DC D-40EZ & D-40 2017 free printable template

Show details

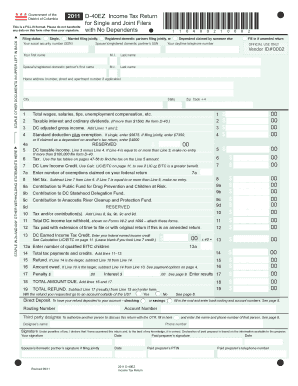

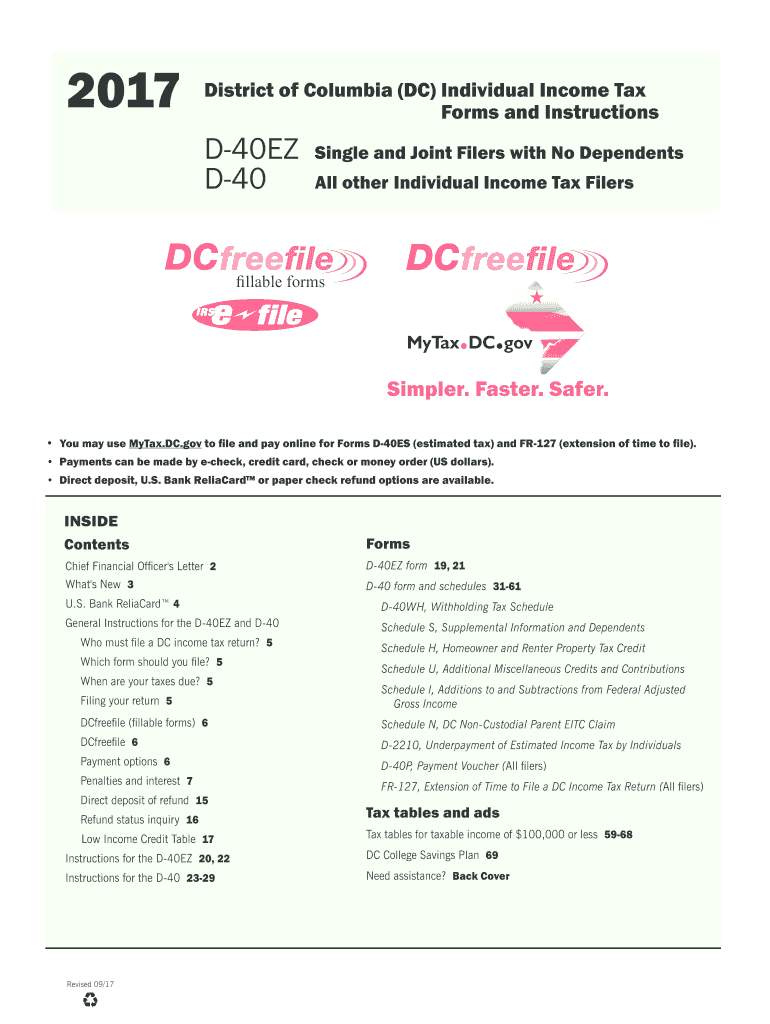

Attach all copies of your Forms W-2 and 1099 that show DC tax withheld to Forms D-40 or D-40EZ and submit Form D-40WH with Forms D-40 or D-40EZ. Staple your payment to the D-40P voucher. Do not attach your payment to your D-40 or D-40EZ return. Mail the D-40P with but not attached to your D-40 or D-40EZ tax return in the envelope provided in this tax booklet. Do not staple the voucher to the D-40 or D-40EZ. Include the D-40P with your D-40 or D-40EZ in the return envelope provided. Use the PO...Box 96169 mail label from the back flap of the return envelope. Please enter the number of qualified EITC dependents on Line 13a of the D-40EZ or Line 27a of the D-40. Filing Jointly D-40 and D-40EZ 2017 and you did not remarry/register in 2017. If legally separated do not file jointly. If you want your refund deposited directly in your bank account complete the Direct Deposit Information on the D-40 or D-40EZ. You must file a D-40 form to use this exception. Complete Schedule N DC Non-Custodial...Parent EITC Claim and attach to the D-40. Registered domestic partners D-40 and D-40EZ cents to the nearest dollar. x 5 7 2 0 4. 00 R O B E R T S Fill in ovals completely. Faster. Safer. You may use MyTax. DC. gov to file and pay online for Forms D-40ES estimated tax and FR-127 extension of time to file. Payments can be made by e-check credit card check or money order US dollars. Direct deposit U*S* Bank ReliaCard or paper check refund options are available. The Office of Tax and Revenue OTR...offers two convenient and easy options for you to file your Individual Income Tax return 1. As a result some tax returns and associated refunds may experience longer processing times. OTR is committed to providing the right refund to the right person as quickly as possible but for some selected returns the processing window could be up to 25 days. In these cases we ask for your patience. MyTax. DC. gov your refund provide substantiating documentation or to communicate with a customer service...representative. The portal is also accessible via mobile devices and tablets and provides the option to go paperless. By opting to go paperless you will receive correspondence from OTR quicker than by mail and have 24/7 access to all correspondence stored electronically within receive an email notification alerting you when a new notice is available to view in your To learn more visit MyTax. DC. gov OTR s Walk-In Center at 1101 4th Street SW Suite W270 from 8 15am to 5 30pm Monday through Friday...or call 202 727-4TAX 4829. John A. Wilson Building 1350 Pennsylvania Avenue NW Suite 203 Washington DC 20004 Phone 202 727-2476 Fax 202 727-1643 www. cfo. dc*gov New for 2017 Income Tax Returns Filing Deadline For Tax Year 2017 the filing deadline will be Tuesday April 17 2018. New Prepaid Debit Card Pre-Acquisition Disclosures The Consumer Financial Protection Board CFPB has published its final Prepaid Account Rule creating detailed consumer protections for prepaid accounts. For tax year 2017...if you elect to receive a refund using the U*S* Bank ReliaCard or use a pre-paid card to make payments you are required to review and acknowledge the Pre-Acquisition Disclosures Short and Long Forms prior to selecting the ReliaCard option as method for receiving a refund or using a pre-paid card when making a payment.

