Get the free MARYLAND FORM 502 RESIDENT INCOME TAX RETURN 2017

Show details

502B. 2017. Dependents' Information. (Attach to Form 502, 505 or 515.) COM/

RAD-026. First Name. Initial. Last Name. Social Security Number. Relationship.

We are not affiliated with any brand or entity on this form

Instructions and Help about maryland form 502 resident

How to edit maryland form 502 resident

How to fill out maryland form 502 resident

Instructions and Help about maryland form 502 resident

How to edit maryland form 502 resident

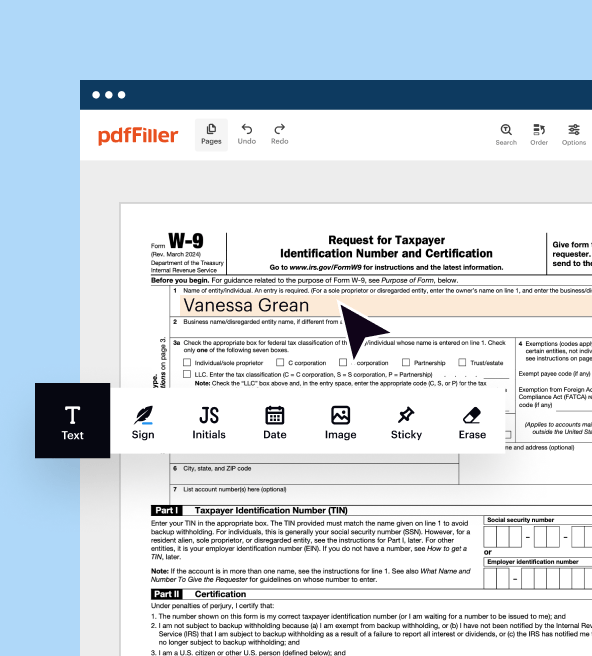

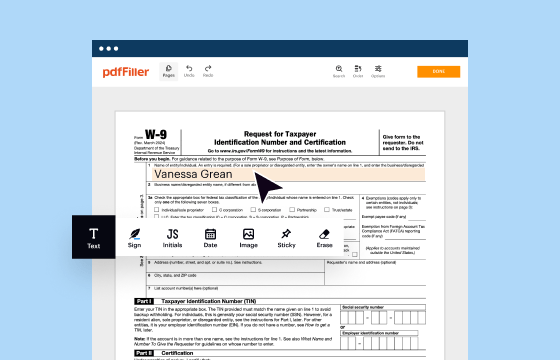

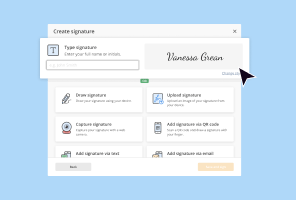

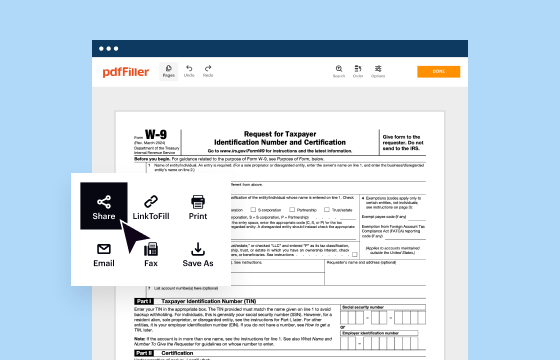

To edit the Maryland Form 502 Resident, ensure you have the most current version of the form. You can use pdfFiller to easily edit the form, allowing you to fill in or correct any details before submission. Simply upload the downloaded form to pdfFiller, and use the editing tools to input your information accurately.

How to fill out maryland form 502 resident

Filling out the Maryland Form 502 Resident requires attention to detail. First, gather all relevant financial documents such as W-2s, 1099s, and other income statements. Use the following steps:

01

Start by entering your name and address at the top of the form.

02

Provide your Social Security number in the designated area.

03

Fill out your income information as instructed, ensuring you report all sources of income.

04

Complete the deductions section, utilizing any applicable credits to reduce your taxable income.

