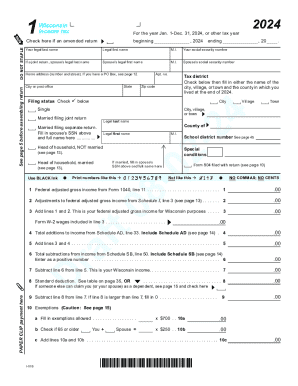

WI I-010i 2018 free printable template

Get, Create, Make and Sign WI I-010i

How to edit WI I-010i online

Uncompromising security for your PDF editing and eSignature needs

WI I-010i Form Versions

How to fill out WI I-010i

How to fill out WI I-010i

Who needs WI I-010i?

Instructions and Help about WI I-010i

Here are a few tips for using Wisconsin e-fileThe Department of Revenues free secure and easy way to file your state tax return First check your version of Adobe Reader You will need version 91 or above to use Wisconsin e-file Right-click the form you want to file selective target as and choose a location on your computer Once saved open the form from your computer to start filing If you are filing Form 1 or claiming a HomesteadCredit you may need to attach documents to your return These could be from other software or images of paper documents you have scanned To attach a file click the paper clip clicked locate the file and click Open The file will appear in the window To delete an attachment click the file then click Delete After clicking Submit if you get a message saying the form is trying to connect to a website check the box next to Remember my action for this site and click Allow We to hope you find these tips helpful Thanks for using Wisconsin e-file

People Also Ask about

How long do I have to pay taxes after filing?

How do I pay my Wisconsin state taxes?

How do I pay owed taxes?

When can I file my Wisconsin state taxes 2022?

How much do you have to make to file taxes 2022 in Wisconsin?

What is the standard deduction for Wisconsin income tax?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit WI I-010i in Chrome?

How do I complete WI I-010i on an iOS device?

How do I edit WI I-010i on an Android device?

What is WI I-010i?

Who is required to file WI I-010i?

How to fill out WI I-010i?

What is the purpose of WI I-010i?

What information must be reported on WI I-010i?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.