pdfFiller is not affiliated with any government organization

Instructions and Help about DC D-40EZ D-40

How to edit DC D-40EZ D-40

How to fill out DC D-40EZ D-40

Instructions and Help about DC D-40EZ D-40

How to edit DC D-40EZ D-40

You can edit the DC D-40EZ D-40 Tax Form using pdfFiller’s intuitive tools. Start by uploading the form to the platform. Once uploaded, you can click on the fields to enter or modify information easily. After making necessary changes, be sure to save your updates before downloading or submitting.

How to fill out DC D-40EZ D-40

To correctly fill out the DC D-40EZ D-40 Tax Form, follow these steps:

01

Gather necessary documents including your identification, income records, and deductions information.

02

Access the form via the IRS website or use pdfFiller to obtain a digital copy.

03

Fill in your personal details such as name, address, and Social Security number.

04

Input your total income and any applicable adjustments.

05

Claim eligible deductions and credits.

06

Review all entries for accuracy before submission.

About DC D-40EZ D-40 2017 previous version

What is DC D-40EZ D-40?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About DC D-40EZ D-40 2017 previous version

What is DC D-40EZ D-40?

The DC D-40EZ D-40 is a simplified tax form used by certain taxpayers in Washington D.C. to report their income and calculate their tax liability. It is designed to streamline the tax filing process for eligible individuals with straightforward financial situations.

What is the purpose of this form?

The primary purpose of the DC D-40EZ D-40 is to allow qualified taxpayers to file their income taxes in a less complicated manner. This form is beneficial for filers with simple tax situations, enabling them to avoid the complexities of the standard DC D-40 form.

Who needs the form?

The DC D-40EZ D-40 is intended for eligible residents of Washington D.C. who meet specific criteria, such as those with a singular source of income and minimal deductions. Generally, this form is suitable for single filers or couples without dependents.

When am I exempt from filling out this form?

You may be exempt from filling out the DC D-40EZ D-40 if your total income is below the filing threshold set by the D.C. Office of Tax and Revenue. Additionally, if you have complex financial situations, such as multiple income sources, significant deductions, or business income, you are advised to use the standard D-40 form instead.

Components of the form

The DC D-40EZ D-40 consists of several key components which include: personal information section, income reporting area, deductions and credits section, and the signature line. Each part must be filled accurately to ensure proper processing of your tax return.

Due date

The due date for submitting the DC D-40EZ D-40 typically aligns with the federal tax deadline, which is usually April 15. If this date falls on a weekend or holiday, the due date is extended to the next business day.

What are the penalties for not issuing the form?

If you fail to file the DC D-40EZ D-40 by the due date, you may incur penalties including late fees and potential interest on any unpaid taxes. It is crucial to file on time or request an extension if necessary to avoid these additional costs.

What information do you need when you file the form?

When filing the DC D-40EZ D-40, you will need to provide personal identification information, details of all sources of income, any eligible deductions or credits, and your Social Security number. Ensure all information is accurate to prevent processing delays.

Is the form accompanied by other forms?

The DC D-40EZ D-40 is typically filed as a standalone form. However, if you are claiming specific credits or deductions that require additional documentation, you may need to include those forms along with your D-40EZ submission.

Where do I send the form?

The completed DC D-40EZ D-40 form should be mailed to the Office of Tax and Revenue for Washington D.C. Ensure you check the latest mailing address on their official website, as it may change from year to year to accommodate administrative updates.

See what our users say