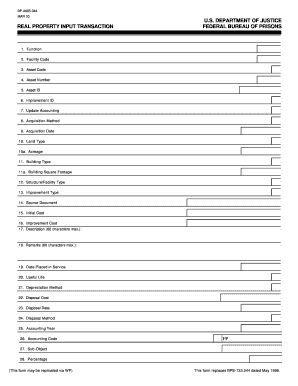

Get the free Loans - (Includes Tax Anticipation Notes, DNR Energy Loans)

Show details

LoansSchool FinanceLoansLoans (Includes Tax Anticipation Notes, DNR Energy Loans) Loans that are to be repaid within a one-year period are considered short term loans. Short term loan proceeds are

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign loans - includes tax

Edit your loans - includes tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your loans - includes tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing loans - includes tax online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit loans - includes tax. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out loans - includes tax

How to fill out loans - includes tax

01

To fill out loans including tax, follow these steps:

02

Gather all necessary documents such as ID proof, income proof, bank statements, etc.

03

Research and compare different loan options available to you.

04

Understand the terms and conditions of each loan and analyze its interest rates and fees.

05

Fill out the loan application form accurately and completely.

06

Provide all required financial information, including details about your taxes.

07

Attach relevant documents as requested, including tax return forms.

08

Double-check all the information provided and make sure it is correct.

09

Submit the loan application along with the necessary documents to the respective institution.

10

Await the lender's decision and respond promptly if they need any additional information.

11

Once approved, review the loan agreement carefully before signing it.

12

Make sure to fulfill all tax obligations related to the loan, including reporting and paying any applicable taxes on time.

13

Repay the loan amount and associated taxes as per the agreed-upon schedule.

14

Monitor your loan account and keep track of any changes in tax regulations or payment requirements.

15

Seek professional advice if you have any doubts or concerns regarding loan repayment and tax obligations.

Who needs loans - includes tax?

01

Loans including tax can be beneficial for various individuals and businesses, including:

02

- Individuals in need of financial assistance to fulfill personal needs like education, home renovation, medical expenses, etc.

03

- Small business owners looking for capital to start or expand their business operations.

04

- Entrepreneurs who require funds for investment in new projects or ventures.

05

- Homebuyers who need mortgages to purchase property.

06

- Students pursuing higher education and requiring student loans to cover tuition fees and living expenses.

07

- Individuals facing unexpected financial emergencies and require immediate funds.

08

- People looking to consolidate their debts or improve their overall financial situation.

09

- Individuals with a good credit history and satisfactory income stability, making them eligible for better loan terms and rates.

10

Ultimately, loans including tax are suitable for anyone who needs financial support and is capable of meeting the repayment obligations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send loans - includes tax to be eSigned by others?

To distribute your loans - includes tax, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I fill out the loans - includes tax form on my smartphone?

Use the pdfFiller mobile app to complete and sign loans - includes tax on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

Can I edit loans - includes tax on an Android device?

You can edit, sign, and distribute loans - includes tax on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is loans - includes tax?

Loans that include tax are loans that have taxes included in the repayment terms.

Who is required to file loans - includes tax?

Anyone who has taken out a loan that includes tax must report it on their tax returns.

How to fill out loans - includes tax?

When filling out loans that include tax, make sure to accurately report the tax amounts included in the loan repayment.

What is the purpose of loans - includes tax?

The purpose of loans that include tax is to provide borrowers with funds while also allowing them to pay for taxes associated with the loan.

What information must be reported on loans - includes tax?

When reporting loans that include tax, individuals must include the total loan amount, interest rate, repayment terms, and the amount of taxes included in the loan.

Fill out your loans - includes tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Loans - Includes Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.