IRS 1041 - Schedule I 2017 free printable template

Show details

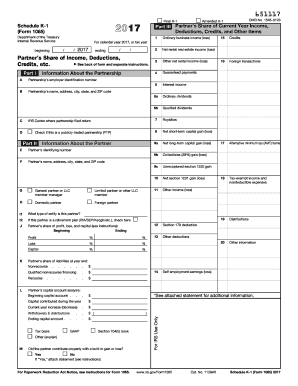

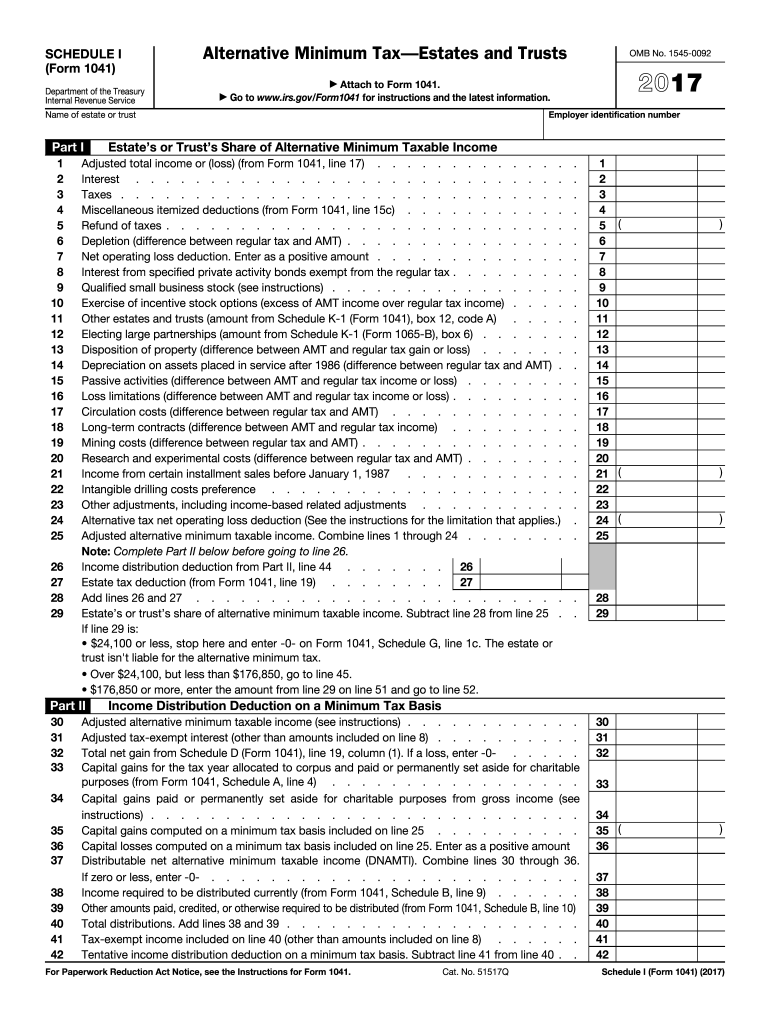

Cat. No. 51517Q Schedule I Form 1041 2017 Page 2 Enter here and on line 26. Exemption amount. Enter the amount from line 29. 25. Go to Part IV of Schedule I to figure line 52 if the estate or trust has qualified dividends or has gain on lines 18a and 19 of column 2 of Schedule D Form 1041 as refigured for the AMT necessary. SCHEDULE I Form 1041 Department of the Treasury Internal Revenue Service Alternative Minimum Tax Estates and Trusts Employer identification number Estate s or Trust s Share...of Alternative Minimum Taxable Income. Adjusted alternative minimum taxable income see instructions. Adjusted tax-exempt interest other than amounts included on line 8. Total net gain from Schedule D Form 1041 line 19 column 1. If a loss enter -0. Capital gains for the tax year allocated to corpus and paid or permanently set aside for charitable purposes from Form 1041 Schedule A line 4. Capital gains paid or permanently set aside for charitable purposes from gross income see instructions....Capital losses computed on a minimum tax basis included on line 25. Enter as a positive amount Distributable net alternative minimum taxable income DNAMTI. Combine lines 30 through 36. If zero or less enter -0-. Income required to be distributed currently from Form 1041 Schedule B line 9. Other amounts paid credited or otherwise required to be distributed from Form 1041 Schedule B line 10 Total distributions. Add lines 38 and 39. Tax-exempt income included on line 40 other than amounts included...on line 8. Tentative income distribution deduction on a minimum tax basis. Subtract line 41 from line 40. Adjusted total income or loss from Form 1041 line 17. Interest. Taxes. Miscellaneous itemized deductions from Form 1041 line 15c. Refund of taxes. Depletion difference between regular tax and AMT. Net operating loss deduction* Enter as a positive amount. Interest from specified private activity bonds exempt from the regular tax. Qualified small business stock see instructions. Exercise of...incentive stock options excess of AMT income over regular tax income. Other estates and trusts amount from Schedule K-1 Form 1041 box 12 code A. Electing large partnerships amount from Schedule K-1 Form 1065-B box 6. Disposition of property difference between AMT and regular tax gain or loss. Depreciation on assets placed in service after 1986 difference between regular tax and AMT. Passive activities difference between AMT and regular tax income or loss. Loss limitations difference between AMT...and regular tax income or loss. Circulation costs difference between regular tax and AMT. Long-term contracts difference between AMT and regular tax income. Mining costs difference between regular tax and AMT. Research and experimental costs difference between regular tax and AMT. Income from certain installment sales before January 1 1987. Intangible drilling costs preference. Other adjustments including income-based related adjustments. Alternative tax net operating loss deduction See the...instructions for the limitation that applies. Note Complete Part II below before going to line 26.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1041 - Schedule I

