Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Pennsylvania (also known as PA or Penn) is a state located in the Northeastern and Mid-Atlantic regions of the United States. The state borders Delaware to the southeast, Maryland to the south, West Virginia to the southwest, Ohio to the west, Lake Erie and the Canadian province of Ontario to the northwest, New York to the north, and New Jersey to the east. Pennsylvania is the 33rd-largest state by area, and the 6th-most populous state according to the most recent official U.S. Census count in 2020. It is the 9th-most densely populated of the 50 states. It is home to many major cities, including Philadelphia, Pittsburgh, Allentown, Erie, Reading, and Scranton.

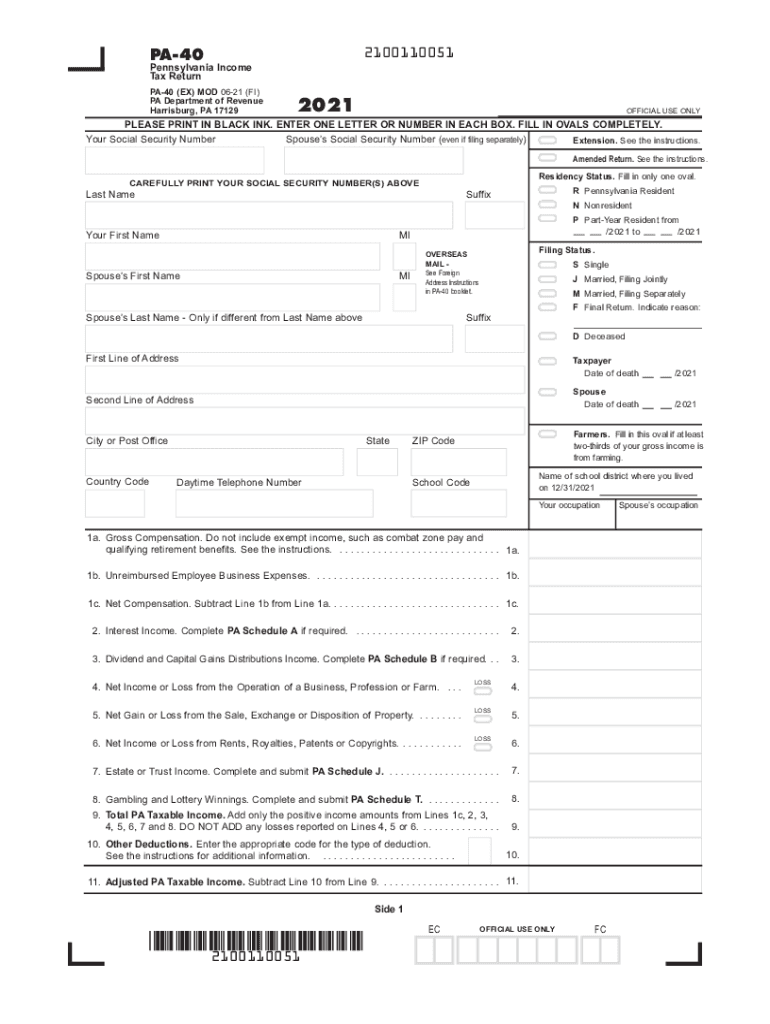

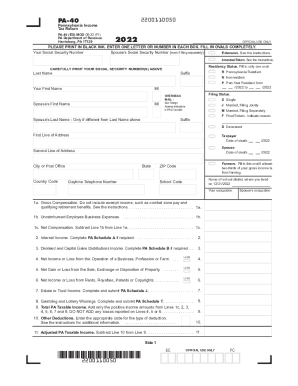

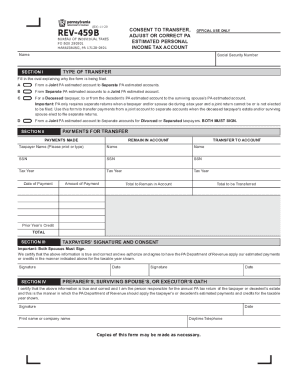

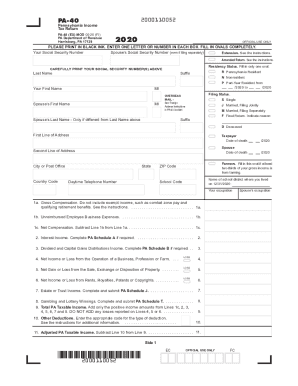

How to fill out pa pennsylvania?

To fill out a Pennsylvania tax form, you will need to provide information about your income, deductions, and other financial information. You can find the forms online on the Pennsylvania Department of Revenue website. Once you have the form, you will need to provide your name, address, Social Security number, and other information about your income, deductions, and other financial information. After filling out the form, you must sign and date it before submitting it to the Pennsylvania Department of Revenue.

