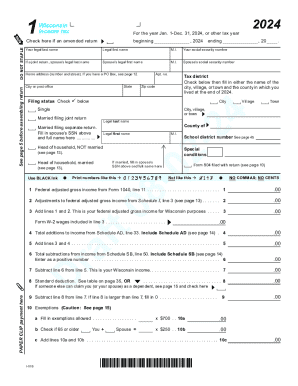

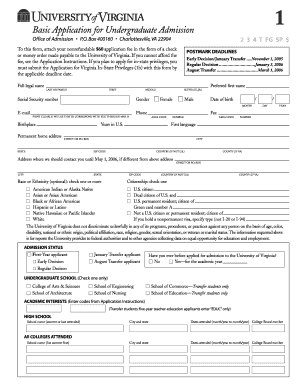

WI I-010i 2017 free printable template

Show details

Caution:

At the time Form 1 went to print, the Internal Revenue

Service hadn't finalized the 2017 federal Schedule A.

The final version of Schedule A now reports net qualified

disaster losses on line

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign WI I-010i

Edit your WI I-010i form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your WI I-010i form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit WI I-010i online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit WI I-010i. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WI I-010i Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out WI I-010i

How to fill out WI I-010i

01

Download the WI I-010i form from the Wisconsin Department of Workforce Development website.

02

Read the instructions carefully before filling out the form.

03

Enter your personal information, including your name, address, and contact details in the designated fields.

04

Provide information about your employment history, including the name of employers, job titles, and dates of employment.

05

Specify the reason for your claim, ensuring to include any relevant details to support your case.

06

Sign and date the form at the bottom after completing all necessary sections.

07

Submit the completed form via mail or electronically, as specified in the submission guidelines.

Who needs WI I-010i?

01

Individuals who have experienced a job loss and wish to apply for unemployment benefits in Wisconsin.

02

Workers seeking to claim unemployment insurance after leaving a job due to specific reasons such as layoffs or company closures.

Fill

form

: Try Risk Free

People Also Ask about

How do I send my federal tax return by mail?

Use the U.S. Postal Service® to mail your tax return, get proof that you mailed it, and track its arrival at the IRS.Mail Your Tax Return with USPS Send to the Correct Address. Check the IRS website for where to mail your tax return. Use Correct Postage. Meet the Postmark Deadline.

Who should file a 1040-ES tax form?

When to file Form 1040-ES. You must make estimated tax payments and file Form 1040-ES if both of these apply: Your estimated tax due is $1,000 or more.

What is the easiest way to pay estimated taxes?

Making payments online is the fastest, easiest way to pay quarterly taxes. If you prefer, you can also make payments by mail. To avoid any tax penalties, take time to learn how much you'll need to pay in quarterly taxes, when quarterly tax payments are due and how to make your payments to the IRS.

Can I make just one estimated tax payment?

You Can Make a One-Time Payment Remember, the schedule set by the IRS is a series of deadlines. You can always make a payment before a set date, and you can cover your entire liability in one payment if you want to. You don't have to divide up what you might owe into a series of four quarterly payments.

What address do I mail my tax return to?

Alaska, Arizona, California, Colorado, Hawaii, Idaho, New Mexico, Nevada, Oregon, Utah, Washington, Wyoming: Department of the Treasury, Internal Revenue Service, Fresno, CA 93888-0014.

What does Es stand for in taxes?

More In Forms and Instructions Use Form 1040-ES to figure and pay your estimated tax. Estimated tax is the method used to pay tax on income that is not subject to withholding (for example, earnings from self-employment, interest, dividends, rents, alimony, etc.).

What is the best way to pay quarterly taxes?

How to pay quarterly taxes You can submit them online through the Electronic Federal Tax Payment System. You can also pay using paper forms supplied by the IRS. When you file your annual tax return, you'll pay the balance of taxes that weren't covered by your quarterly payments.

Can I split estimated tax payments?

The IRS allows both parties the ability to divide the estimated tax payments based on agreement. If the couple cannot agree upon a solution, tax payments will be split in proportion to each party's respective tax, as reflected on his or her current year, separately filed tax return.

Do I have to make estimated tax payments every quarter?

For estimated tax purposes, a year has four payment periods. Taxpayers must make a payment each quarter. For most people, the due date for the first quarterly payment is April 15.

How to make an estimated tax payment in Wisconsin?

How do I make estimated tax payments? Payments can be made via Quick Pay or in My Tax Account. Complete and print the interactive Form 1-ES Voucher. Call us at (608) 266-2486 to request vouchers.

Can you make 1 estimated tax payment?

You Can Make a One-Time Payment Remember, the schedule set by the IRS is a series of deadlines. You can always make a payment before a set date, and you can cover your entire liability in one payment if you want to. You don't have to divide up what you might owe into a series of four quarterly payments.

What is wi Form 1-ES?

Form 1-ES Wisconsin Estimated Income Tax Interactive Voucher.

Why did I get a 1040-ES?

The IRS provides Form 1040-ES for you to calculate and pay estimated taxes for the current year. While the 1040 relates to the previous year, the estimated tax form calculates taxes for the current year. You use Form 1040-ES to pay income tax, self-employment tax and any other tax you may be liable for.

What are es payments?

If you are in business for yourself, you generally need to make estimated tax payments. Estimated tax is used to pay not only income tax, but other taxes such as self-employment tax and alternative minimum tax. If you don't pay enough tax through withholding and estimated tax payments, you may be charged a penalty.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in WI I-010i?

With pdfFiller, the editing process is straightforward. Open your WI I-010i in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I create an electronic signature for the WI I-010i in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your WI I-010i in seconds.

How do I fill out WI I-010i on an Android device?

Use the pdfFiller mobile app and complete your WI I-010i and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is WI I-010i?

WI I-010i is a specific informational form used by the state of Wisconsin for reporting certain tax-related information.

Who is required to file WI I-010i?

Taxpayers who meet specific criteria related to income and tax obligations in Wisconsin are required to file WI I-010i.

How to fill out WI I-010i?

To fill out WI I-010i, provide the requested personal information, financial data, and any other details specified on the form, ensuring all required fields are completed accurately.

What is the purpose of WI I-010i?

The purpose of WI I-010i is to collect information necessary for the state of Wisconsin to assess and process tax liabilities effectively.

What information must be reported on WI I-010i?

The information that must be reported on WI I-010i includes personal identification details, income sources, deductions, and any other relevant financial data as per the form's requirements.

Fill out your WI I-010i online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

WI I-010i is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.