IRS 1040-V 2017 free printable template

Show details

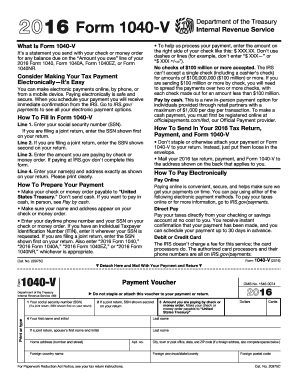

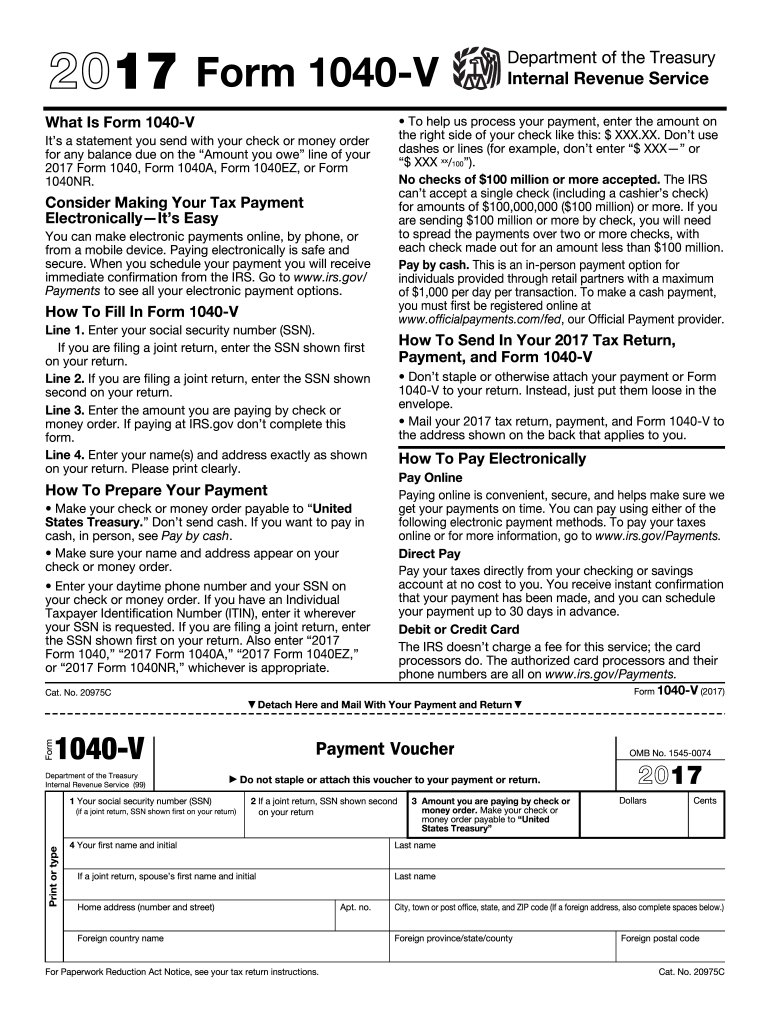

Cat. No. 20975C Form Detach 1040-V Department of the Treasury Internal Revenue Service 99 Here and Mail With Your Payment and Return Payment Voucher 1 Your social security number SSN if a joint return SSN shown first on your return Print or type 4 Your first name and initial Foreign country name For Paperwork Reduction Act Notice see your tax return instructions. Paying electronically is safe and secure. When you schedule your payment you will receive immediate confirmation from the IRS. Go...to www.irs.gov/ Payments to see all your electronic payment options. How To Fill In Form 1040-V Line 1. Enter your social security number SSN. If you are filing a joint return enter the SSN shown first on your return. Line 2. If you are filing a joint return enter the SSN shown second on your return. Line 3. Enter the amount you are paying by check or money order. Mail your 2017 tax return payment and Form 1040-V to the address shown on the back that applies to you. How To Pay Electronically Pay...Online Paying online is convenient secure and helps make sure we get your payments on time. You can pay using either of the following electronic payment methods. To pay your taxes online or for more information go to www.irs.gov/Payments. If paying at IRS.gov don t complete this form. How To Send In Your 2017 Tax Return Payment and Form 1040-V Don t staple or otherwise attach your payment or Form 1040-V to your return. Instead just put them loose in the envelope. Mail your 2017 tax return...payment and Form 1040-V to the address shown on the back that applies to you. How To Pay Electronically Pay Online Paying online is convenient secure and helps make sure we get your payments on time. If you are filing a joint return enter the SSN shown second on your return. Line 3. Enter the amount you are paying by check or money order. If paying at IRS.gov don t complete this form. How To Send In Your 2017 Tax Return Payment and Form 1040-V Don t staple or otherwise attach your payment or...Form 1040-V to your return. Instead just put them loose in the envelope. Mail your 2017 tax return payment and Form 1040-V to the address shown on the back that applies to you. How To Fill In Form 1040-V Line 1. Enter your social security number SSN. If you are filing a joint return enter the SSN shown first on your return. Line 2. If you are filing a joint return enter the SSN shown second on your return. Line 3. Enter the amount you are paying by check or money order. If paying at IRS.gov don...t complete this form. How To Send In Your 2017 Tax Return Payment and Form 1040-V Don t staple or otherwise attach your payment or Form 1040-V to your return. Instead just put them loose in the envelope. Officialpayments. com/fed our Official Payment provider. It s a statement you send with your check or money order for any balance due on the Amount you owe line of your 2017 Form 1040 Form 1040A Form 1040EZ or Form 1040NR. Consider Making Your Tax Payment Electronically It s Easy You can make...electronic payments online by phone or from a mobile device. Paying electronically is safe and secure. When you schedule your payment you will receive immediate confirmation from the IRS. Go to www.irs.gov/ Payments to see all your electronic payment options. How To Fill In Form 1040-V Line 1. Enter your social security number SSN. If you are filing a joint return enter the SSN shown first on your return. Line 2. Form 1040-V What Is Form 1040-V To help us process your payment enter the amount...on the right side of your check like this XXX. XX. Don t use dashes or lines for example don t enter XXX or XXX xx/100. No checks of 100 million or more accepted. The IRS can t accept a single check including a cashier s check for amounts of 100 000 000 100 million or more. If you are sending 100 million or more by check you will need to spread the payments over two or more checks with each check made out for an amount less than 100 million. Pay by cash.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1040-V

