CA Title Insurance Disclosure 2011-2025 free printable template

Show details

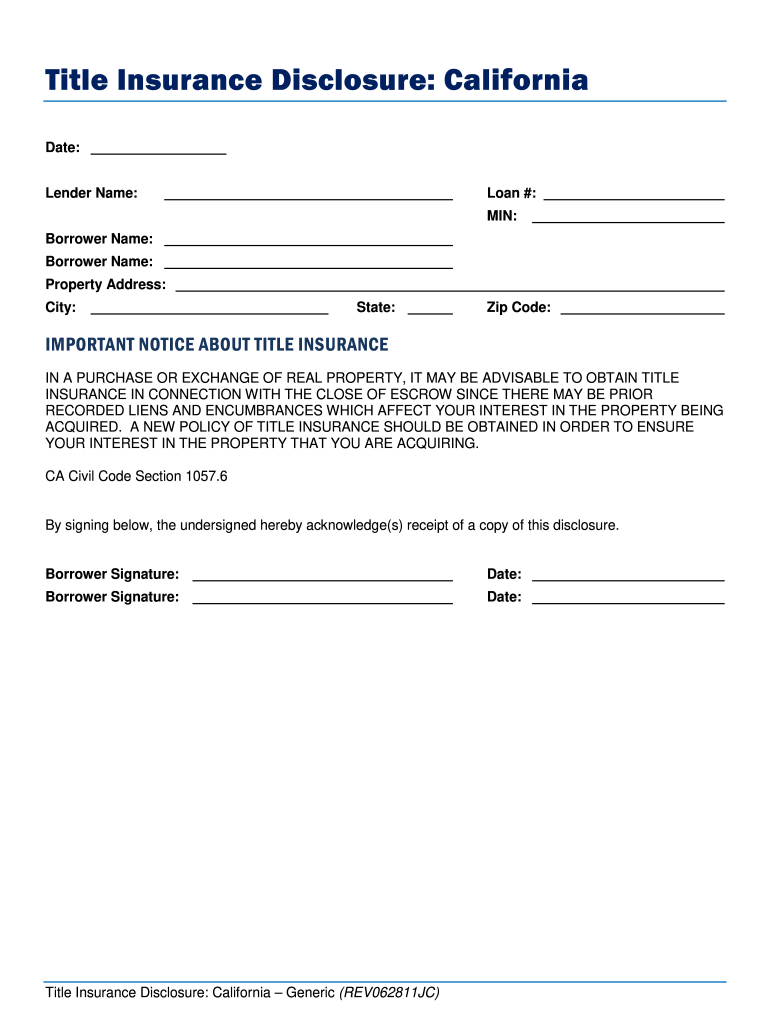

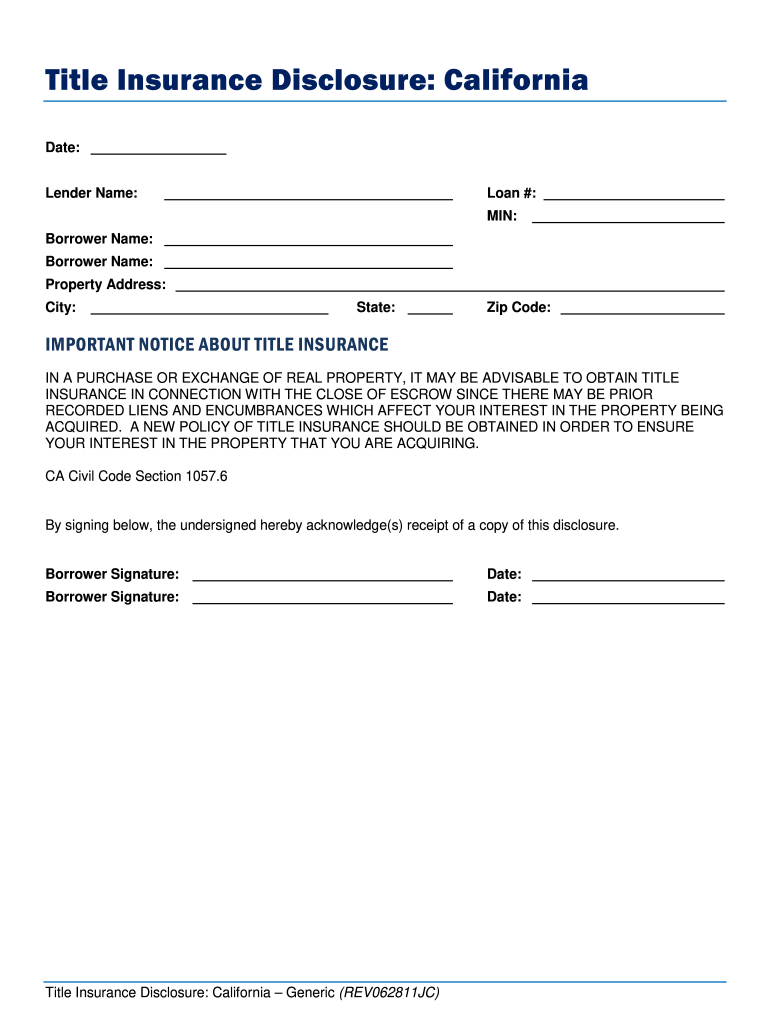

Title Insurance Disclosure: California Date: Lender Name: Loan #: MIN: Borrower Name: Borrower Name: Property Address: City: State: Zip Code: IMPORTANT NOTICE ABOUT TITLE INSURANCE IN A PURCHASE OR

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign california title insurance disclosure form get

Edit your california title insurance disclosure get form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your california title insurance disclosure form sample form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CA Title Insurance Disclosure online

To use the services of a skilled PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit CA Title Insurance Disclosure. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out CA Title Insurance Disclosure

How to fill out CA Title Insurance Disclosure

01

Obtain the CA Title Insurance Disclosure form from your title insurer or real estate agent.

02

Fill in the property address at the top of the form.

03

Provide the names of the parties involved in the transaction: buyer(s) and seller(s).

04

Indicate the date of the transaction.

05

Review the title insurance policy options and choose the appropriate coverage level.

06

Include any additional information required by your title insurer, such as special endorsements or exceptions.

07

Sign and date the form to confirm the information is accurate.

Who needs CA Title Insurance Disclosure?

01

Homebuyers purchasing property in California.

02

Sellers involved in a real estate transaction.

03

Real estate agents facilitating property sales.

04

Title insurers providing title insurance services.

Fill

form

: Try Risk Free

People Also Ask about

Is owner's title insurance required in California?

Lenders will require their own title insurance as a condition of your loan. A lender's policy insures that the lender's security interest in the property has priority over claims that others may have in your property. A lender's policy does not protect you.

What is California Standard policy of Title Insurance?

A standard policy insures primarily against defects in title which are discoverable through an examination of the public record. This includes defects in title or recorded liens or encumbrances, such as unpaid taxes or assessments, and defects due to lack of access to an open street.

What is the purpose of collecting a statement of Information from client?

A Statement of Information is filed to divulge your company's activities over the prior year. This information is often most important to shareholders or other parties that have an interest in your company.

