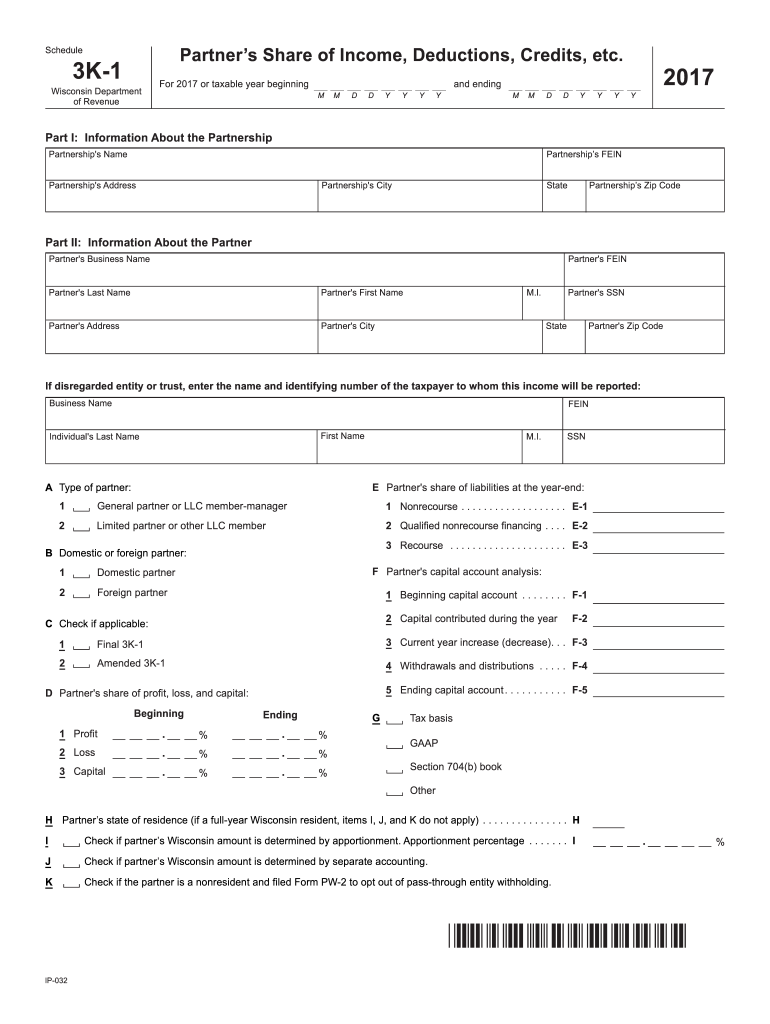

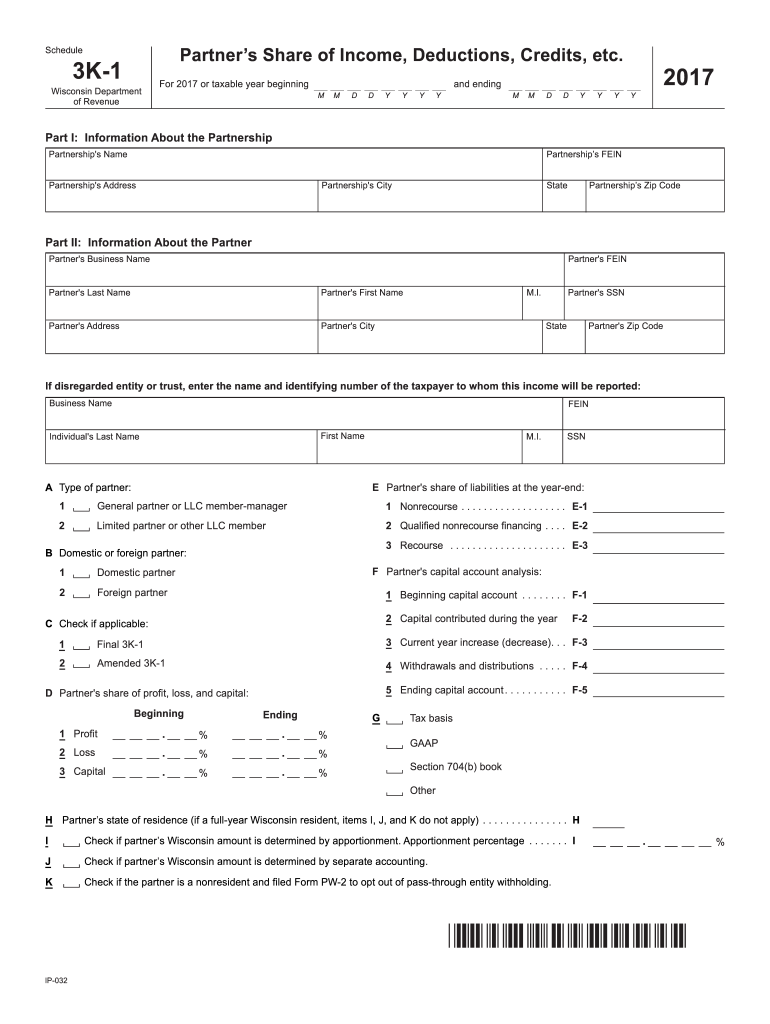

WI DoR Schedule 3K-1 2017 free printable template

Show details

F-3 Amended 3K-1 4 Withdrawals and distributions. F-4 5 Ending capital account. F-5 Beginning Ending G 1 Profit. 2 Loss 3 Capital Tax basis GAAP Section 704 b book Other H Partner s state of residence if a full-year Wisconsin resident items I J and K do not apply. 22 23 Gross income before deducting expenses from all activities. 23 Wisconsin Indicate factor used First factor Second factor Third factor Total company Part V Schedule 3K-1 - Partner s Share of Additions and Subtractions...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign WI DoR Schedule 3K-1