How to edit IRS 1040-V

How to fill out IRS 1040-V

Instructions and Help about IRS 1040-V

How to edit IRS 1040-V

To edit IRS 1040-V, first, download the form from the IRS website or obtain it from a reliable third-party provider. Use pdfFiller to make necessary changes, as it offers easy editing tools that allow you to input information directly into the form. Save your edited document for submission and review it for accuracy before filing.

How to fill out IRS 1040-V

Filling out IRS 1040-V requires accurate information to ensure the proper processing of your tax payment. Start by providing your name, social security number, and address at the top of the form. Next, indicate the amount you are submitting and check the box if you prefer to receive a notice of your payment. Review the completed form thoroughly to ensure all sections are filled correctly.

About IRS 1040-V 2017 previous version

What is IRS 1040-V?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1040-V 2017 previous version

What is IRS 1040-V?

IRS 1040-V is a payment voucher used by taxpayers who are making payments towards their income tax liabilities. This form is essential for ensuring that the IRS correctly identifies your payment and associates it with your specific tax return. Although this version of the form is from 2017, understanding its usage can still benefit those correcting past tax filings or handling previous tax issues.

What is the purpose of this form?

The primary purpose of IRS 1040-V is to facilitate the submission of payments with your tax return. It helps taxpayers separate their payment from the return and provides a means for the IRS to apply the payment to the correct account. Without this voucher, payments may be misapplied, leading to potential delays or errors in tax processing.

Who needs the form?

Taxpayers who are required to make payments with their federal income tax returns must use IRS 1040-V. This includes individuals who owe tax during the filing process or those who are making estimated tax payments. If you expect to owe taxes when filing your return, you will likely need to complete this form to ensure accurate processing.

When am I exempt from filling out this form?

You may be exempt from filling out IRS 1040-V if you are due for a refund or if you are not making any payment with your tax return. Additionally, if you file your taxes electronically and select an automatic payment option, a separate voucher is not required.

Components of the form

IRS 1040-V consists of several components that are crucial for accurate filings. The form includes fields for your personal information, the payment amount, and checkboxes for specific options regarding your payment acknowledgment. Each section must be filled out properly to avoid processing issues.

What are the penalties for not issuing the form?

Failing to submit IRS 1040-V when required may lead to penalties such as late payment fees or interest on unpaid taxes. It can also result in complications with the IRS in applying your payment to your account correctly. To avoid these penalties, ensure that you complete and include the voucher with your payment.

What information do you need when you file the form?

When filing IRS 1040-V, you will need your name, social security number, and payment amount. Additionally, it is advisable to have your tax return information handy to ensure the payment is correctly related to your tax obligations. Being thorough in filling out this information is critical for proper processing.

Is the form accompanied by other forms?

IRS 1040-V is typically submitted alongside Form 1040 or other related income tax forms. It serves as a standalone payment voucher, but it should be included when making payments related to your tax return. Ensure all forms are submitted together to avoid processing delays.

Where do I send the form?

The mailing address for IRS 1040-V depends on where you reside and whether you're sending a payment or filing electronically. Generally, if you are mailing a check, you should send it to the address specified in the instructions for Form 1040. Always refer to the latest IRS instructions for the correct mailing address.

See what our users say