How to edit IRS 1041 - Schedule I

How to fill out IRS 1041 - Schedule I

Instructions and Help about IRS 1041 - Schedule I

How to edit IRS 1041 - Schedule I

To edit IRS 1041 - Schedule I, you can use pdfFiller's editing tools. Simply upload the form to your account, and utilize the text editing features to make necessary adjustments. Ensure that all information is accurate and complete before proceeding to the next steps.

How to fill out IRS 1041 - Schedule I

Filling out IRS 1041 - Schedule I requires you to first gather necessary information about the income, deductions, and credits related to the estate or trust. Follow these steps to accurately complete the form:

01

Obtain a copy of the IRS 1041 - Schedule I form from the IRS website or your pdfFiller account.

02

Enter the identifying information at the top of the form, including the estate or trust’s name, address, and Employer Identification Number (EIN).

03

Fill out the income sections, reporting all relevant income received by the estate or trust.

04

Complete the deductions section by listing qualifying expenses that can be deducted.

05

Review the completed form for accuracy and completeness before submission.

About IRS 1041 - Schedule I 2017 previous version

What is IRS 1041 - Schedule I?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1041 - Schedule I 2017 previous version

What is IRS 1041 - Schedule I?

IRS 1041 - Schedule I is a tax form used by estates and trusts to report income, deductions, and credits. It provides the IRS with detailed information about the income generated by an estate or trust, allowing for accurate tax reporting and compliance.

What is the purpose of this form?

The purpose of IRS 1041 - Schedule I is to report the income received and the expenses incurred by an estate or a trust during the tax year. This form helps determine the overall tax liability of the estate or trust and ensures compliance with federal tax laws.

Who needs the form?

Estates and trusts that generate income, meet certain thresholds, or distribute income to beneficiaries need to file IRS 1041 - Schedule I. This includes anyone managing a trust or estate that must report its earnings to the IRS.

When am I exempt from filling out this form?

You may be exempt from filing IRS 1041 - Schedule I if the estate or trust has no taxable income or if the amount is below the filing threshold set by the IRS. Additionally, certain small estates may qualify for an exemption based on specific criteria.

Components of the form

The components of IRS 1041 - Schedule I include sections for reporting total income, identifying various income sources, and listing eligible deductions. Each section must be filled out carefully to reflect the true financial state of the estate or trust.

What are the penalties for not issuing the form?

Failure to file IRS 1041 - Schedule I when required can result in penalties imposed by the IRS. These can include fines based on the time the form is late, as well as potential interest charges on any taxes owed. Ensuring timely and accurate filing helps avoid such penalties.

What information do you need when you file the form?

When filing IRS 1041 - Schedule I, you will need the estate or trust's EIN, details on income received, and records of deductions. Accurate financial records, including bank statements and documentation of expenses, will assist in completing the form effectively.

Is the form accompanied by other forms?

IRS 1041 - Schedule I is typically filed along with Form 1041, the U.S. Income Tax Return for Estates and Trusts. Additional forms may be required depending on the income sources and deductions being reported.

Where do I send the form?

The completed IRS 1041 - Schedule I must be sent to the address designated for estates and trusts on the IRS website's instructions. This varies based on the location and whether you are submitting by mail or electronically.

See what our users say