What is a statement of Information used for in real estate?

Statements of Information provide title companies with the information they need to distinguish the buyers and sellers of real property from others with similar names.

What is a statement of Information for escrow?

The Statement of Information is a one-page document that asks for name, date of birth, social security number and current and previous addresses for both the buyer/borrower and seller.

What is the purpose of a statement of Information real estate?

Statements of Information provide title companies with the information they need to distinguish the buyers and sellers of real property from others with similar names.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my CA Title Insurance Disclosure in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your CA Title Insurance Disclosure and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I edit CA Title Insurance Disclosure in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your CA Title Insurance Disclosure, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I complete CA Title Insurance Disclosure on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your CA Title Insurance Disclosure. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is CA Title Insurance Disclosure?

CA Title Insurance Disclosure is a document that informs buyers and sellers about the costs and services associated with title insurance, ensuring transparency and understanding in real estate transactions in California.

Who is required to file CA Title Insurance Disclosure?

Real estate agents, title insurers, or any party involved in the sale of property in California are required to file the CA Title Insurance Disclosure as part of the transaction process.

How to fill out CA Title Insurance Disclosure?

To fill out the CA Title Insurance Disclosure, individuals must provide detailed information regarding the title insurance costs, services, and any affiliated business arrangements, following the guidelines outlined in the form.

What is the purpose of CA Title Insurance Disclosure?

The purpose of CA Title Insurance Disclosure is to ensure that all parties in a real estate transaction are fully aware of the title insurance fees and related services, helping them to make informed decisions.

What information must be reported on CA Title Insurance Disclosure?

The information that must be reported on CA Title Insurance Disclosure includes the estimated cost of title insurance, list of services provided, details of any affiliated business relationships, and the identity of the service providers.

Fill out your CA Title Insurance Disclosure online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA Title Insurance Disclosure is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.