pa 40 2015 form, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

Can I create an eSignature for the pa 40 2015 form in Gmail?

Create your eSignature using pdfFiller and then eSign your pa 40 2015 form immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I complete pa 40 2015 form on an Android device?

Complete pa 40 2015 form and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.