Edit your WI DoR Schedule 3K-1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your WI DoR Schedule 3K-1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing WI DoR Schedule 3K-1 online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit WI DoR Schedule 3K-1. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WI DoR Schedule 3K-1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out WI DoR Schedule 3K-1

How to fill out WI DoR Schedule 3K-1

01

Obtain the WI DoR Schedule 3K-1 form from the Wisconsin Department of Revenue website or your tax preparation software.

02

Enter the name of the partnership at the top of the form.

03

Provide the partnership's taxpayer identification number (TIN).

04

Fill in your name and address as a partner in the partnership.

05

Indicate your share of partnership income, loss, deductions, and credits for the tax year.

06

Report any guaranteed payments you received during the year.

07

Calculate your distributive share of items such as ordinary income, capital gains, and credits.

08

Review the form for accuracy and completeness before submitting it with your tax return.

Who needs WI DoR Schedule 3K-1?

01

Individuals who are partners in a partnership operating in Wisconsin.

02

Partners receiving income, loss, or credits from partnerships that file Schedule 3K-1.

Instructions and Help about WI DoR Schedule 3K-1

Fill

form

: Try Risk Free

People Also Ask about

What is the payroll tax in Wisconsin?

If you're a new employer, you will pay 3.05% if your payroll is less than $500,000 and 3.25% if your payroll is above $500,000. If you're a new employer in the construction industry, you'll pay 2.90% if your payroll is less than $500,000, and 3.10% if your payroll is above $500,000.

What is a 3K-1 form in Wisconsin?

Schedule 3K-1 shows each partner's share of the partnership's income, deductions, credits, etc., which have been sum- marized on Schedule 3K. Like Schedule 3K, Schedule 3K-1 requires an entry for the federal amount, adjustment, and amount determined under Wisconsin law of each applicable item.

What is a Schedule 3K-1 in Massachusetts?

Schedule 3K-1 is designed to allow the partner- ship to report each partner's distributive share of partnership income. A separate Schedule 3K-1 is required for each partner.

What is the minimum income to file taxes in Wisconsin?

You are required to file a Wisconsin income tax return if your Wisconsin gross income is $2,000 or more. Gross income means income before deducting expenses. While net income reported to you may be less than $2,000, gross income may be over that amount, requiring that a Wisconsin income tax return be filed.

What is the capital gains tax in Wisconsin?

The capital gains tax rate reaches 8.75%. Wisconsin taxes capital gains as income. Long-term capital gains can apply a deduction of 30% (or 60% for capital gains from the sale of farm assets). The capital gains tax rate reaches 7.65%.

What is Schedule I for Wisconsin?

Make the election using Wisconsin Schedule I, Adjustments to Convert 2021 Federal Adjusted Gross Income and Itemized Deductions to the Amounts Allowable for Wisconsin. Example: For federal tax purposes you claim the credit under sec. 45E of the IRC for 50 percent of the startup costs of a small employer pension plan.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit WI DoR Schedule 3K-1 from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including WI DoR Schedule 3K-1, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I make edits in WI DoR Schedule 3K-1 without leaving Chrome?

WI DoR Schedule 3K-1 can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I create an electronic signature for the WI DoR Schedule 3K-1 in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your WI DoR Schedule 3K-1 in minutes.

What is WI DoR Schedule 3K-1?

WI DoR Schedule 3K-1 is a tax form used in Wisconsin to report income, deductions, and credits that are passed through to partners in a partnership or shareholders in an S corporation.

Who is required to file WI DoR Schedule 3K-1?

Partnerships and S corporations doing business in Wisconsin are required to file WI DoR Schedule 3K-1 to report the income and deductions allocated to their partners or shareholders.

How to fill out WI DoR Schedule 3K-1?

To fill out WI DoR Schedule 3K-1, you need to enter the entity's name, Employer Identification Number (EIN), and provide the individual partner or shareholder's information, including their share of income, deductions, and credits based on the entity's operations.

What is the purpose of WI DoR Schedule 3K-1?

The purpose of WI DoR Schedule 3K-1 is to assist in the accurate reporting of income, deductions, and credits from partnerships and S corporations to ensure partners and shareholders can report their respective shares on their personal tax returns.

What information must be reported on WI DoR Schedule 3K-1?

The information that must be reported on WI DoR Schedule 3K-1 includes the partner's or shareholder's name, address, federal identification number, their share of the entity's income, losses, deductions, and any credits associated with their investment in the entity.

Fill out your WI DoR Schedule 3K-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

WI DoR Schedule 3k-1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.