05

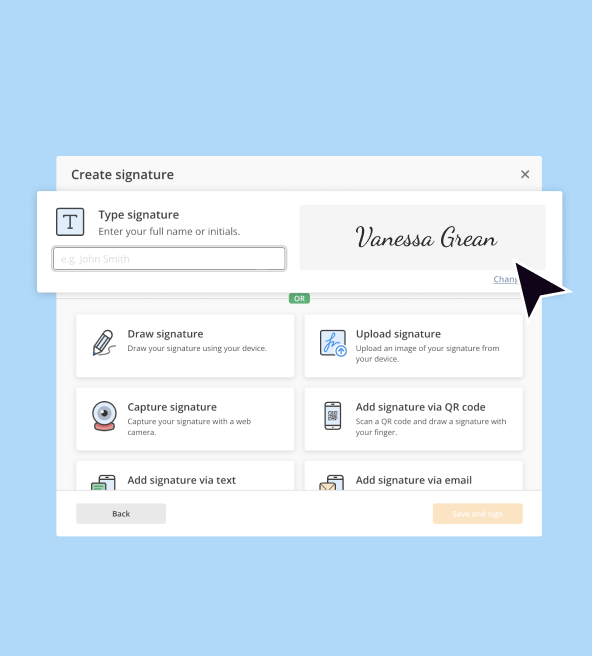

Sign and date the form at the end before submission.

Latest updates to maryland form 502 resident

Latest updates to maryland form 502 resident

Check the Maryland Comptroller's website for the latest updates to the Form 502 Resident, including any revisions in tax rates or changes in allowable deductions that may affect your filing. Regular updates ensure compliance with current tax laws and regulations.

All You Need to Know About maryland form 502 resident

What is maryland form 502 resident?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About maryland form 502 resident

What is maryland form 502 resident?

The Maryland Form 502 Resident is the state's individual income tax return for residents. This form is used to report income and calculate the taxes owed to the state of Maryland. Filing this form is mandatory for all residents who earn taxable income within the state.

What is the purpose of this form?

The purpose of the Maryland Form 502 Resident is to assess and collect state income taxes. By filing this form, taxpayers report their income, claims deductions, and determine their overall tax liability to the state. Accurate reporting is critical for ensuring compliance with Maryland tax laws.

Who needs the form?

Residents of Maryland must file Form 502 if they have earned income that exceeds the minimum filing thresholds set by the state. This includes income from wages, self-employment, and other taxable sources. Individuals who meet these criteria must complete and submit the form annually.

When am I exempt from filling out this form?

Exemptions from filing the Maryland Form 502 Resident include individuals whose income is below the filing threshold or those who have no Maryland source income. Certain non-residents and specific categories of income may also qualify for exemptions. Always verify current regulations to determine eligibility for exemption.

Components of the form

Key components of the Maryland Form 502 Resident include personal information (name, address, Social Security number), income details (wages, interest, dividends), deductions (standard or itemized), and credits. Each section must be completed accurately to ensure proper tax assessment.

What are the penalties for not issuing the form?

Failing to file the Maryland Form 502 Resident may result in penalties, including fines or interest on any taxes owed. The state may also impose additional penalties for late filing. It's crucial to submit the form by the due date to avoid these financial repercussions.

What information do you need when you file the form?

When filing the Maryland Form 502 Resident, you need your personal identification information, details about all sources of income, deductions, and any applicable tax credits. It is also essential to have copies of supporting documents, such as W-2s and 1099s, to substantiate your claims.

Is the form accompanied by other forms?

Maryland Form 502 Resident may need to be accompanied by additional supporting documents, such as Form 502CR for claiming credits and any necessary schedules for specific income types or deductions. Check the requirements based on your financial situation.

Where do I send the form?

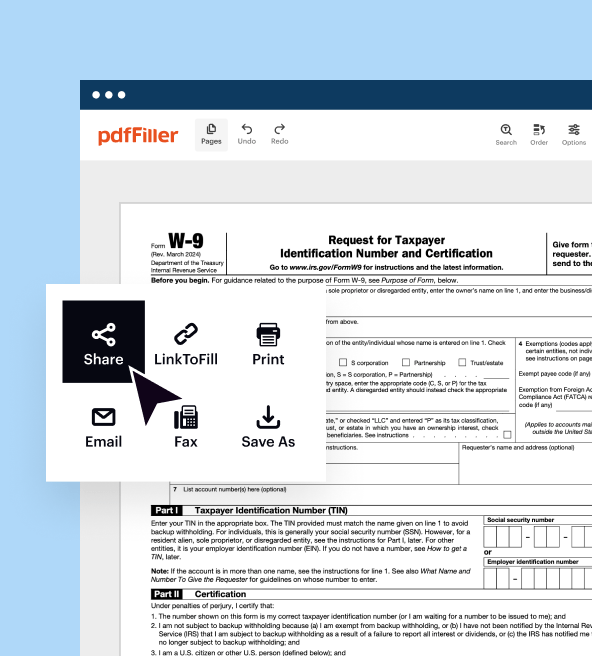

After completing the Maryland Form 502 Resident, send it to the appropriate address indicated in the instructions, based on your county of residence. Ensure to check for the correct department to avoid delays in processing your return.

See what our users say