MI 4632 2014 free printable template

Show details

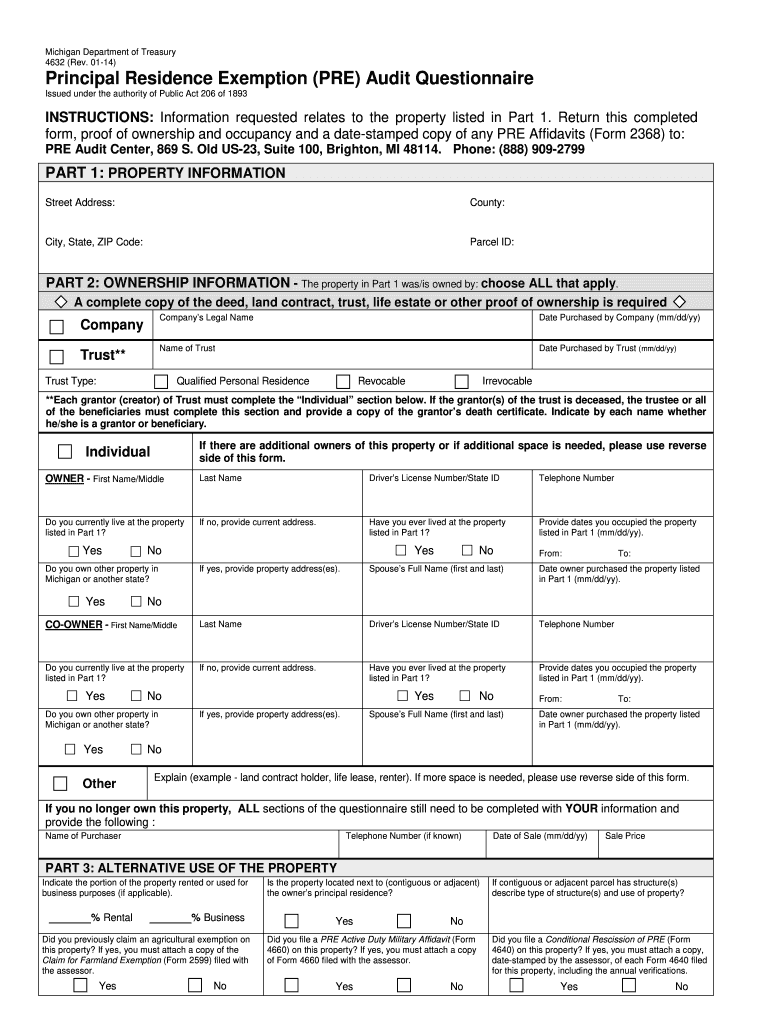

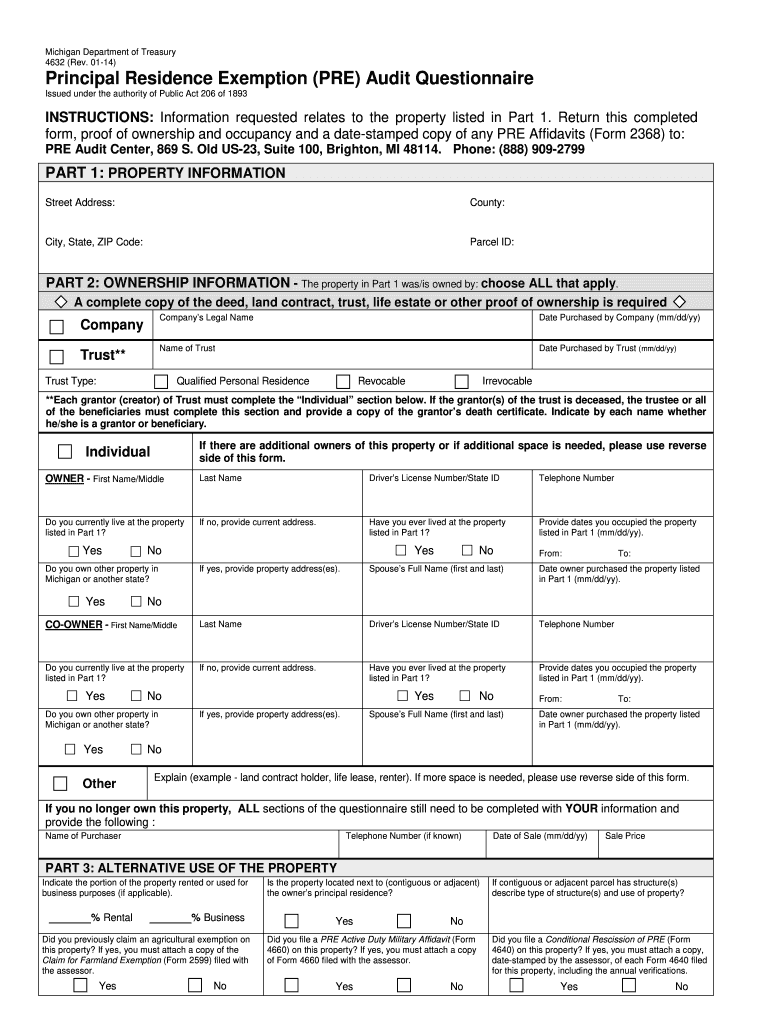

Michigan Department of Treasury 4632 (Rev. 0114) Principal Residence Exemption (PRE) Audit Questionnaire Issued under the authority of Public Act 206 of 1893 INSTRUCTIONS: Information requested relates

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MI 4632

Edit your MI 4632 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MI 4632 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MI 4632 online

Follow the guidelines below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit MI 4632. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MI 4632 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MI 4632

How to fill out MI 4632

01

Obtain form MI 4632 from the official website or designated office.

02

Read the instructions provided with the form carefully.

03

Fill out the applicant's personal information, including name, address, and contact details.

04

Provide any relevant identification numbers where required.

05

Complete the sections related to the purpose of submitting the form.

06

Review the completed form to ensure accuracy and completeness.

07

Sign and date the form as required.

08

Submit the form via the designated submission method (mail, online, in-person).

Who needs MI 4632?

01

Individuals applying for a specific service or benefit that requires MI 4632.

02

Organizations or entities that need to provide information for regulatory compliance.

03

Applicants who need to verify their identity or eligibility for a program.

Fill

form

: Try Risk Free

People Also Ask about

How much tax do you pay when you sell a house in Quebec?

If you sell your house or residential complex, you generally have to report a capital gain or loss on the sale. In general, half (50%) of a capital gain on the sale of your house is taxable.

At what age do you stop paying property taxes in Michigan?

Applicant or spouse of applicant must reach age 65 by December 31 of the tax year.

Is there a property tax exemption in Michigan?

Property owned and used as a homestead by a disabled and honorably discharged veteran is exempt from Michigan property taxes .

What is the form for principal residence exemption in Michigan?

Complete the Michigan Form 2368 The form you use to apply for this exemption is a State of Michigan form called the Principal Residence Exemption (PRE) Affidavit. The affidavit has to be filed with our office on or before June 1st to be applied to the current tax year.

