CA Affidavit of Exemption from Documentary Transfer Tax - County of San Joaquin 2010 free printable template

Show details

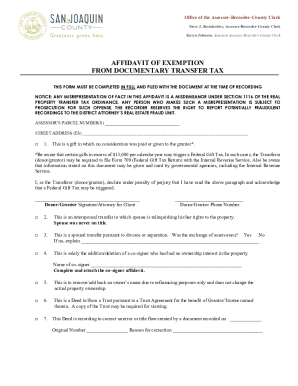

COUNTY OF SAN JOAQUIN ASSESSOR RECORDER COUNTY CLERKAFFIDAVIT OF EXEMPTION FROM DOCUMENTARY TRANSFER TAX THIS FORM MUST BE COMPLETED IN FULL AND FILED WITH THE DOCUMENT AT THE TIME OF RECORDINGNOTICE:

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA Affidavit of Exemption from Documentary Transfer Tax

Edit your CA Affidavit of Exemption from Documentary Transfer Tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA Affidavit of Exemption from Documentary Transfer Tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CA Affidavit of Exemption from Documentary Transfer Tax online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit CA Affidavit of Exemption from Documentary Transfer Tax. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA Affidavit of Exemption from Documentary Transfer Tax - County of San Joaquin Form Versions

Version

Form Popularity

Fillable & printabley

4.8 Satisfied (60 Votes)

4.0 Satisfied (50 Votes)

4.4 Satisfied (41 Votes)

How to fill out CA Affidavit of Exemption from Documentary Transfer Tax

How to fill out CA Affidavit of Exemption from Documentary Transfer Tax

01

Obtain the CA Affidavit of Exemption from Documentary Transfer Tax form from the official county website or office.

02

Read the instructions carefully to understand the requirements for filing the affidavit.

03

Fill in the property address accurately in the designated section of the form.

04

Provide the names of the parties involved in the transfer, including the buyer and seller.

05

Specify the reason for claiming the exemption by checking the appropriate box and providing a brief explanation if required.

06

Include any relevant details that support the exemption, such as the type of transaction (e.g., gift, transfer between family members).

07

Sign and date the affidavit, ensuring to include your printed name.

08

Submit the completed affidavit to the appropriate county office where the property is located, either in person or by mail.

Who needs CA Affidavit of Exemption from Documentary Transfer Tax?

01

Anyone who is transferring property in California and believes they qualify for an exemption from the documentary transfer tax.

02

Individuals who are transferring property as a gift, or to family members, may need to complete this affidavit.

03

Real estate professionals handling transactions on behalf of clients that meet exemption criteria.

Fill

form

: Try Risk Free

People Also Ask about

What is the Los Angeles County Declaration of Documentary transfer tax?

In addition to the Countywide documentary transfer tax of $1.10 per $1,000.00 an additional City documentary transfer tax has been imposed on all documents that convey real property within the cities of Culver City, Los Angeles, Pomona, Redondo Beach and Santa Monica (R&T 11911C).

What is the documentary transfer tax in Los Angeles?

Effective April 1, 2023, a new documentary-transfer tax will be imposed on residential and commercial real-property sales and transfers within the City of Los Angeles where the consideration or value is greater than $5 million.

How much is documentary transfer tax in California?

California's Revenue and Taxation Codes calls for the payment of a County Documentary Transfer Tax on the value of all real property of which ownership is being transferred. All counties have the same tax amount, which is 0.11% of the value.

What is the affidavit of transfer tax in San Francisco?

The purpose of this form is to explain the nature of the transaction and to determine if the transfer is taxable. Transfer tax is based on the purchase price if it is a purchase. Otherwise, it is based on the fair market value of the property being transferred.

What is documentary transfer tax in California?

The Documentary Transfer Tax (DTT) imposes a tax on each deed, instrument, or writing by which any lands, tenements, or any other realty sold, shall be granted, transferred, or otherwise conveyed to another person. The State Revenue and Taxation Code 11902 - 11934 governs this tax.

Who pays documentary transfer tax in California?

The payment of the transfer tax can be negotiated between the Buyer and the Seller. Normally, in Southern California, the Seller pays. In Northern California, the Buyer pays.

How is the documentary transfer tax calculated in California?

How much is the Documentary Transfer Tax? It depends on the location of the property. The County Transfer Tax is a standard of $1.10 per $1,000 of the sales price throughout the State. However, there are certain cities that also collect their own City Transfer Tax and those differ.

What is the declaration of documentary transfer tax in California?

The City documentary transfer tax rate is computed on consideration or value of the property conveyed, exclusive of existing liens and encumbrances, and is added to the Countywide $1.10 per $1,000.00 documentary transfer tax.

What is the transfer tax in San Francisco?

Transfer Tax If entire value or consideration is Tax rate for entire value or consideration is More than $250,000 but less than $1,000,000$3.40 for each $500 or portion thereof$1,000,000 or more but less than $5,000,000$3.75 for each $500 or portion thereof4 more rows

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute CA Affidavit of Exemption from Documentary Transfer Tax online?

pdfFiller has made it easy to fill out and sign CA Affidavit of Exemption from Documentary Transfer Tax. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I make changes in CA Affidavit of Exemption from Documentary Transfer Tax?

With pdfFiller, it's easy to make changes. Open your CA Affidavit of Exemption from Documentary Transfer Tax in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Can I sign the CA Affidavit of Exemption from Documentary Transfer Tax electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your CA Affidavit of Exemption from Documentary Transfer Tax.

What is CA Affidavit of Exemption from Documentary Transfer Tax?

The CA Affidavit of Exemption from Documentary Transfer Tax is a legal document used in California to claim an exemption from the documentary transfer tax when transferring property. It is typically used in transactions that meet specific criteria outlined in California Revenue and Taxation Code.

Who is required to file CA Affidavit of Exemption from Documentary Transfer Tax?

The party responsible for filing the CA Affidavit of Exemption from Documentary Transfer Tax is generally the property transferor or their representative. This includes individuals or entities involved in property transfers that qualify for an exemption from the documentary transfer tax.

How to fill out CA Affidavit of Exemption from Documentary Transfer Tax?

To fill out the CA Affidavit of Exemption from Documentary Transfer Tax, you need to provide details such as the property address, the names of the parties involved, the nature of the exemption being claimed, and any relevant identification numbers. Make sure to review the specific instructions that accompany the form to ensure accurate completion.

What is the purpose of CA Affidavit of Exemption from Documentary Transfer Tax?

The purpose of the CA Affidavit of Exemption from Documentary Transfer Tax is to formally declare and document a claim for exemption from the payment of documentary transfer taxes associated with a property transfer. This helps reduce unnecessary financial burdens on qualifying transactions.

What information must be reported on CA Affidavit of Exemption from Documentary Transfer Tax?

The information that must be reported on the CA Affidavit of Exemption from Documentary Transfer Tax includes the property address, the names and addresses of the parties involved, the specific exemption being claimed, and any additional details necessary to substantiate the exemption claim.

Fill out your CA Affidavit of Exemption from Documentary Transfer Tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA Affidavit Of Exemption From Documentary Transfer Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.