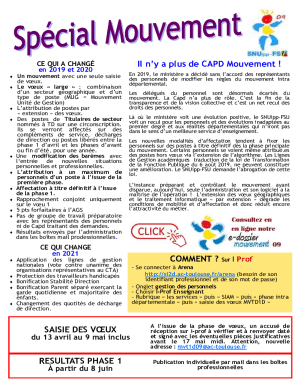

MI 4632 2017 free printable template

Show details

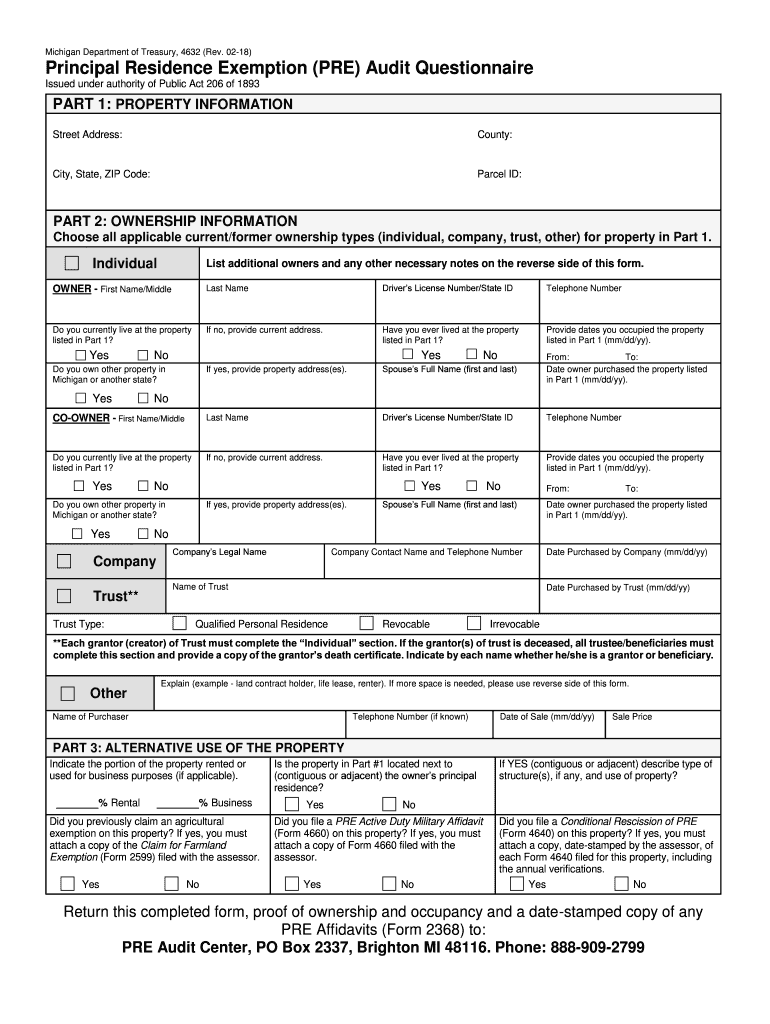

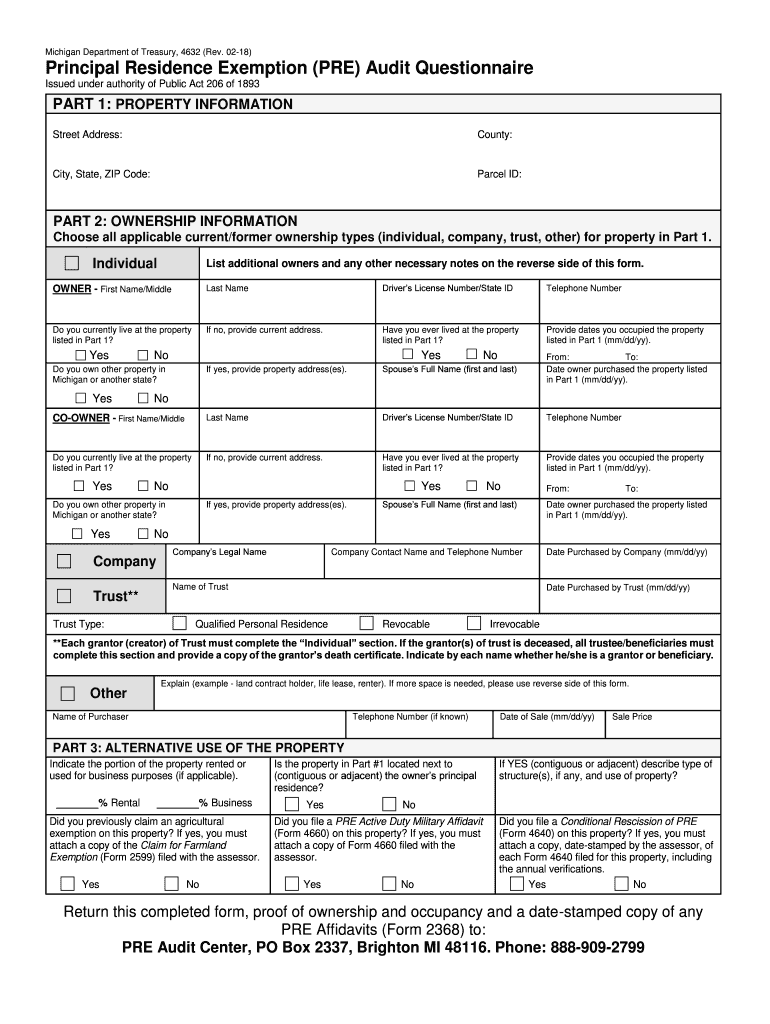

Michigan Department of Treasury, 4632 (Rev. 0218)Principal Residence Exemption (PRE) Audit Questionnaire

Issued under authority of Public Act 206 of 1893PART 1: PROPERTY INFORMATION

Street Address:County:City,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MI 4632

Edit your MI 4632 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MI 4632 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MI 4632 online

Follow the steps below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit MI 4632. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MI 4632 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MI 4632

How to fill out MI 4632

01

Begin by obtaining the MI 4632 form from the official website or your local office.

02

Fill out your personal information in the designated fields, including your name, address, and contact details.

03

Provide details regarding the purpose of the form in the appropriate section.

04

Attach any required documents or evidence that supports your application.

05

Review the completed form for accuracy and completeness.

06

Sign and date the form at the bottom.

07

Submit the form according to the instructions provided, either online or by mail.

Who needs MI 4632?

01

Individuals applying for a specific program or service related to Michigan state requirements.

02

Residents needing to report changes in their personal information that may affect their applications.

03

Those involved in legal or official matters requiring documentation as specified by state regulations.

Fill

form

: Try Risk Free

People Also Ask about

How much tax do you pay when you sell a house in Quebec?

If you sell your house or residential complex, you generally have to report a capital gain or loss on the sale. In general, half (50%) of a capital gain on the sale of your house is taxable.

At what age do you stop paying property taxes in Michigan?

Applicant or spouse of applicant must reach age 65 by December 31 of the tax year.

Is there a property tax exemption in Michigan?

Property owned and used as a homestead by a disabled and honorably discharged veteran is exempt from Michigan property taxes .

What is the form for principal residence exemption in Michigan?