Who is required to file pa pennsylvania?

In Pennsylvania, individuals who meet certain income thresholds or have specific types of income or deductions are required to file a state tax return. Generally, Pennsylvania residents are required to file a state tax return if:

1. They are single, have Pennsylvania taxable income of at least $12,000, and are under the age of 65.

2. They are single, have Pennsylvania taxable income of at least $13,000, and are 65 years of age or older.

3. They are married filing jointly, have Pennsylvania taxable income of at least $24,000, and both spouses are under 65.

4. They are married filing jointly, have Pennsylvania taxable income of at least $25,000, and one spouse is 65 or older.

5. They are married filing jointly, have Pennsylvania taxable income of at least $26,000, and both spouses are 65 or older.

6. They are a dependent and have unearned income (such as interest, dividends, or capital gains) of more than $2,600.

7. They are a nonresident of Pennsylvania but earned income in the state.

It is important to note that these thresholds and requirements may change from year to year, so individuals should consult the Pennsylvania Department of Revenue or a tax professional for the most up-to-date information.

What is the purpose of pa pennsylvania?

The purpose of Pennsylvania, commonly known as PA, is to serve as a state within the United States. As one of the 50 states, Pennsylvania has several purposes:

1. Governance: Pennsylvania exists to provide a system of governance and administration for its residents. It has a state government with elected officials, a governor, legislative bodies, and a judiciary.

2. Representation: Pennsylvania helps ensure that its residents have representation at the national level. The state is entitled to a certain number of representatives in the United States Congress based on its population, allowing the people of Pennsylvania to have a voice in the federal decision-making process.

3. Protection and Services: Pennsylvania is responsible for providing various public services to its residents. This includes education, healthcare, transportation infrastructure, public safety, environmental protection, and social services, among others.

4. Economic Development: The state's purpose also includes fostering economic growth and development within its borders. Pennsylvania has industries such as manufacturing, agriculture, energy, technology, and finance that contribute to its economy and provide jobs for its residents.

5. Preservation of History and Culture: Pennsylvania is home to numerous historic sites, landmarks, cultural institutions, and diverse communities. Preserving and promoting its history, culture, and heritage is another purpose of the state.

Overall, the purpose of Pennsylvania is to provide governance, representation, public services, economic development, and cultural preservation for its residents, contributing to the overall functioning and prosperity of the United States.

What information must be reported on pa pennsylvania?

The specific information that must be reported on Pennsylvania state tax returns can vary depending on the individual's circumstances and the specific forms being filed. However, some common types of information that may need to be reported include:

1. Personal information: This includes your name, Social Security number, address, and marital status.

2. Income: All sources of income must be reported, including wages, salaries, tips, self-employment income, rental income, investment income, and any other form of taxable income.

3. Deductions: Pennsylvania allows certain deductions, such as tuition and fees deduction, student loan interest deduction, and charitable contributions. These deductions will need to be reported if applicable.

4. Credits: Certain tax credits, such as the Child Tax Credit, Earned Income Credit, and Pennsylvania Property Tax Relief, may be available to eligible individuals. These credits must be reported accurately.

5. Tax withholdings: If you had taxes withheld from your paychecks throughout the year, you will need to report this information to ensure you receive the appropriate tax credit.

6. Business information: If you operate a business or are self-employed, additional information may need to be reported, such as business income and expenses, asset depreciation, and employer identification numbers.

It is important to consult the specific instructions provided by the Pennsylvania Department of Revenue or seek assistance from a tax professional to ensure accurate reporting of all necessary information.

When is the deadline to file pa pennsylvania in 2023?

The deadline to file Pennsylvania state income tax returns for the year 2023 is typically on April 15th. However, it's essential to note that tax deadlines can change or be extended, so it's advisable to double-check with the Pennsylvania Department of Revenue closer to the date.

What is the penalty for the late filing of pa pennsylvania?

The penalty for late filing of Pennsylvania state taxes varies depending on the amount of tax owed and the length of time it remains unpaid. The penalty for late filing is generally 5% of the tax due for each month or part of a month that the return is late, up to a maximum of 25% of the total tax due. Additionally, interest will be charged on the unpaid amount at a rate of 3% per year. It is important to note that penalties and interest can accumulate quickly, so it is advisable to file and pay taxes on time to avoid these additional costs.

How can I manage my pa pennsylvania directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your pa 40 instructions 2021 form and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I complete pa state income tax online?

Filling out and eSigning printable pa 40 tax form 2021 is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I create an eSignature for the pa 40 tax form in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your pa income tax form and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.