How do I become exempt from property taxes in Michigan?

Property Tax Exemption An eligible person must own and occupy his/her home as a principal residence (homestead) and meet poverty income standards. The local Board of Review may interview the applicant in order to determine eligibility, ing to the local guidelines, and will review all applications.

What is the 2 out of 5 year rule?

The 2-out-of-five-year rule states that you must have both owned and lived in your home for a minimum of two out of the last five years before the date of sale. However, these two years don't have to be consecutive, and you don't have to live there on the date of the sale.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit MI 4632 online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your MI 4632 to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I fill out MI 4632 using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign MI 4632 and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How do I fill out MI 4632 on an Android device?

On an Android device, use the pdfFiller mobile app to finish your MI 4632. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is MI 4632?

MI 4632 is a form used by individuals and businesses to report specific financial information for tax purposes in the state of Michigan.

Who is required to file MI 4632?

Individuals and entities that meet certain financial thresholds or engage in specific financial activities as defined by the Michigan Department of Treasury are required to file MI 4632.

How to fill out MI 4632?

To fill out MI 4632, gather all relevant financial documents, follow the instructions provided on the form, and complete each section accordingly before submitting it to the Michigan Department of Treasury.

What is the purpose of MI 4632?

The purpose of MI 4632 is to ensure accurate reporting of financial activities and to facilitate the assessment of tax liabilities within the state of Michigan.

What information must be reported on MI 4632?

The information required on MI 4632 typically includes income, deductions, credits, and other pertinent financial data as specified in the form's instructions.

Fill out your MI 4632 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MI 4632 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.