MD Comptroller 502 2017 free printable template

Show details

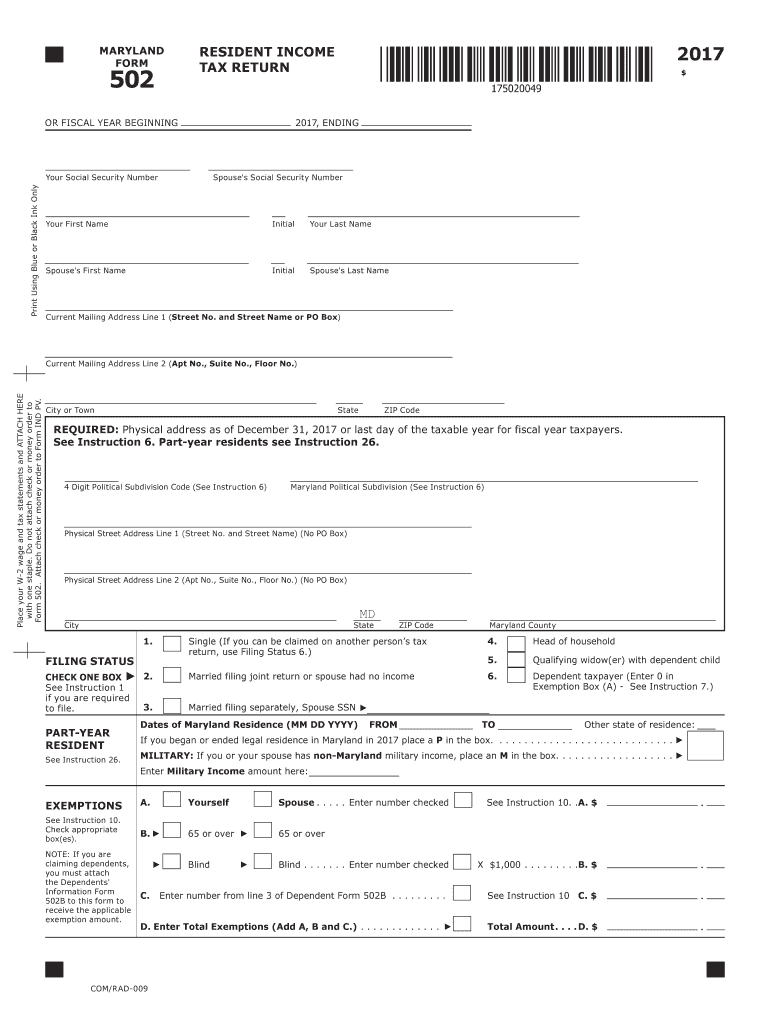

Do not attach check or money order to Form 502. Attach check or money order to Form IND PV. City or Town State ZIP Code REQUIRED Physical address as of December 31 2017 or last day of the taxable year for fiscal year taxpayers. See Instruction 6. Part-year residents see Instruction 26. 4 Digit Political Subdivision Code See Instruction 6 Maryland Political Subdivision See Instruction 6 Physical Street Address Line 1 Street No. and Street Name No PO Box MD City Maryland County Single If you can...be claimed on another person s tax return use Filing Status 6. MARYLAND FORM OR FISCAL YEAR BEGINNING 2017 ENDING Your Social Security Number Print Using Blue or Black Ink Only RESIDENT INCOME TAX RETURN Spouse s Social Security Number Your First Name Initial Your Last Name Spouse s First Name Spouse s Last Name Current Mailing Address Line 1 Street No. and Street Name or PO Box Place your W-2 wage and tax statements and ATTACH HERE with one staple. Do not attach check or money order to Form...502. Attach check or money order to Form IND PV. City or Town State ZIP Code REQUIRED Physical address as of December 31 2017 or last day of the taxable year for fiscal year taxpayers. Do not attach Form IND PV or check/money order to Form 502. Place Form IND PV with attached check/ money order on TOP of Form 502 and mail to Payment Processing PO Box 8888. 19. 20. Taxable net income Subtract line 19 from line 18. 20. 21. Maryland tax from Tax Table or Computation Worksheet Schedules I or II. 21....TAX 23. Poverty level credit See Instruction 18. COMPUTATION 24. Other income tax credits for individuals from Part K line 11 of Form 502CR Attach Form 502CR.. COM/RAD-009 NAME Page 2 SSN INCOME 1. Adjusted gross income from your federal return.. 1b. 1c. 1d. Taxable Pension IRA Annuities Attach Form 502R.. ADDITIONS 1b. Earned income. 1a. 1c. Capital Gain or loss. 1a. Wages salaries and/or tips. 1d. 1e. Place a Y in this box if the amount of your investment income is more than 3 450. 2....Tax-exempt interest on state and local obligations bonds other than Maryland. 3. State retirement pickup.. If less than 0 enter 0. 33. 34. Total Maryland and local tax Add lines 27 and 33. 34. 35. Contribution to Chesapeake Bay and Endangered Species Fund See Instruction 20. Page 3 if MD tax is withheld and attach. 41. 2017 estimated tax payments amount applied from 2016 return payment made with an extension request and Form MW506NRS. 42. Refundable earned income credit from worksheet in...Instruction 21. 43. Refundable income tax credits from Part M line 6 of Form 502CR 44. See Instruction 6. Part-year residents see Instruction 26. 4 Digit Political Subdivision Code See Instruction 6 Maryland Political Subdivision See Instruction 6 Physical Street Address Line 1 Street No* and Street Name No PO Box MD City Maryland County Single If you can be claimed on another person s tax return use Filing Status 6. Head of household Qualifying widow er with dependent child Married filing joint...return or spouse had no income Dependent taxpayer Enter 0 in Exemption Box A - See Instruction 7.

