WI DoR Schedule 3K-1 2018 free printable template

Show details

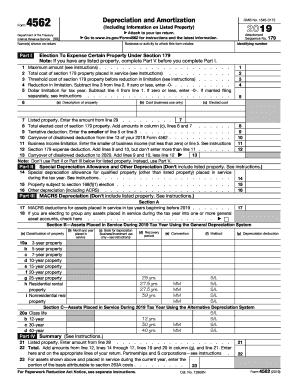

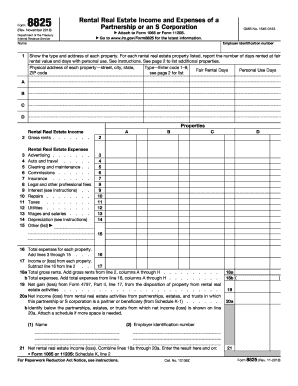

F-3 Amended 3K-1 Include Schedule AR 4 Withdrawals and distributions. F-4 5 Ending capital account. F-5 Beginning Ending G 1 Profit. 2 Loss 3 Capital Tax basis GAAP Section 704 b book Other H Partner s state of residence if a full-year Wisconsin resident items I J and K do not apply. 21b 22 Income loss. 22 23 Gross income before deducting expenses from all activities. 23 Wisconsin Indicate factor used First factor Second factor Third factor Total company Part V Schedule 3K-1 - Partner s...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign WI DoR Schedule 3K-1

Edit your WI DoR Schedule 3K-1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your WI DoR Schedule 3K-1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit WI DoR Schedule 3K-1 online

To use the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit WI DoR Schedule 3K-1. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WI DoR Schedule 3K-1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out WI DoR Schedule 3K-1

How to fill out WI DoR Schedule 3K-1

01

Obtain a copy of the WI DoR Schedule 3K-1 form.

02

Fill in the entity's name, address, and FEIN (Federal Employer Identification Number) at the top of the form.

03

List the income, deductions, and credits of the entity as instructed in the form.

04

Distribute the amount of income or loss to the partners or shareholders based on their ownership percentages.

05

Complete any additional information required for each partner or shareholder, such as their names and addresses.

06

Review the completed form for accuracy and ensure all calculations are correct.

07

Submit the form along with the entity's tax return to the Wisconsin Department of Revenue.

Who needs WI DoR Schedule 3K-1?

01

Any partnership or entity doing business in Wisconsin that is required to report income or loss to its partners or shareholders.

02

Partners and shareholders of a partnership or entity who receive a Schedule 3K-1 for reporting their share of income on their individual tax returns.

Instructions and Help about WI DoR Schedule 3K-1

Fill

form

: Try Risk Free

People Also Ask about

Does Wisconsin require a state tax return?

You are required to file a Wisconsin income tax return if your Wisconsin gross income is $2,000 or more. Gross income means income before deducting expenses. While net income reported to you may be less than $2,000, gross income may be over that amount, requiring that a Wisconsin income tax return be filed.

Does Wisconsin require a copy of federal tax return?

You will need an electronic copy of your complete federal income tax return and any other attachments. If you used software to file your federal income tax return, you should have had the option to save it in an electronic format.

Do you have to send a copy of your federal tax return with your state return in California?

California Franchise Tax Board requires the federal return to be attached to the California return as follows: Form 540: Federal return is required if federal return includes supporting forms or schedules other than Schedule A or Schedule B. Form 540NR: Federal return is required for all Form 540NR returns.

What is the sales and use tax in Wisconsin?

In Wisconsin, the state sales and use tax is 5% on the purchase price of taxable retail sales. In addition, counties may impose local sales and use tax of up to 0.5% on the purchase price. As discussed below, in limited circumstances other taxes may apply (such as "room" tax and stadium district tax).

What is a 3K-1 form in Wisconsin?

Schedule 3K-1 shows each partner's share of the partnership's income, deductions, credits, etc., which have been sum- marized on Schedule 3K. Like Schedule 3K, Schedule 3K-1 requires an entry for the federal amount, adjustment, and amount determined under Wisconsin law of each applicable item.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the WI DoR Schedule 3K-1 in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your WI DoR Schedule 3K-1 right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How can I fill out WI DoR Schedule 3K-1 on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your WI DoR Schedule 3K-1. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

How do I edit WI DoR Schedule 3K-1 on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share WI DoR Schedule 3K-1 on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is WI DoR Schedule 3K-1?

WI DoR Schedule 3K-1 is a tax form used in Wisconsin to report pass-through entity income, which is distributed to partners or shareholders.

Who is required to file WI DoR Schedule 3K-1?

Partnerships, LLCs treated as partnerships for tax purposes, and S corporations that have Wisconsin-resident partners or shareholders are required to file WI DoR Schedule 3K-1.

How to fill out WI DoR Schedule 3K-1?

To fill out WI DoR Schedule 3K-1, provide details on the entity's income, deductions, credits, and each partner or shareholder's share of these amounts, along with their identifying information.

What is the purpose of WI DoR Schedule 3K-1?

The purpose of WI DoR Schedule 3K-1 is to provide the state of Wisconsin with necessary information regarding income earned by partnerships and S corporations so that it can allocate taxes appropriately.

What information must be reported on WI DoR Schedule 3K-1?

The information reported on WI DoR Schedule 3K-1 includes income, deductions, credits, and the individual share of each partner or shareholder in these amounts.

Fill out your WI DoR Schedule 3K-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

WI DoR Schedule 3k-1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.