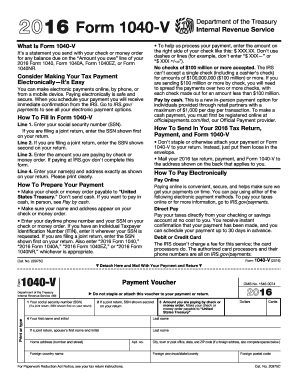

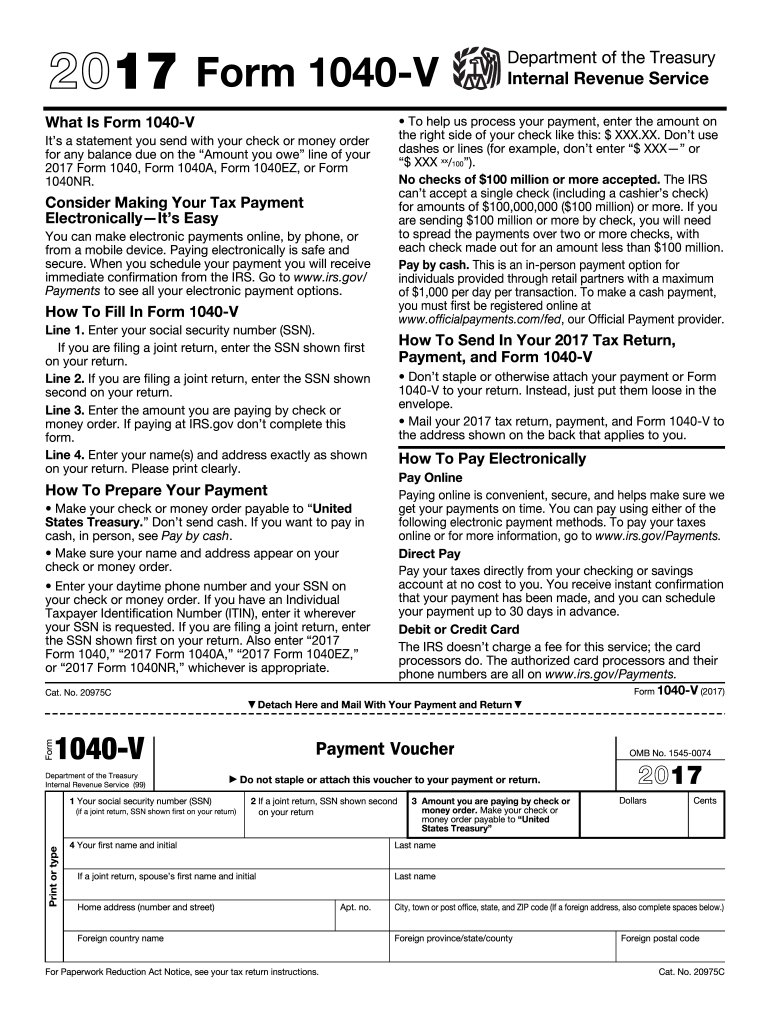

IRS 1040-V 2017 free printable template

Instructions and Help about IRS 1040-V

How to edit IRS 1040-V

How to fill out IRS 1040-V

About IRS 1040-V 2017 previous version

What is IRS 1040-V?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1040-V

What should I do if I made an error after submitting my IRS 1040-V?

If you discover an error after submission, you can correct it by filing an amended return. Ensure you're clear about the changes needed and identify if the IRS 1040-V submission affects any other forms you've filed. Mistakes should be addressed as soon as possible to mitigate any potential penalties.

How can I verify if my IRS 1040-V has been processed?

To check the status of your IRS 1040-V submission, visit the IRS website and use their tracking tool or call their customer service. Keep your information handy for verification, including your Social Security number and the exact amount of your payment, as this will facilitate the query process.

What are common mistakes people make when filing the IRS 1040-V?

Common errors include not signing the form, incorrect payment amounts, or mismatching taxpayer identification details. It's crucial to double-check all information before submission as these small mistakes may delay processing or result in penalties related to your IRS 1040-V.

Can I submit IRS 1040-V electronically?

Yes, you can submit your IRS 1040-V electronically if you filed your tax return online. Ensure that your e-filing software supports direct payment methods and complies with IRS e-signature requirements to avoid complications during submission.

What should I do if I receive a notice from the IRS regarding my 1040-V?

If you receive a notice related to your IRS 1040-V, carefully read the details to understand the issue. Prepare any documentation requested and respond promptly. If you're uncertain about how to address the notice, consider consulting a tax professional for guidance.

See what our users say