pdfFiller is not affiliated with any government organization

Instructions and Help about MD Comptroller 502

How to edit MD Comptroller 502

How to fill out MD Comptroller 502

Instructions and Help about MD Comptroller 502

How to edit MD Comptroller 502

To edit the MD Comptroller 502 form, access a copy of the form in pdf format. Use pdfFiller’s editing tools to make necessary adjustments to fields such as payee details or financial amounts. Save your changes to maintain an accurate record of the edits made for compliance purposes.

How to fill out MD Comptroller 502

Filling out the MD Comptroller 502 form involves several steps. First, gather all necessary information related to your tax payments. Next, complete sections of the form including the payer's and payee's personal and financial information accurately. Finally, review the form for errors before submission.

About MD Comptroller previous version

What is MD Comptroller 502?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About MD Comptroller previous version

What is MD Comptroller 502?

The MD Comptroller 502 form is a tax document used in Maryland for reporting various payments made to service providers. This form is essential for tax compliance and accurate financial reporting to the state. By completing this form, payers ensure that their tax obligations are met correctly.

What is the purpose of this form?

The purpose of the MD Comptroller 502 is to report specific payments made to individuals or businesses in Maryland. This form helps the state monitor tax liabilities of service providers. Additionally, it aids in facilitating proper withholding tax collection from payments made to these entities.

Who needs the form?

Any business or individual that makes reportable payments to service providers in Maryland is required to use the MD Comptroller 502 form. This typically includes employers, corporations, and certain entities that hire independent contractors or other service providers. If you are making payments that fall under these categories, you will need to fill out this form.

When am I exempt from filling out this form?

Exemptions from filling out the MD Comptroller 502 form apply in certain situations. For example, if payments are made to corporations in most cases, they may not require reporting on this form. Additionally, payments that do not meet the threshold amount set by the Comptroller's office for reporting purposes are also exempt.

Components of the form

The MD Comptroller 502 consists of several components. Key sections include payer information, payee information, payment details, and a section for totals. Understanding each component is essential for accurate reporting and compliance with state tax regulations.

What are the penalties for not issuing the form?

Failure to file the MD Comptroller 502 form when required can result in penalties. The Maryland Comptroller’s office may impose fines for noncompliance, which can increase over time if the form remains unfiled. It's crucial to meet filing obligations to avoid any unnecessary financial consequences.

What information do you need when you file the form?

When filing the MD Comptroller 502 form, you need specific information including the payer’s and payee’s names, addresses, and taxpayer identification numbers. You should also include detailed payment information such as the amounts paid and the dates of payment. Having all relevant data at hand ensures a smooth filing process.

Is the form accompanied by other forms?

The MD Comptroller 502 form may need to be submitted alongside other tax forms depending on your specific circumstances. For example, if you are also reporting employee wages, you may need to include accompanying forms like the W-2. Verify requirements to determine if additional documentation is necessary.

Where do I send the form?

The MD Comptroller 502 form must be sent to the Maryland Comptroller's office. Specifically, it should be mailed to the designated address for the filing year. Double-check the current mailing address on the Maryland Comptroller's official website to ensure your form reaches the appropriate department.

See what our users say