IRS 8821 2018 free printable template

Show details

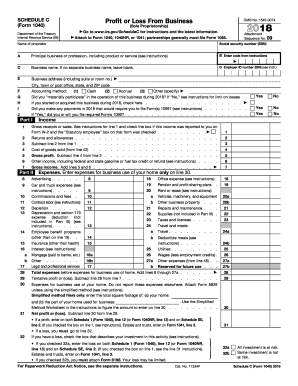

Form Go Tax Information Authorization OMB No. 1545-1165 For IRS Use Only to www.irs.gov/Form8821 for instructions and the latest information. Received by Don t Rev. January 2018 Department of the Treasury Internal Revenue Service sign this form unless all applicable lines have been completed. Don t use Form 8821 to request copies of your tax returns or to authorize someone to represent you. Name Telephone Function Date 1 Taxpayer information* Taxpayer must sign and date this form on line 7....Taxpayer name and address Taxpayer identification number s Daytime telephone number Plan number if applicable 2 Appointee. If you wish to name more than one appointee attach a list to this form* Check here if a list of additional appointees is attached CAF No* Name and address PTIN Fax No* Check if new Address periods and specific matters you list below. See the line 3 instructions. By checking here I authorize access to my IRS records via an Intermediate Service Provider. a Type of Tax...Information Income Employment Payroll Excise Estate Gift Civil Penalty Sec* 4980H Payments etc* b Tax Form Number 1040 941 720 etc* c Year s or Period s d Specific Tax Matters 4 Specific use not recorded on Centralized Authorization File CAF. If the tax information authorization is for a specific use not recorded on CAF check this box. See the instructions. If you check this box skip lines 5 and 6. 5 Disclosure of tax information you must check a box on line 5a or 5b unless the box on line 4 is...checked a If you want copies of tax information notices and other written communications sent to the appointee on an ongoing basis check this box. Note. Appointees will no longer receive forms publications and other related materials with the notices. b If you don t want any copies of notices or communications sent to your appointee check this box. 6 Retention/revocation of prior tax information authorizations. If the line 4 box is checked skip this line. If the line 4 box isn t checked the IRS...will automatically revoke all prior Tax Information Authorizations on file unless you check the line 6 box and attach a copy of the Tax Information Authorization s that you want to retain*. To revoke a prior tax information authorization s without submitting a new authorization see the line 6 instructions. 7 Signature of taxpayer. If signed by a corporate officer partner guardian partnership representative executor receiver administrator trustee or party other than the taxpayer I certify that I...have the authority to execute this form with respect to the tax matters and tax periods shown on line 3 above. IF NOT COMPLETE SIGNED AND DATED THIS TAX INFORMATION AUTHORIZATION WILL BE RETURNED. DON T SIGN THIS FORM IF IT IS BLANK OR INCOMPLETE* Signature Print Name For Privacy Act and Paperwork Reduction Act Notice see instructions. Name Telephone Function Date 1 Taxpayer information* Taxpayer must sign and date this form on line 7. Taxpayer name and address Taxpayer identification number s...Daytime telephone number Plan number if applicable 2 Appointee.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 8821

How to edit IRS 8821

How to fill out IRS 8821

Instructions and Help about IRS 8821

How to edit IRS 8821

To edit the IRS 8821 form, utilize pdfFiller’s document editing tools, which allow you to make changes easily. Upload your existing IRS 8821 form to the platform, select the text or fields you wish to adjust, and make your edits. Once completed, save and download the updated version for your records or submission.

How to fill out IRS 8821

To fill out IRS 8821, follow these steps:

01

Begin by providing your personal information in the designated fields, including your name, address, and Social Security number.

02

Next, enter the name and address of the party you are authorizing to receive your tax information.

03

Specify the types of tax returns the authorized representative can access.

04

Sign and date the form to validate your authorization.

About IRS 8 previous version

What is IRS 8821?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 8 previous version

What is IRS 8821?

IRS 8821 is the "Tax Information Authorization" form. This document allows individuals to designate another party to receive confidential tax information from the IRS. By filling out this form, taxpayers can ensure their chosen representative has the authority to access certain tax details without transferring full power of attorney.

What is the purpose of this form?

The purpose of IRS 8821 is to authorize transparency in tax-related matters between the taxpayer and the designated representative. This enables the authorized person to handle inquiries, discuss tax returns, or retrieve tax documents without needing the taxpayer present. It streamlines communication with the IRS, especially during audits or other tax-related situations.

Who needs the form?

Individuals who require assistance managing their tax issues, such as those undergoing audits or seeking advice on tax matters, should consider completing IRS 8821. This form is also beneficial for representatives managing the tax affairs of clients or individuals who need someone to discuss their tax issues.

When am I exempt from filling out this form?

You may be exempt from filling out IRS 8821 if your tax matters do not require the involvement of a third party, or if you are using a different method of authorization, such as a power of attorney. In some cases, if you are communicating directly with the IRS regarding your taxes without needing a representative, the form is unnecessary.

Components of the form

The IRS 8821 form consists of several key components including taxpayer identification details, information about the representative, the scope of the authorization, and the taxpayer's signature. Each section must be filled accurately to ensure proper authorization and processing by the IRS.

What are the penalties for not issuing the form?

Failure to issue IRS 8821 when necessary can result in delays in communication and resolution of tax issues with the IRS. Although there are no direct financial penalties for not submitting the form, lacking authorization can complicate your interactions and could hinder your representative's ability to assist you effectively.

What information do you need when you file the form?

When filing IRS 8821, you need to provide your full name, address, Social Security number or Employer Identification Number, along with similar identifying information for the designated representative. Additionally, specify the types of tax returns and the years of returns you wish to authorize access to.

Is the form accompanied by other forms?

IRS 8821 is typically a standalone form and does not require accompanying forms for it to be valid. However, depend on the tax situation; additional documentation may be necessary when addressing specific tax issues or when additional authorizations are required.

Where do I send the form?

To submit IRS 8821, mail the completed form to the address specified on the instructions of the form based on your state of residence. Ensure that you check the latest IRS directives regarding submission as this information may vary over time.

See what our users say