Complete the Michigan Form 2368 The form you use to apply for this exemption is a State of Michigan form called the Principal Residence Exemption (PRE) Affidavit. The affidavit has to be filed with our office on or before June 1st to be applied to the current tax year.

How do I become exempt from property taxes in Michigan?

Property Tax Exemption An eligible person must own and occupy his/her home as a principal residence (homestead) and meet poverty income standards. The local Board of Review may interview the applicant in order to determine eligibility, ing to the local guidelines, and will review all applications.

What is the 2 out of 5 year rule?

The 2-out-of-five-year rule states that you must have both owned and lived in your home for a minimum of two out of the last five years before the date of sale. However, these two years don't have to be consecutive, and you don't have to live there on the date of the sale.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send MI 4632 to be eSigned by others?

Once you are ready to share your MI 4632, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How can I get MI 4632?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the MI 4632 in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I edit MI 4632 in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your MI 4632, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

What is MI 4632?

MI 4632 is a Michigan state form used for reporting various tax-related information for businesses operating in the state.

Who is required to file MI 4632?

Businesses operating in Michigan that meet certain criteria, such as those with specific types of transactions or income, are required to file MI 4632.

How to fill out MI 4632?

To fill out MI 4632, follow the instructions provided with the form, complete all required fields, and ensure that all relevant financial information is accurately reported.

What is the purpose of MI 4632?

The purpose of MI 4632 is to collect information from businesses for tax assessment and compliance purposes, ensuring accurate reporting and payment of taxes.

What information must be reported on MI 4632?

The information that must be reported on MI 4632 includes business income, deductions, credits, and any other relevant financial details as outlined in the form instructions.

Fill out your MI 4632 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MI 4632 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.