Get the free Create Your Personal Financial Statement

Show details

Create Your Personal Financial Statement

Form Swift Interactive, Downloadable PDF form

Use the wizard at this useful website to create a professional and organized personal financial statement. The

items

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign create your personal financial

Edit your create your personal financial form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your create your personal financial form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit create your personal financial online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit create your personal financial. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out create your personal financial

How to fill out create your personal financial

01

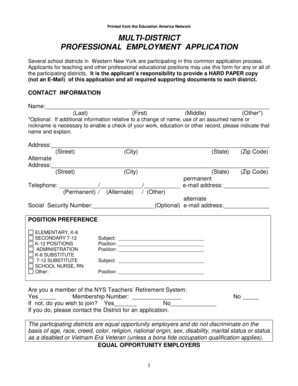

Step 1: Start by gathering all necessary financial documents such as bank statements, credit card statements, loan statements, and investment statements.

02

Step 2: Create a list of all your sources of income including your salary, rental income, freelance work, and any other income streams.

03

Step 3: List down all your monthly expenses such as rent or mortgage payments, utilities, groceries, transportation costs, insurance premiums, and entertainment expenses.

04

Step 4: Calculate your net worth by subtracting your total liabilities (debts) from your total assets (cash, investments, property, etc.).

05

Step 5: Analyze your spending patterns and identify areas where you can potentially cut back or save more money.

06

Step 6: Set financial goals for yourself such as saving for retirement, paying off debt, or building an emergency fund.

07

Step 7: Create a budget to allocate your income towards different expenses and financial goals.

08

Step 8: Regularly track your expenses and income to ensure you are staying on track with your financial plan.

09

Step 9: Revisit and update your personal financial plan periodically to reflect any changes in your financial situation or goals.

10

Step 10: Seek professional advice from a financial advisor if needed, especially for complex financial matters or investment decisions.

Who needs create your personal financial?

01

Anyone who wants to gain better control and understanding of their personal finances.

02

Individuals who want to be more organized with their financial information and track their progress towards financial goals.

03

People who are looking to improve their financial situation or reduce debt.

04

Those who want to plan for major life events such as buying a house, starting a family, or retiring.

05

Entrepreneurs or self-employed individuals who need to manage their business and personal finances separately.

06

Anyone who wants to build an emergency fund or save for future expenses.

07

Individuals who want to make informed financial decisions and maximize their savings and investments.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send create your personal financial for eSignature?

To distribute your create your personal financial, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I edit create your personal financial online?

The editing procedure is simple with pdfFiller. Open your create your personal financial in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Can I create an eSignature for the create your personal financial in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your create your personal financial and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

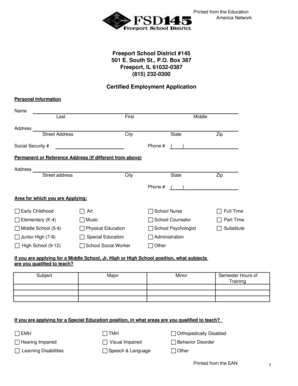

What is create your personal financial?

Create your personal financial is a form that allows individuals to disclose their financial information to the concerned authorities.

Who is required to file create your personal financial?

Public officials, government employees, and certain individuals are required to file create your personal financial.

How to fill out create your personal financial?

Create your personal financial form can usually be filled out online or in hard copy, with detailed instructions provided by the respective authority.

What is the purpose of create your personal financial?

The purpose of create your personal financial is to ensure transparency and accountability by disclosing financial interests, assets, and liabilities of individuals in positions of power or influence.

What information must be reported on create your personal financial?

Information such as income, assets, investments, property owned, debts, and financial interests must be reported on create your personal financial.

Fill out your create your personal financial online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Create Your Personal Financial is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.